- Bitcoin’s would possibly goal $61k first this week as accumulation was rising.

- A bullish sample appeared on ETH’s every day chart, indicating a worth rise.

The previous week wasn’t fairly risky, as most cryptos had been in a consolidating sample, witnessing merely single-digit actions

Nonetheless, Toncoin [TON] decoupled from the market as its worth elevated by greater than 13% over the last seven days.

What does the crypto week forward maintain?

The crypto week forward would possibly look a bit totally different, although. On the time of writing, the Worry and Greed Index had a studying of 28, which means that the market was in a “fear” section.

This indicated an increase in volatility within the coming days in the direction of the north.

Bitcoin and Ethereum’s weekly targets

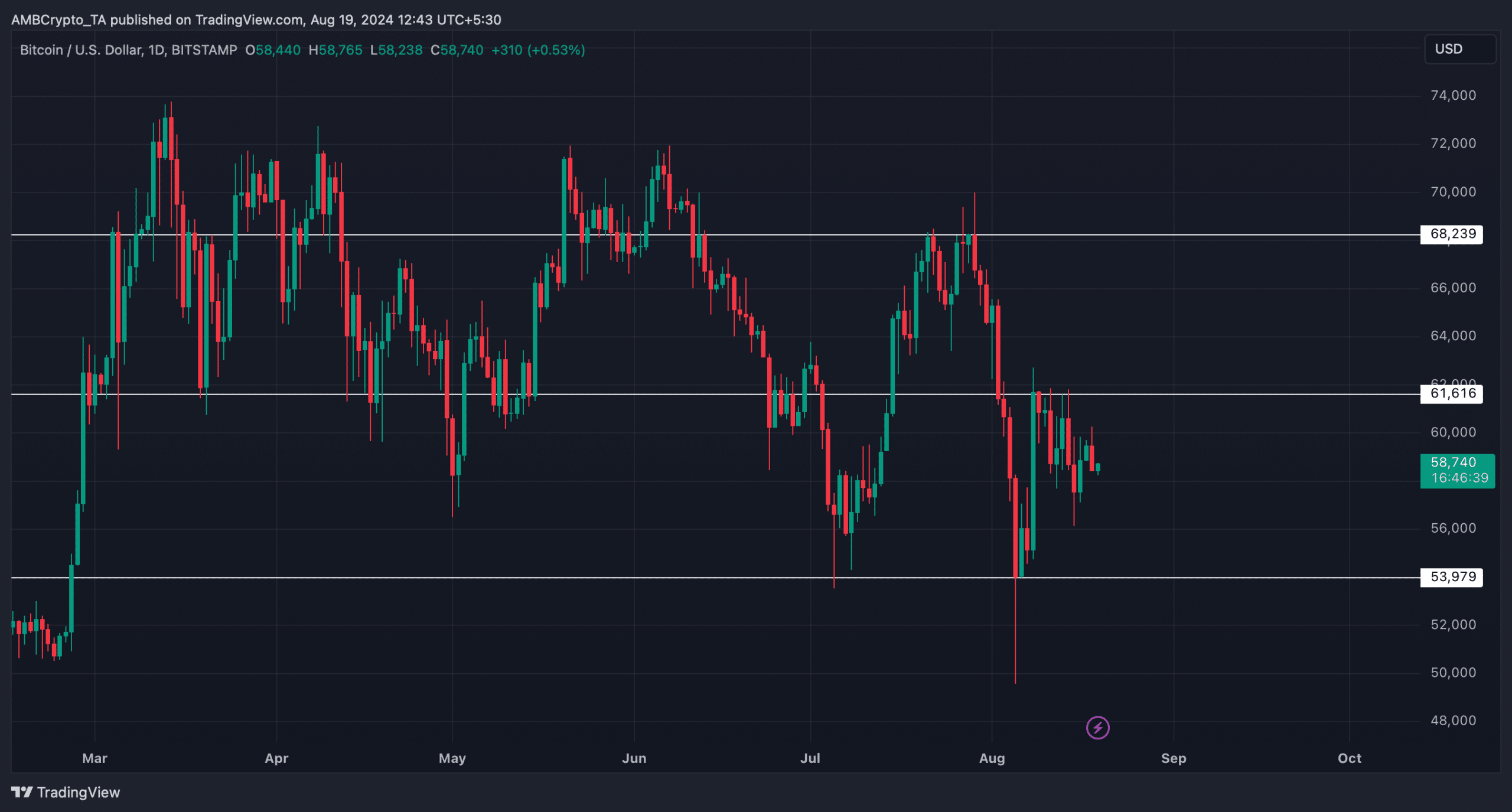

CoinMarketCap’s knowledge revealed that Bitcoin’s [BTC] worth had moved marginally final week. At press time, it was buying and selling at $58,630.

