Coinspeaker

QCP Capital: Bitcoin Poised for $100K-$120K Rally, however Dangers Stay

QCP Capital, one of many largest digital asset buying and selling corporations and choices desks, projected that Bitcoin

BTC

$88 814

24h volatility:

1.9%

Market cap:

$1.75 T

Vol. 24h:

$96.50 B

may eye $100K-$120K. The agency cited sturdy worth motion post-US election and the potential institution of a US Bitcoin Strategic Reserve as key causes for the outlook.

“In view of Bitcoin’s impressive rally since the US election, our view is that $100,000–$120,000 may not be too far off,” wrote QCP Capital in its each day market replace.

BTC Quick-Time period Dangers

Nevertheless, the buying and selling agency highlighted elevated promoting of name choices (bullish bets) and shopping for of places (bearish bets) by giant gamers as a threat. It meant that enormous gamers had been cashing out from their ‘Trump Trade’ bets and shopping for protecting places to hedge in opposition to a possible worth pullback.

“Implied volatility has been falling on the move up as many large players were positioned for it and sold calls into the rally. With each new high, our desk observed market is selling calls and buying puts to hedge their downside risk,” added QCP Capital.

This partly defined the current worth stalling above $93K and the following pullback. On the time of writing, BTC was valued at $88K, a couple of 6% decline from the newest all-time excessive (ATH).

Supply: BTCUSDT, TradingView

Presto Analysis, a crypto-focused analysis agency, echoed a sentiment just like that of QCP Capital. The analysts famous sluggish demand from TradFi, citing a decline in MicroStrategy’s MSTR and Coinbase’s COIN as indications of the unwinding of the ‘Trump trade.’

“We’re at an all-time high, and some are unwinding the ‘Trump trade,’ which includes long $BTC positions…ETF inflows also show signs of a slowdown, although whether it’s a blip or a lasting trend remains to be seen,” the analysis agency wrote.

Based on Soso Worth information, the US spot BTC ETFs noticed a each day web outflow of $400.67 million on Thursday.

Insights from BTC Choices Market

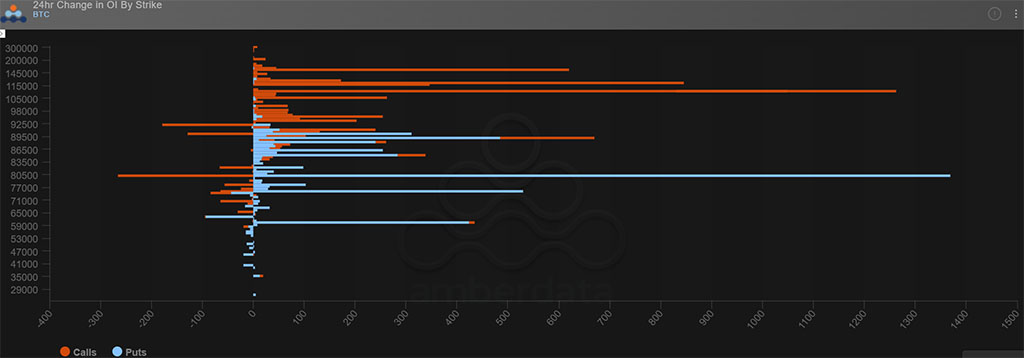

That stated, giant gamers within the BTC choices market anticipated wild worth swings on both aspect, however there was an amazing bullish bias.

Supply: Amberdata

Up to now 24 hours, the modifications in OI (Open Curiosity) charges or cash inflows in name choices had been concentrated at $95K, $105K, $110K, and $120K targets. This indicated the degrees as potential and rapid upside targets.

Nevertheless, there was additionally important OI in places (draw back bets) at $80K and $75K. In brief, these ranges may act as assist in case of an prolonged pullback.

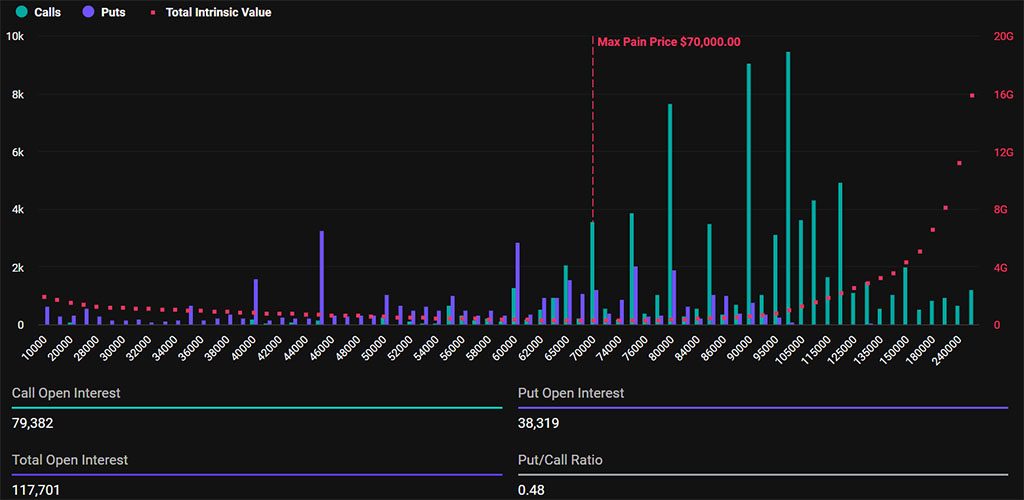

Supply: Deribit

However the end-November and December choices expiries remained arguably bullish. For instance, Deribit choices for the December 27 expiry had a Put/Name ratio of 0.48, which was lower than 1 and meant extra calls (bullish bets) than places (bearish bets), a bullish cue.subsequent

QCP Capital: Bitcoin Poised for $100K-$120K Rally, however Dangers Stay