- Peter Schiff has proposed the launch of USA Coin.

- That is in step with his continued criticism of Bitcoin.

Peter Schiff, the outspoken critic of Bitcoin and a staunch advocate for gold, has as soon as once more aimed on the cryptocurrency. In a latest social media submit, Schiff proposed the concept of a U.S.-issued digital forex known as “USA coin” as a substitute for Bitcoin.

He instructed that USA coin might cap its provide at 21 million, like Bitcoin. Nevertheless, it might have an “upgraded blockchain” to make it viable for funds.

Whereas Schiff’s skepticism is well-documented, this new suggestion has reignited the controversy on the viability of Bitcoin versus government-backed digital currencies.

Bitcoin vs USA coin – Schiff’s proposal

Schiff argues that Bitcoin’s scalability and use as a medium of trade are its basic weaknesses. He claims that USA coin might overcome these challenges by enhancing blockchain performance and leveraging the belief of a government-issued forex.

Nevertheless, this suggestion has drawn criticism from Bitcoin supporters who emphasize decentralization as Bitcoin’s core power.

Bitcoin is designed to function with out central management. The design ensures that no single entity, authorities or in any other case, can manipulate its provide or insurance policies.

In distinction, USA coin, being issued by the U.S. authorities, would inherently be centralized. This centralization might restrict its attraction to those that worth Bitcoin for its resistance to censorship and inflation.

BTC’s historic efficiency vs. Schiff’s criticisms

To know Schiff’s ongoing skepticism, it’s essential to revisit his historical past of Bitcoin predictions. Through the years, Schiff has repeatedly predicted Bitcoin’s demise, but the cryptocurrency continues to defy his expectations.

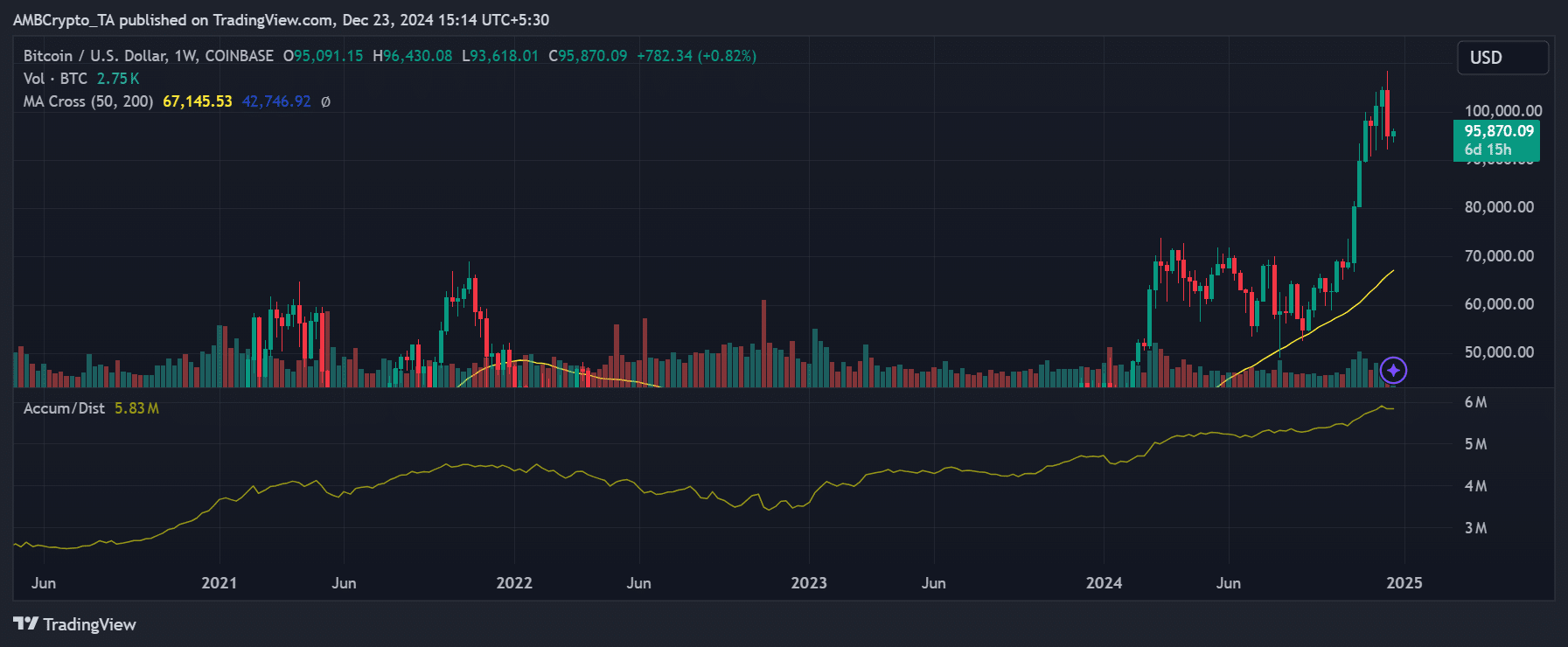

A look at Bitcoin’s historic efficiency tells a special story.

Bitcoin has risen from being valued at just some cents in its early days to its present worth of roughly $95,000. Regardless of intervals of great volatility, its long-term development trajectory has made it one of many best-performing property of the previous decade.

Schiff’s predictions of Bitcoin’s collapse throughout its earlier worth surges (e.g., at $1,000 in 2013 or $20,000 in 2017) haven’t materialized, additional fueling debates between his supporters and crypto advocates.

The implications of a government-issued digital forex

If the U.S. have been to create a digital forex like USA coin, it might seemingly operate extra like a Central Financial institution Digital Foreign money (CBDC) than a decentralized cryptocurrency.

CBDCs are designed to work inside present monetary techniques, doubtlessly providing quicker and safer transactions. Nevertheless, they lack the core options that make Bitcoin distinctive.

Schiff’s suggestion, whereas hypothetical, displays a broader development of governments exploring digital currencies to take care of management. Whether or not USA coin might “make everyone rich,” as Schiff claims, stays extremely speculative.

Whereas his skepticism of Bitcoin has but to be validated, his feedback carry consideration to the rising curiosity in government-backed digital property. Whether or not USA coin, or some other centralized digital asset, can compete with Bitcoin is a query solely time can reply.