On Tuesday, BofA Securities reinstated protection on Nomura Holdings (NYSE:), issuing a Impartial ranking and setting a worth goal of $5.79. The agency highlighted a good price-to-book (P/B) ratio of 0.78x for Nomura, based mostly on a smoothed return on fairness (ROE) of seven%, a price of capital of 9%, and no anticipated development. Nonetheless, as a result of short-term uncertainty surrounding potential regulatory penalties, BofA Securities has utilized a ten% low cost to the P/B ratio, leading to a diminished goal.

The analyst from BofA Securities famous that whereas Nomura’s revenue development has been steady since mid-FY3/24, the corporate’s earnings have traditionally proven vital volatility. The analyst identified that the wholesale enterprise, which is about twice the dimensions of the wealth administration (WM) enterprise when it comes to top-line revenues, contributes to this volatility, particularly as a result of fluctuations in world markets inside the wholesale section.

Regardless of the expansion in asset-based earnings from wealth administration and funding administration, in addition to funding financial institution charges, these components usually are not anticipated to considerably affect the near-term volatility confronted by world markets. This evaluation means that whereas there are optimistic elements to Nomura’s enterprise, the potential impression of regulatory penalties is a noteworthy concern that tempers the outlook.

Nomura’s wealth administration and funding administration companies have been recognized as areas of regular development. Nonetheless, the agency’s evaluation signifies that this development is overshadowed by the near-term volatility of world markets, which is basically pushed by the wholesale aspect of the enterprise.

BofA Securities’ worth goal of $5.79 for Nomura Holdings displays a cautious stance, acknowledging each the corporate’s steady revenue development in sure areas and the challenges it faces with market volatility and regulatory uncertainties. The Impartial ranking suggests a wait-and-see method to the inventory, because the market assesses the potential outcomes of Nomura’s regulatory points.

In different latest information, Nomura Holdings faces potential penalties from the Securities and Alternate Surveillance Fee (SESC) of Japan for alleged market manipulation actions. In the meantime, JPMorgan has resumed protection on Nomura, assigning a Impartial ranking, acknowledging the corporate’s potential to outperform relying on the enterprise setting. Nonetheless, JPMorgan additionally famous that Nomura seems to lag behind Daiwa Securities Group when it comes to revenue stability and capital allocation effectivity.

In earnings information, Nomura reported a gradual improve in web income and web revenue for the primary quarter of the fiscal yr ending March 2025. The corporate’s web income rose by 2% to ¥454.4 billion, pre-tax revenue by 12% to ¥102.9 billion, and web revenue by 21% to ¥68.9 billion. The Wealth Administration and Asset Administration segments noticed development, whereas the Wholesale section skilled a lower in web income.

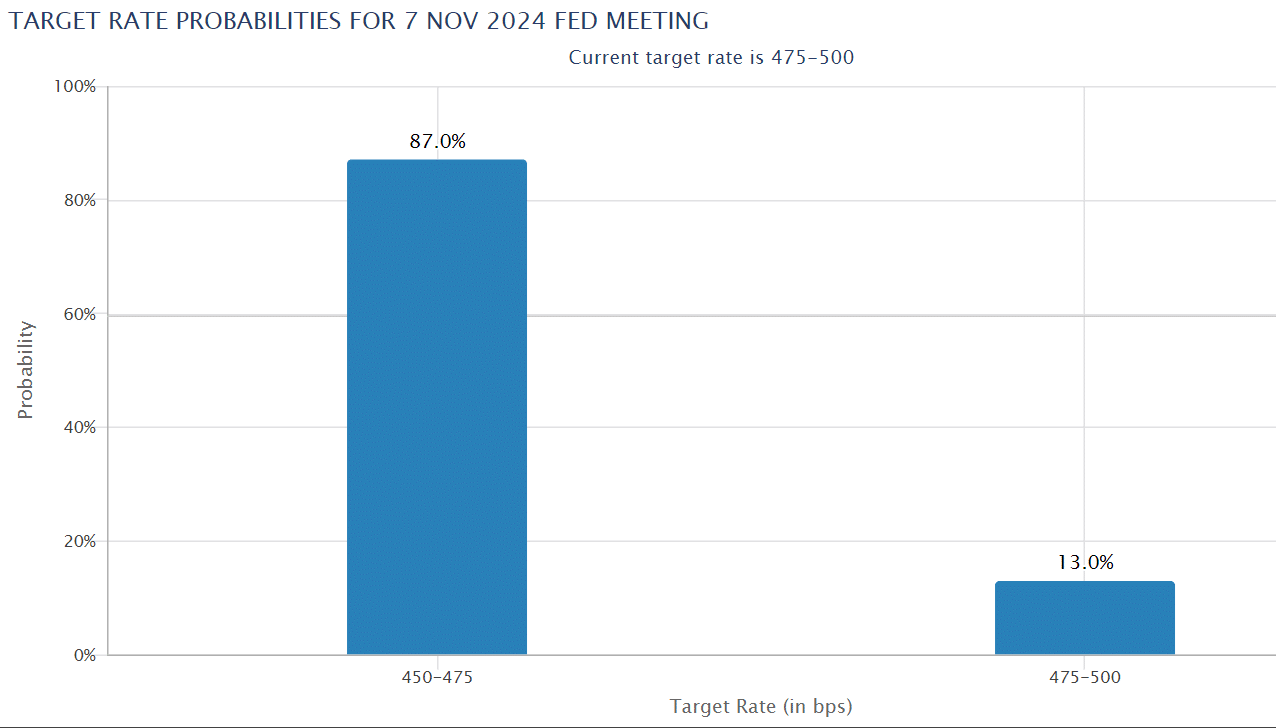

When it comes to market expectations, main brokerages, together with J.P. Morgan, Citigroup, Wells Fargo, Goldman Sachs, Nomura, Deutsche Financial institution, Morgan Stanley, and Barclays, anticipate that the Federal Reserve will decrease rates of interest within the coming months. The consensus factors in direction of a 25 foundation factors discount, following latest financial indicators similar to an increase within the U.S. unemployment price and an uptick in July’s retail gross sales.

InvestingPro Insights

Current InvestingPro information offers extra context to BofA Securities’ evaluation of Nomura Holdings (NYSE:NMR). The corporate’s P/B ratio of 0.67 as of the final twelve months ending Q1 2025 aligns carefully with BofA’s honest P/B estimate of 0.78x, supporting their valuation method. Nomura’s present P/E ratio of 11.09 and ahead P/E of 10.91 recommend the inventory is buying and selling at comparatively modest valuations, which might be enticing to worth traders regardless of the short-term uncertainties highlighted within the report.

InvestingPro Suggestions reveal that Nomura has maintained dividend funds for 33 consecutive years, demonstrating a dedication to shareholder returns even in risky market situations. This observe report could present some stability for traders involved concerning the firm’s earnings volatility. Moreover, Nomura’s liquid belongings exceeding short-term obligations point out a robust monetary place, which may assist the corporate navigate potential regulatory penalties talked about within the BofA report.

For traders looking for a extra complete evaluation, InvestingPro gives 7 extra ideas for Nomura Holdings, offering deeper insights into the corporate’s monetary well being and market place.

This text was generated with the assist of AI and reviewed by an editor. For extra data see our T&C.