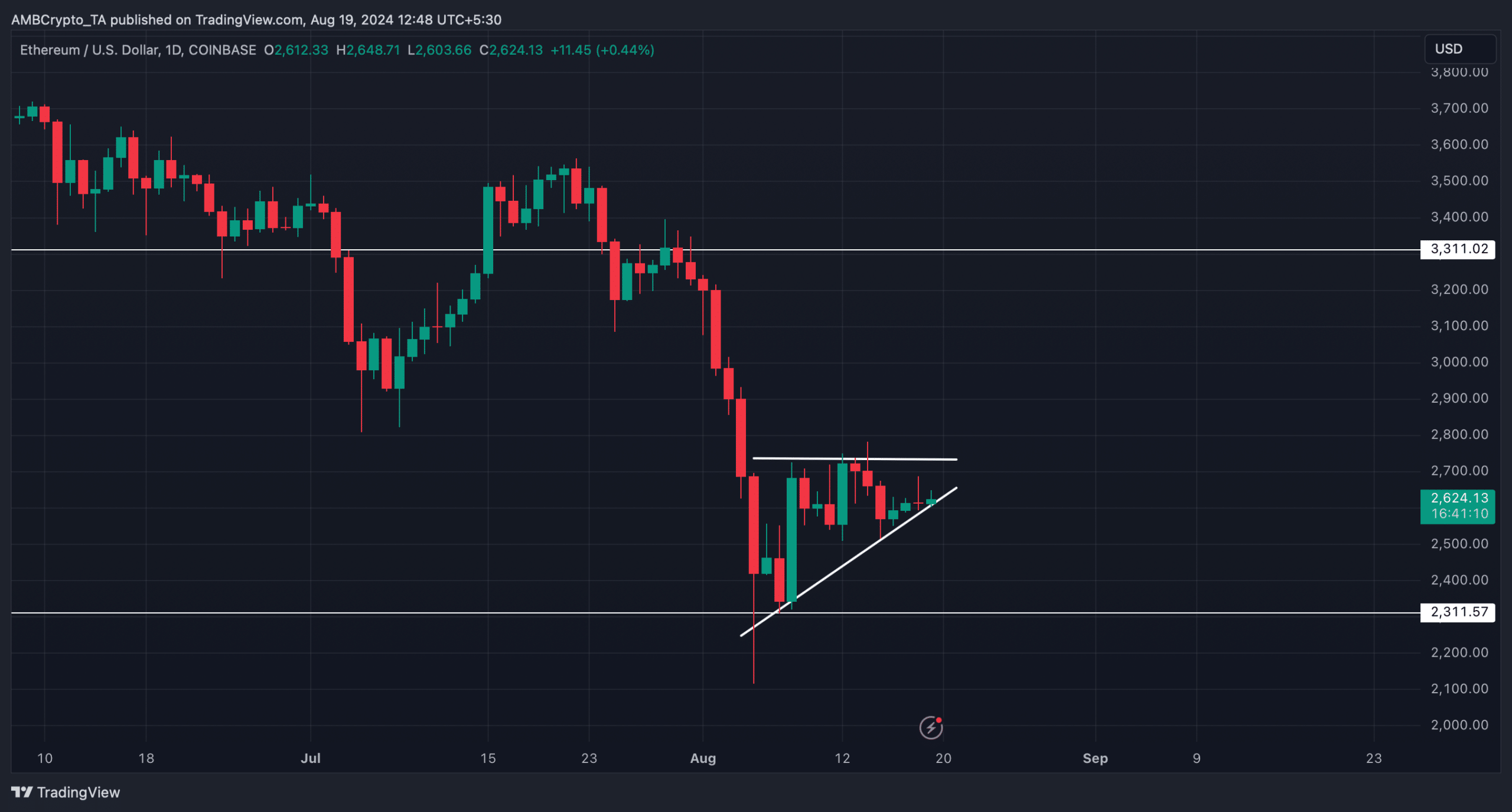

Nonetheless, Ethereum’s [ETH] worth witnessed a 23% weekly surge. On the time of writing, the king of altcoins was buying and selling at $2,630.

AMBCrypto then deliberate to evaluate BTC and ETH’s metrics and every day charts to seek out out their upcoming targets.

