The crypto market is navigating a wave of combined sentiment, with main digital property exhibiting various levels of optimism and skepticism, in accordance with a Santiment report revealed on Jan. 9.

The evaluation highlights stark variations in dealer sentiment for main cryptocurrencies and urges traders to undertake contrarian methods to navigate these risky situations.

Combined sentiment

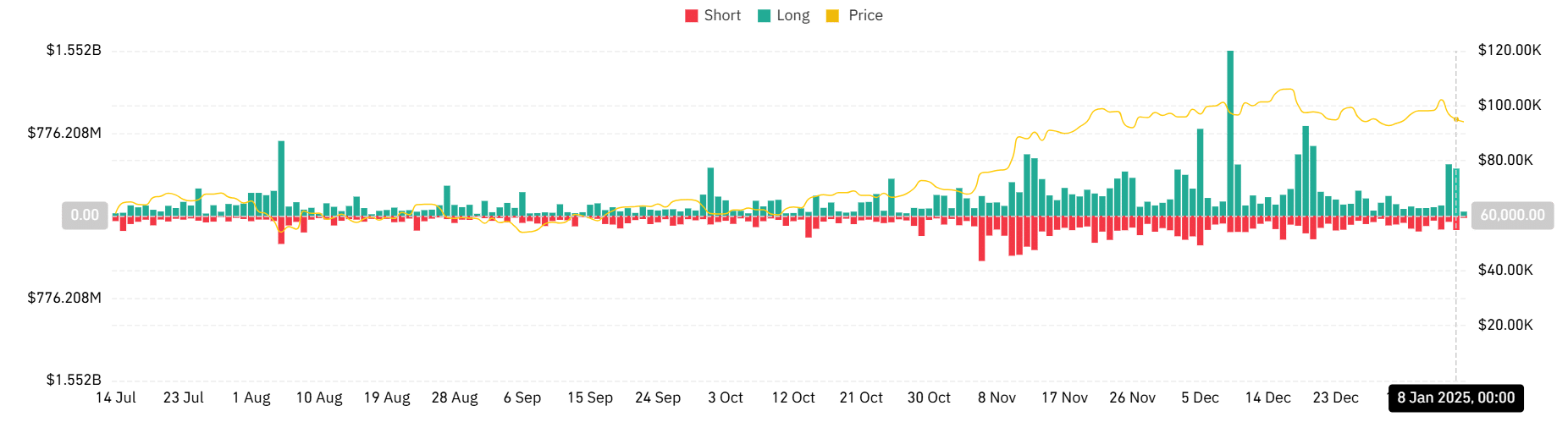

Bitcoin (BTC), the market chief, presently trades at $93,775 with a impartial sentiment score of three out of 5. Merchants stay cautious as BTC consolidates following a latest pullback, ready for a decisive value motion. The report suggested holding positions for now, as intervals of stagnation usually precede main value shifts.

Ethereum (ETH) faces extra bearish sentiment, scoring 2 out of 5 as its value hovers round $3,280, precariously near the $3,000 help degree. The report warned {that a} breach of this threshold might set off panic promoting, creating potential shopping for alternatives for long-term traders prepared to take a contrarian stance.

In the meantime, BNB reveals a impartial sentiment of three as merchants monitor the asset for indicators of renewed momentum following its dip under $700. The report added that BNB’s historic conduct suggests the potential for a breakout transfer if it decouples from broader market traits.

Alternatively, XRP has retained a semi-bullish sentiment rating of 4 after a robust efficiency late final 12 months. Whereas optimism stays excessive, the report cautioned in opposition to chasing good points in XRP, as prolonged enthusiasm in altcoins has traditionally signaled a threat of corrections.

Solana (SOL) has equally attracted semi-bullish sentiment, scoring 4, whilst its value fell 8% this previous week to $190. SANInsights highlights that retail optimism stays unusually excessive, suggesting merchants ought to look forward to sentiment to chill additional earlier than re-entering the market.

In distinction, Dogecoin (DOGE) has the bottom sentiment rating of 1, with its value declining 28% over the previous month. The report flags DOGE as a possible contrarian alternative, noting that excessive bearish sentiment has usually preceded recoveries within the memecoin’s historical past.

Contrarian technique

The report emphasised the significance of contrarian methods, citing historic traits the place market sentiment serves as a counter-indicator for value actions.

The report highlighted that contrarian methods — shopping for throughout concern and promoting throughout euphoria — stay efficient instruments for navigating the risky crypto market.

Belongings like Ethereum and Dogecoin, that are presently gripped by bearish sentiment, might current outsized returns for traders prepared to take calculated dangers.

In the meantime, excessive optimism round XRP and Solana suggests warning, as property in such phases usually face corrective pressures earlier than resuming progress.