- Dell Applied sciences didn’t add BTC to its holdings in Q2

- Alternatively, AI was the largest driver of the agency’s earnings

Michael Dell, CEO of tech {hardware} big Dell Applied sciences, left the Bitcoin group disenchanted after it was revealed that the agency didn’t undertake a BTC technique in Q2. The crypto group anticipated a declaration of BTC holdings through the Q2 earnings report on 29 August. This, as a result of the CEO has been publicly in assist of the world’s largest cryptocurrency throughout X (previously Twitter).

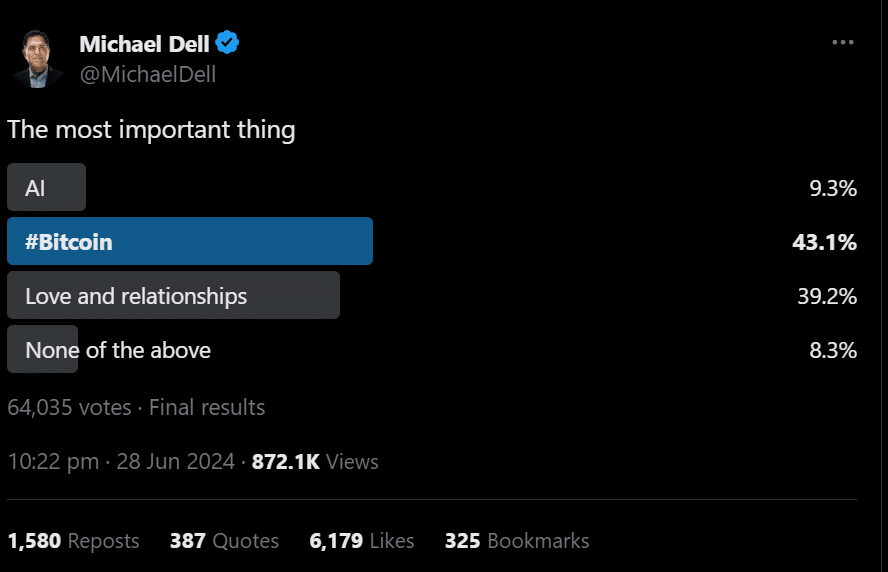

Dell’s ‘public support’ for BTC

In June, Dell performed an X ballot to find out ‘the most important thing’ between AI, BTC, and love/relationships. The ballot outcomes ranked BTC larger than the remainder of the gadgets and attracted optimistic reactions from among the prime BTC bulls like Michael Saylor.

Per week earlier than conducting the aforementioned ballot, Dell Applied sciences’ Chief posted a cryptic message – ‘Scarcity creates value,’ which is often related to BTC due to its capped provide of 21 million cash.

These posts created the impression that the exec was leaning in the direction of the crypto asset. By extension, many additionally believed Dell would undertake the well-known BTC technique that Michael Saylor and MicroStrategy pioneered.

Nevertheless, BTC wasn’t talked about within the agency’s Q2 earnings report. Most market watchers couldn’t disguise their disappointment after their BTC hopes had been dashed.

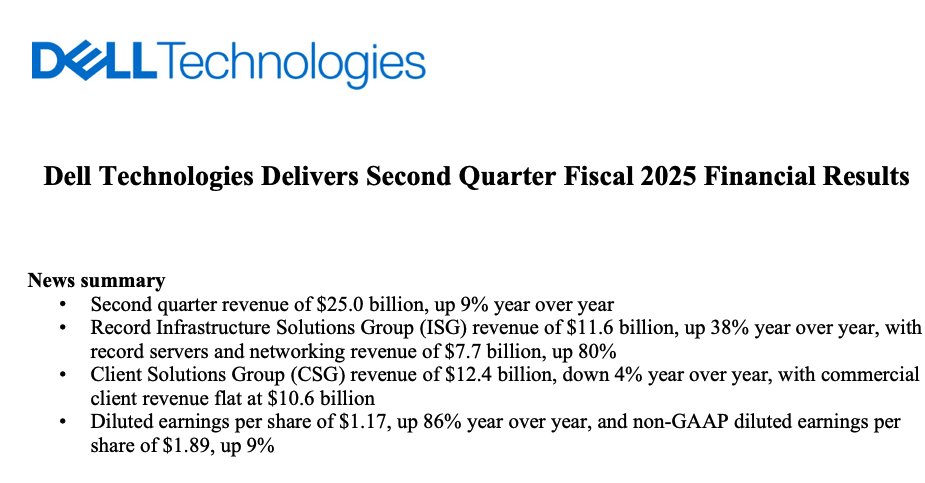

Curiously, regardless of Bitcoin rating larger than AI within the ballot on X, AI was the main driver of the agency’s Q2 earnings. Reacting to the agency’s Q2 efficiency, Dell Applied sciences’ Vice Chairman Jeff Clarke stated,

“Our AI momentum accelerated in Q2, and we’ve seen an increase in the number of enterprise customers buying AI solutions each quarter.”

Right here, it’s value noting that MicroStrategy’s Bitcoin technique, which includes conserving BTC as a part of the treasury, has been adopted by the likes of Semler Scientific and Metaplanet.

MicroStrategy, at press time, held 226.5K BTC, value over $13B. The technique’s fundamental objective is to spice up the underlying inventory’s worth, particularly amid growing institutional adoption via BTC ETFs. This was just lately famous by Eric Semler, Chairman of Semler Scientific. He stated,

“We are encouraged by the growing institutional adoption of bitcoin. It was recently reported that for the first time, institutions own more than 20% of bitcoin ETF assets under management. We believe this increasing institutionalization will drive value for both Bitcoin prices and for our stockholders.”