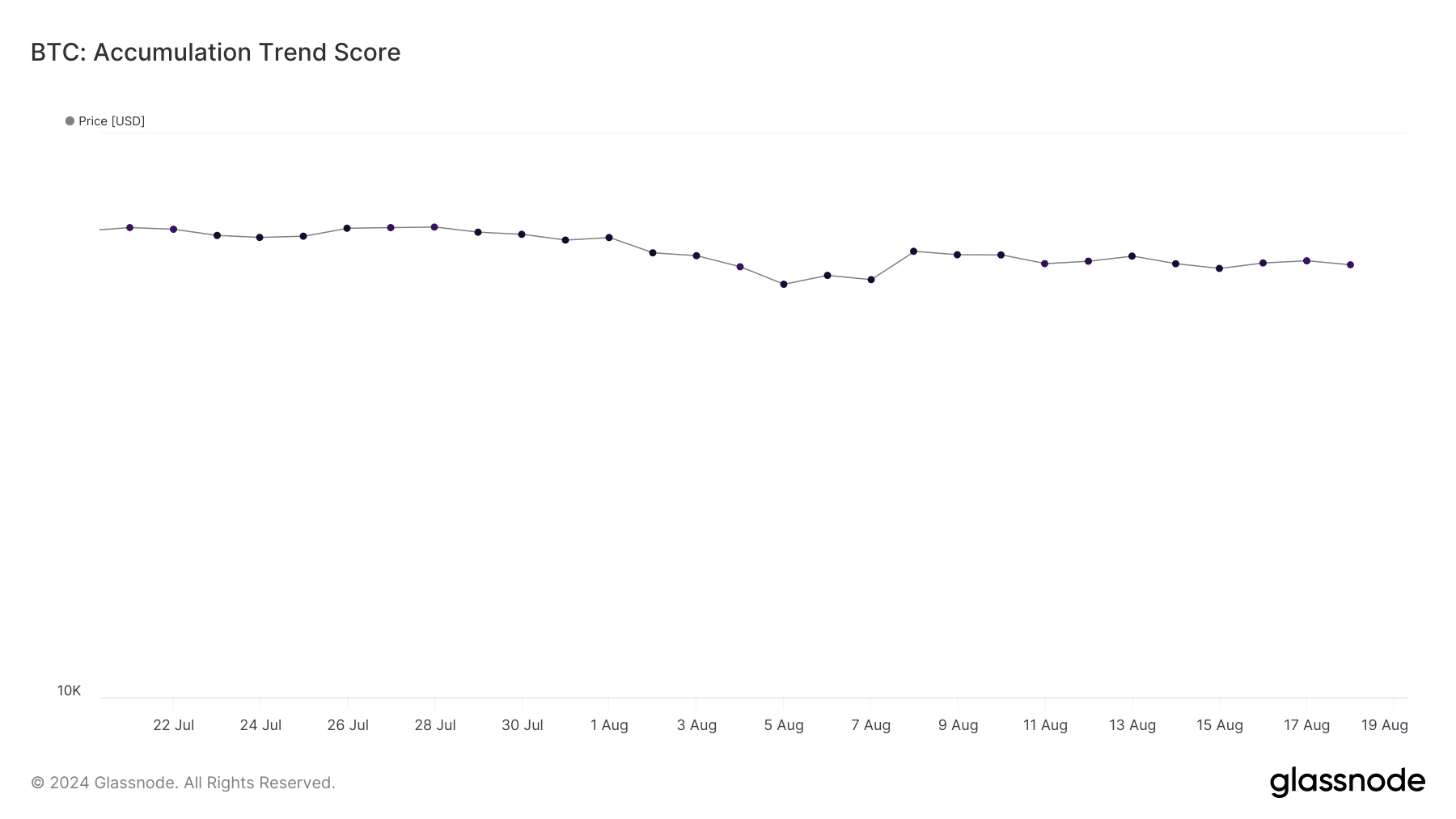

Starting with BTC, its alternate reserve was dropping at press time, which means that promoting stress was low. Its accumulation pattern rating had a worth above 0.7.

For the uninitiated, a quantity nearer to 1 signifies that purchasing stress is dominant available in the market.

Nonetheless, CryptoQuant’s knowledge revealed that BTC’s aSORP was crimson. This recommended that extra buyers had been promoting at a revenue. In the course of a bull market, it could possibly point out a market prime.

AMBCrypto’s have a look at BTC’s every day chart revealed that if the bulls gear up, then it could be essential for BTC to go above $61k this week. A profitable breakout above it could enable BTC to focus on $68k.

Nonetheless, in case of a worth drop, BTC would possibly plummet to its assist at $54k.

