Picture supply: Getty Photographs

Investing in a mixture of FTSE 250 progress, worth, and dividend shares is usually a highly effective technique for attaining a powerful and steady return.

Every kind of share gives distinctive advantages, and mixing them in a portfolio will help traders obtain a stability of capital appreciation and regular revenue whereas on the similar time lowering threat.

Progress shares can get pleasure from spectacular share worth positive aspects as earnings take off. Dividend shares provide a stream of revenue that may be reinvested to ship substantial compound positive aspects. And worth shares present a margin of security that may restrict worth drops throughout market downturns.

With all this in thoughts, listed below are two high FTSE 250 shares I feel are value a detailed look.

The expansion and worth inventory

Cybersecurity companies have important scope for progress as our lives develop into more and more digitalised and the variety of cyber assaults will increase. That is definitely the case for NCC Group (LSE:NCC) whose backside line is tipped to swell 120% this monetary 12 months, and by 25% and 21% respectively within the following two.

NCC supplies two essential providers. Its Cyber Safety unit helps firms detect on-line threats, simulate assaults and conduct threat assessments. And its Escode arm gives software program escrow and verification providers that shield information and demanding software program.

NCC’s share worth is rebounding strongly as market circumstances enhance. Final month, it tipped a better-than-expected 4% revenues rise for the 4 months to September. Although traders ought to be conscious of a doable reversal if the US financial system strikes into recession.

That stated, the cheapness of the agency’s shares might assist restrict any transfer to the draw back. It trades on a price-to-earnings progress (PEG) ratio of 0.2. Any studying beneath 1 signifies {that a} share is undervalued.

The dividend inventory

With a ten.7% ahead dividend yield, NextEnergy Photo voltaic Revenue‘s (LSE:NESF) one of many greatest potential payers on the FTSE 250 at the moment. Actually, its yield is greater than 3 times bigger than the index common.

Extremely-high yields like this may function purple flags for traders. They’ll point out an unsustainable dividend, with firms usually paying out greater than earnings. Huge yields can be a results of a collapsing inventory worth that displays mounting pressures on the corporate.

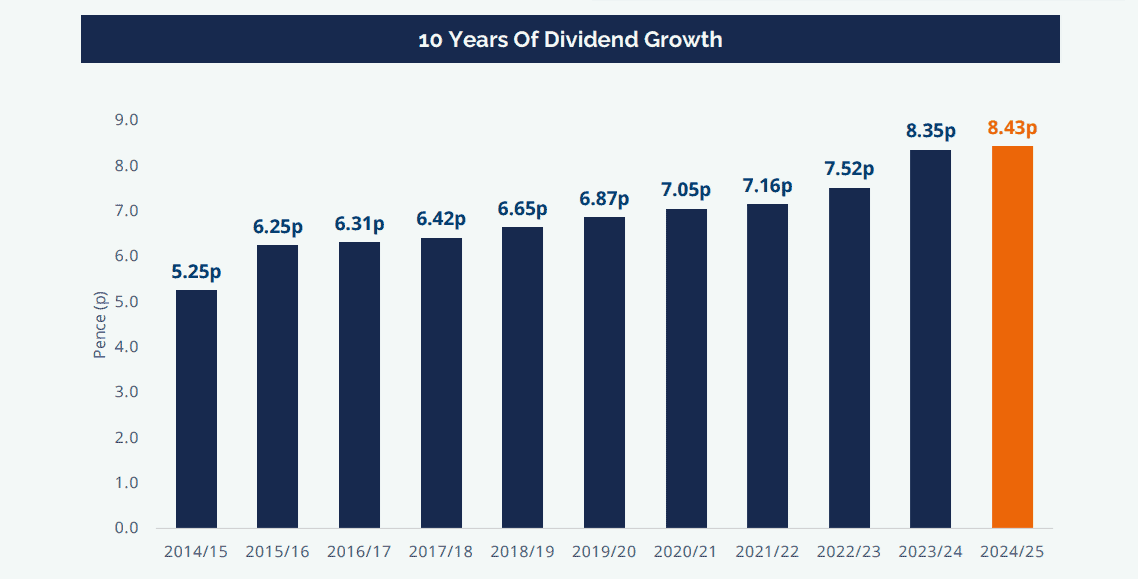

However neither of those apply to NextEnergy. It has an extended historical past of paying a big and rising dividend, because the chart beneath exhibits. Certainly, it’s paid a whopping £345m in dividends since its IPO in 2014.

The vitality producer has two essential points of interest for me. The defensive nature of its operations helps robust money flows, and subsequently strong dividends, throughout all factors of the financial cycle. It additionally has an opportunity to ship terrific long-term returns as demand for clear vitality steadily rises.

Close to-term returns could also be impacted if rates of interest stay round present highs. However on stability, I feel it’s a terrific revenue inventory to contemplate this October.