Coinspeaker

Spot Bitcoin ETFs Rebound with $62.09M Influx, whereas GBTC Continues Outflow Development

Regardless of a risky pre-halving week, spot-traded Bitcoin trade-traded funds (ETFs) within the United States appear to be regaining traders’ belief. Information from SoSoValue signifies that, after 5 consecutive days of net outflow, these ETFs recorded web inflows once more on Monday, April twenty second, 2024.

Spot Bitcoin ETFs noticed only a $62 million influx on Monday. The Constancy Sensible Origin Bitcoin Fund (FBTC) attracted the highest single-day web influx of $34.83 million. Different prominent funds like ARK 21Shares Bitcoin ETF noticed over $22.5 million in inflows. The iShares Bitcoin Belief experienced a stable $19.65 million influx.

Whereas a lot of the spot Bitcoin ETFs experienced inflows, Grayscale Bitcoin Belief ETF (GBTC), recognized for important withdrawals beforehand, continued this sample with a net outflow of round $35 million. Nonetheless, it’s essential to acknowledge that regardless of Grayscale’s outflow, the general net influx for spot Bitcoin ETFs stays constructive.

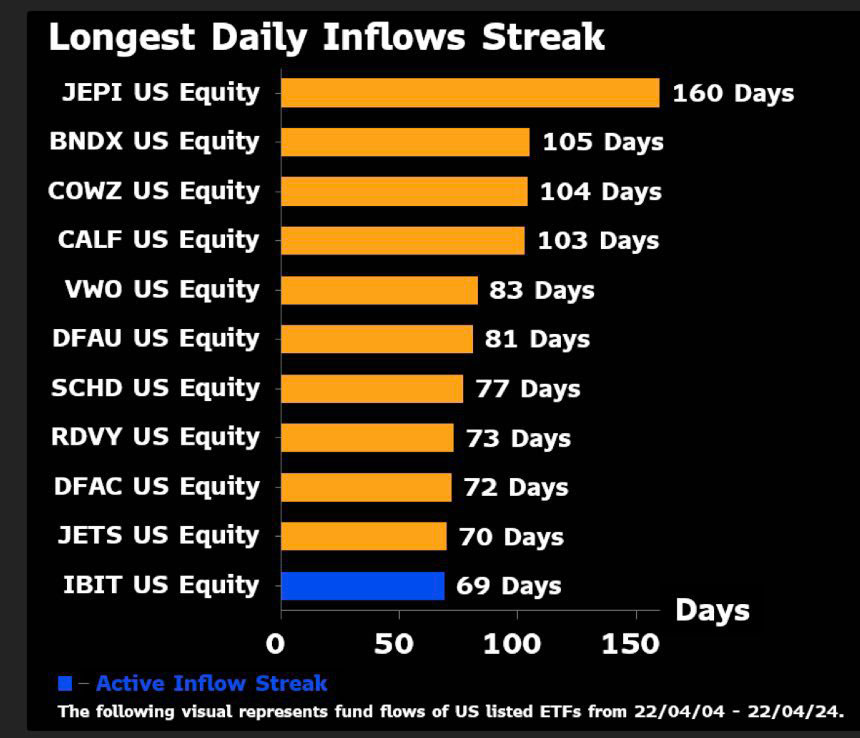

BlackRock’s IBIT Maintains 69-Day Influx Streak

BlackRock’s iShares Bitcoin Belief ETF (IBIT) has constantly captured traders’ attention, drawing a powerful streak of 69 consecutive days of web inflows as of April 23, 2024. This exceptional streak positions IBIT on the verge of securing a spot among the many high 10 Trade-Traded Funds with the lengthiest day by day influx durations.

Photograph: Bloomberg

In April, IBIT experienced a noteworthy day by day average influx of $223.4 million. Remarkably, the utmost influx reached a considerable $849 million, whereas the minimal stood at $18 million. This vary reveals a commendable degree of investor engagement.

Fidelity’s FBTC doesn’t carry out as well as IBIT however nonetheless displays a constructive investor outlook. The fund attracted a mean influx of $118 million in April, with a peak influx of $473 million. Nonetheless, it’s vital to notice that FBTC had zero inflows on three separate days in April.

Grayscale Bitcoin Belief’s battles persist, marking an reverse trajectory from BlackRock’s IBIT. The previous quarter noticed huge Bitcoin outflows from GBTC, totaling almost 300,000 cash. April alone witnessed outflows exceeding $1.6 billion – a stark distinction to IBIT’s inflows throughout that point.

Grayscale Seeks Redemption with “Mini Bitcoin ETF”

In an try and reverse its fortunes, Grayscale revealed its plan to launch an modern low-cost product titled “Grayscale Bitcoin Mini Trust”. This contemporary providing stands out with its minimal expense ratio of merely 0.15%, potentially positioning it as the most affordable Bitcoin ETF centered on spot market publicity.

GBTC’s substantial 1.5% payment doubtless discouraged traders, especifically when in comparison with extra inexpensive choices from BlackRock and Constancy. Due to this fact, the low-cost “Grayscale Bitcoin Mini Trust”. With a 0.15% payment, addresses Grayscale’s difficulties by enhancing competitiveness by way of revised product choices.

The launch of the Bitcoin Mini Belief, with its disruptive payment construction, signifies Grayscale’s willpower to regain its market share and appeal to new inflows. Nonetheless, solely time will inform if this technique proves profitable within the face of sturdy competitors from established gamers within the Bitcoin ETF panorama.

Spot Bitcoin ETFs Rebound with $62.09M Influx, whereas GBTC Continues Outflow Development