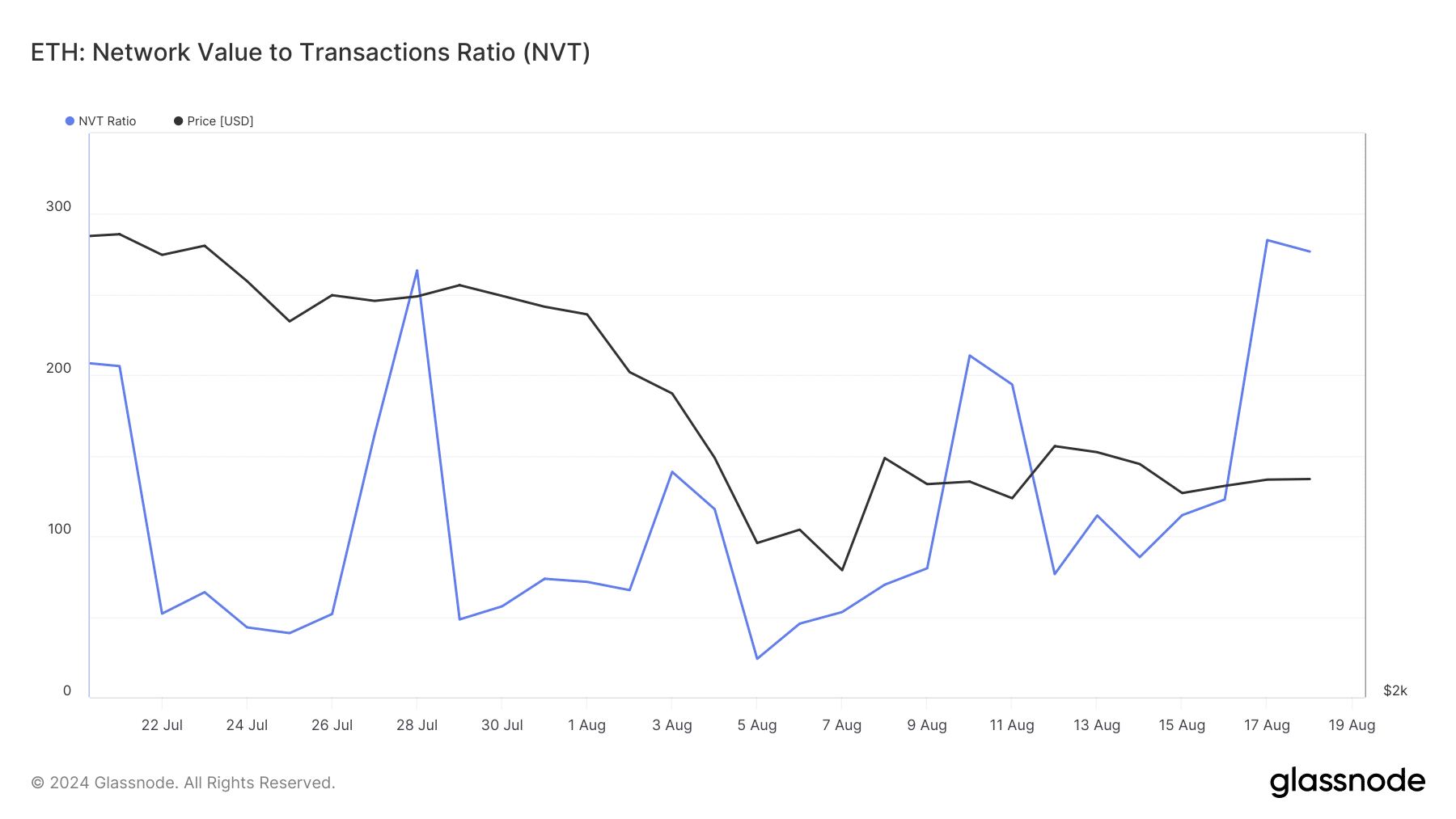

When it got here to Ethereum, AMBCrypto’s examination of Glassnode’s knowledge identified a pointy improve in ETH’s NVT ratio. Normally, this means that an asset is overvalued, indicating a worth correction.

Nonetheless, ETH’s alternate reserve was additionally dropping, suggesting weak promoting stress.

Learn Ethereum’s [ETH] Worth Prediction 2024-2025

Upon nearer inspection, AMBCrypto additionally discovered a bullish ascending triangle sample on ETH’s every day chart.

In case of a bullish breakout, ETH would possibly start its restoration section and attain $3.3k within the coming days of the week. Nonetheless, if ETH faces rejection at $2,736, the token would possibly as nicely drop to $2.3 once more.