- Bitcoin’s 129% YTD acquire was pushed by halving and macroeconomic elements.

- Analysts predicted additional good points, however challenges like altcoin dominance and market corrections remained.

Bitcoin [BTC] has had an distinctive 2024, reaching a exceptional 129% year-to-date acquire, pushed by a collection of pivotal occasions, together with the April halving and the end result of the U.S. Presidential election.

With the cryptocurrency now approaching the $100,000 mark, all eyes are on Bitcoin’s subsequent transfer. Analysts are optimistic, with many predicting additional good points as market circumstances proceed to evolve.

As Bitcoin rides this wave of momentum, the query stays: will it break by the $100K threshold and push even larger?

Bitcoin’s post-halving surge

Bitcoin’s 2024 halving in April considerably lowered miner rewards, slicing new BTC issuance to three.125 BTC per block.

Traditionally, halvings set off provide shocks that bolster worth momentum over the next months. True to type, Bitcoin surged by over 85% since April, crossing $95,000 in December.

This rally has been fueled by a mixture of macro and sector-specific elements. Bitcoin’s standing as “digital gold” gained additional attraction amid inflation considerations and geopolitical instability, drawing institutional traders.

Moreover, renewed retail curiosity and the U.S. Presidential election, which introduced crypto-friendly insurance policies into focus, bolstered optimism.

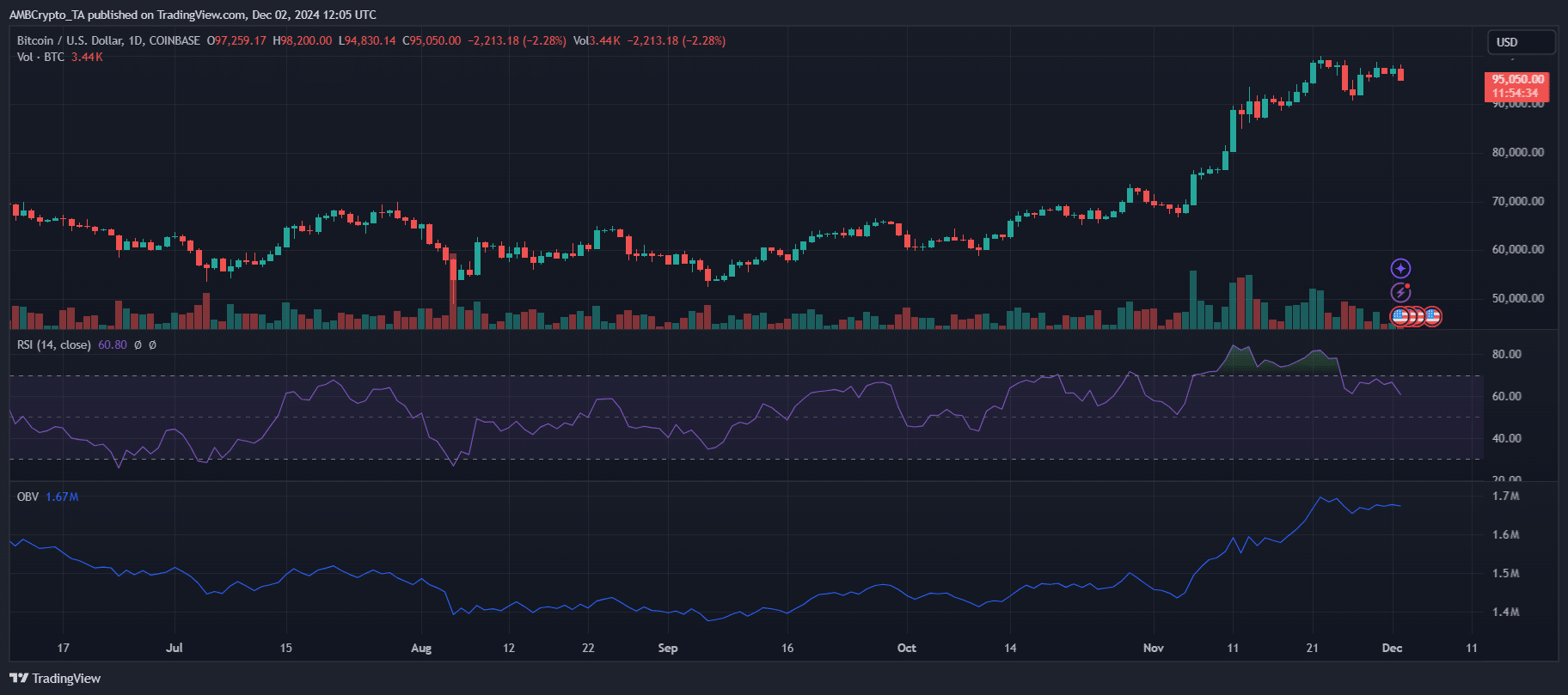

Supply: TradingView

The chart exhibits a gradual uptrend supported by robust on-chain metrics, comparable to rising lively addresses and rising open curiosity in BTC futures.

Nonetheless, the RSI close to 61 suggests the asset is nearing overbought territory, signaling potential short-term consolidation.

The $100K threshold and shifting market dynamics

Bitcoin’s march towards $100,000 stays a defining narrative for the market. On the twenty second of November, BTC briefly touched $99,000 earlier than retreating to the $96,000-$98,000 vary.

In the meantime, Bitcoin Futures on the Chicago Mercantile Change (CME) crossed $100,200 twice inside per week by the twenty ninth of November, fueling hypothesis that spot costs might quickly observe.

Whereas breaking $100K is essentially psychological, it represents a vital milestone for market sentiment as nicely.

Regardless of Bitcoin’s good points, dominance fell to 56.1% on the thirtieth of November, as traders rotated into altcoins, suggesting the onset of a possible altcoin season.

This drop in dominance signifies profit-taking amongst Bitcoin holders and renewed curiosity in higher-risk belongings, signaling a diversification of market focus.

Bitcoin’s instant trajectory will depend on whether or not the psychological $100K barrier turns into a actuality, alongside its capability to keep up dominance amid rising altcoin exercise.

What lies forward for Bitcoin?

Bitcoin’s trajectory pointed to additional progress, with analysts like Raoul Pal forecasting a neighborhood prime of $110,000 by early 2025 and a possible peak in late 2025.

Macro elements just like the April halving and institutional adoption proceed to bolster long-term bullish sentiment. Nonetheless, dangers comparable to regulatory adjustments and broader market corrections might mood good points.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

As altcoins acquire momentum, Bitcoin’s dominance could face extra strain, signaling a diversifying market.

Whether or not Bitcoin breaches the $100K psychological barrier and sustains its upward momentum will rely upon renewed shopping for strain and broader crypto market developments.