Final night time (10 October), Tesla (NASDAQ: TSLA) held its extremely anticipated robotaxi occasion. On the Hollywood occasion, CEO Elon Musk revealed the corporate’s plans for self-driving taxis. Ought to I rush to purchase Tesla inventory for my ISA now that we all know what its plans are? Let’s focus on.

Robotaxis are the longer term

As a development investor who’s seeking to capitalise on long-term technological traits, I’m enthusiastic about robotaxis. Wanting 10-20 years out, I reckon that they’re the way forward for mobility (they’re far safer than human-driven automobiles).

Already, I’ve a big place in Alphabet – the proprietor of Waymo (which has self-driving taxis on the highway within the US right this moment). I’ve additionally been build up a place in Uber (which companions with Waymo), as I reckon it has the platform that quite a lot of robotaxi corporations will function from sooner or later.

As for Tesla, I used to be ready for the robotaxi occasion to see what the corporate’s plans are. My analysis led me to imagine that Tesla would reveal a number of Cybercab prototypes, an app for shoppers, and an replace to its Full Self-Driving (FSD) know-how that might enable its automobiles to drive by themselves.

What did Tesla reveal?

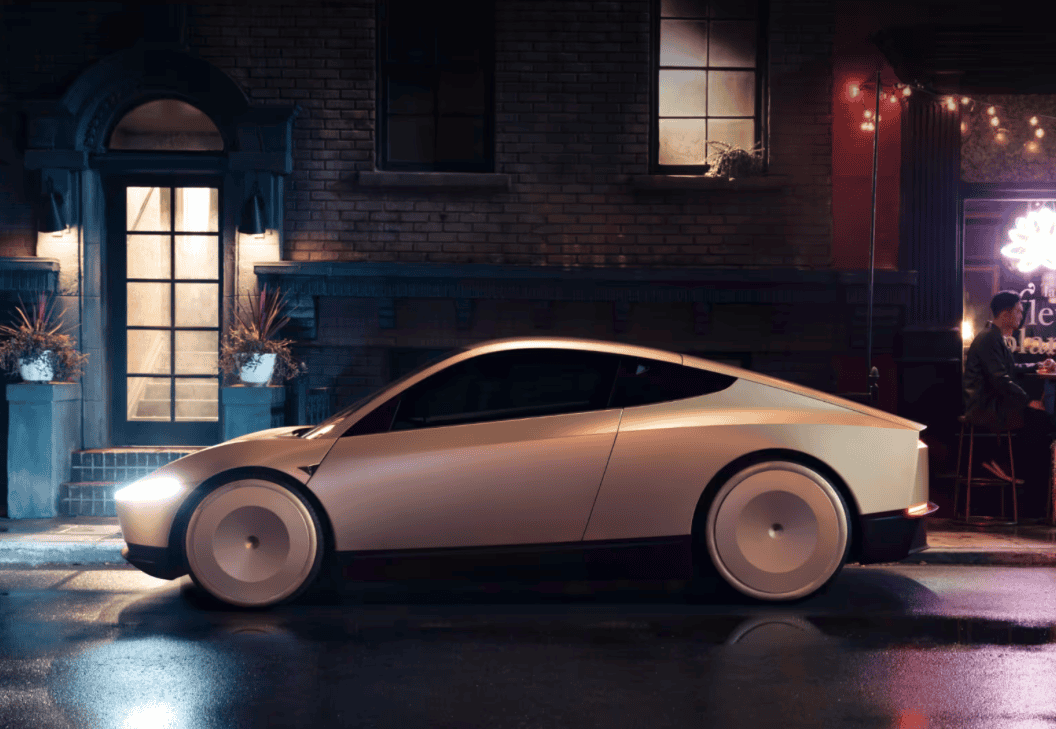

Ultimately, I believed the occasion final night time was a bit of bit underwhelming (given the hype). The corporate did showcase a brand new Cybercab prototype that will likely be obtainable for lower than $30k. Futuristic in design, it had no steering wheel or pedals.

It additionally revealed a ‘Robovan’ that may transport 20 individuals. Musk mentioned this could possibly be best for transporting sports activities groups.

However there was no app for shoppers. And the timelines for robotaxi roll-out have been a bit disappointing. Presently, Tesla doesn’t plan to begin Cybercab manufacturing till 2026 or 2027. Provided that Musk has a historical past of over-promising and under-delivering in the case of timelines, it could possibly be years till these self-driving taxis are literally on the highway.

It’s price noting that Tesla plans to launch absolutely autonomous driving in Texas and California subsequent yr. Nevertheless, the corporate hasn’t secured regulatory approval but so, once more, it might really be years earlier than we see this.

Ought to I purchase?

Provided that Tesla isn’t more likely to have robotaxis on the highway for some time, I’m not in a rush to purchase the inventory right this moment. Lately, it has rallied onerous. And for me, the valuation is just too excessive proper now.

At right this moment’s share worth, the forward-looking price-to-earnings (P/E) ratio’s 105. That’s about 5 occasions the P/E ratio Alphabet’s buying and selling on.

As for its market-cap, it’s round $750bn. That compares to $160bn for Uber.

Evaluating these market-cap figures, Uber appears a a lot safer wager on self-driving taxis to me. Finally, a whole lot of billions of {dollars} of Tesla’s market-cap’s primarily based on robotaxi optimism and I’m not satisfied that’s justified when it’s doubtless that there will likely be many corporations with autonomous taxis sooner or later (Waymo, Mercedes-Benz, Cruise, and so on).

Now, I could find yourself shopping for Tesla inventory someday. Evidently the corporate’s pivoting to robotics and AI and that is thrilling.

However for now, I’m going to maintain it on my watchlist. And I’m going to proceed build up my place in Uber, as I feel it has tons of potential.