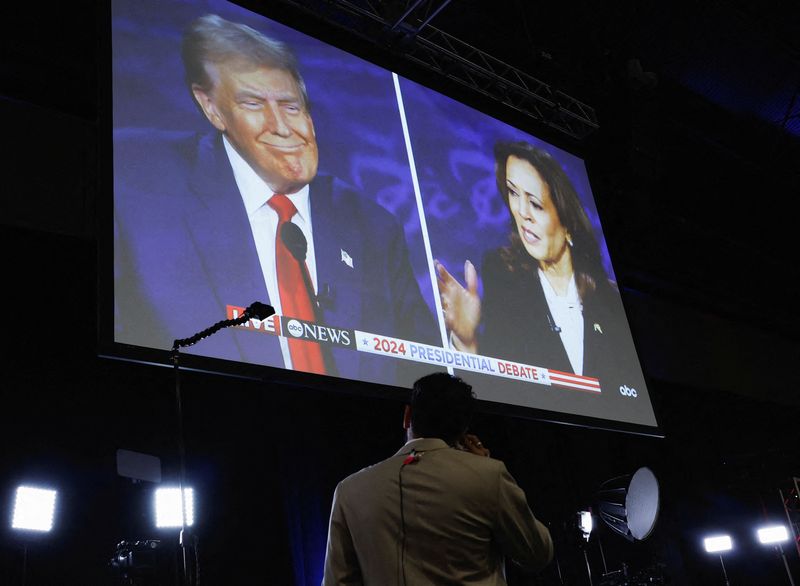

Picture supply: Getty Pictures

hVIVO (LSE: HVO) is a small-cap UK inventory that’s skyrocketed almost 400% in 5 years. So it clearly doesn’t want a raging bull market to do nicely.

However with rate of interest cuts on the horizon and a brand new authorities dedicated to stability, I feel the stage is ready for smaller UK shares like this to carry out very strongly.

Report H1

For these unfamiliar, the corporate is a specialist contract analysis organisation (CRO) targeted on human problem trials. These contain wholesome volunteers being uncovered to pathogens to check vaccines and coverings, offering crucial knowledge on efficacy and security in a managed surroundings.

The agency recruits volunteers by means of its FluCamp platform, which has a database of over 320,000 contributors. Its prospects are usually biopharma corporations.

In July, we obtained a buying and selling replace for the primary half of the yr, which means a lot of the agency’s interim outcomes launched at this time (10 September) was already identified. However the report confirmed stable progress, nonetheless.

Income rose 30.6% yr on yr to £35.6m, whereas EBITDA jumped 67.6% to achieve £8.7m. That EBITDA margin of 24.5% improved from 19.1% final yr. Fundamental adjusted earnings per share elevated 30.6%.

The corporate ended June with £37.1m in money, up from £31.3m. It’s began paying an annual dividend.

Trying forward, administration expects full-year income to be £62m, which might characterize income development of round 11%. And 100% of that steering is already absolutely contracted.

The EBITDA margin is anticipated to be on the higher finish of market expectations (22%-24%).

By 2028, the agency sees annual income of no less than £100m, suggesting the highest line will develop at a compound annual charge of about 14%.

Additional margin enlargement anticipated

This development will probably be underpinned by the corporate’s new state-of-the-art quarantine facility at Canary Wharf. That is the world’s largest human problem unit.

Throughout H1, it helped assist the inoculation of a file variety of volunteers throughout varied research.

Earlier than relocating, hVIVO used quarantine rooms throughout a number of flooring, leading to a 7-8 minute pattern supply time to the lab. The brand new facility is on one flooring and incorporates a pneumatic chute system, reducing pattern transport time to about 30 seconds.

Operational efficiencies like this are anticipated to additional enhance revenue margins. The agency additionally continues to diversify its income streams by means of scientific trial design, volunteer recruitment companies, and hLAB, its specialised laboratory service providing.

The weighted contracted orderbook stood at £71m in June, however administration sees a £40m pipeline of promising alternatives within the short-to-medium time period.

Affordable valuation

Naturally, the corporate might face reputational dangers if a high-profile downside happens throughout a trial. Plus, it doesn’t have an extended monitor file of profitability.

As for valuation, the inventory is buying and selling on a price-to-sales (P/S) ratio of three.5 and a ahead price-to-earnings (P/E) a number of of 20.5. Neither strikes me as stretched.

Trying forward, I feel the inventory might fly greater, particularly if a bull market takes off. I grew to become a shareholder final yr and added to my place this yr. It stays certainly one of my favorite small-cap shares.