Coinspeaker

Spot Bitcoin ETFs Sees eighth Consecutive Day of Influx Streak

The US spot Bitcoin exchange-traded fund (ETF) market proceeds to realize momentum, with internet inflows for eight days in a row as of Could 20, 2024. This constructive pattern comes amidst rising anticipation for the approval of spot Ether ETFs, which may result in comparable merchandise for different cryptocurrencies like Solana (SOL).

Bitcoin ETFs Appeal to $153M

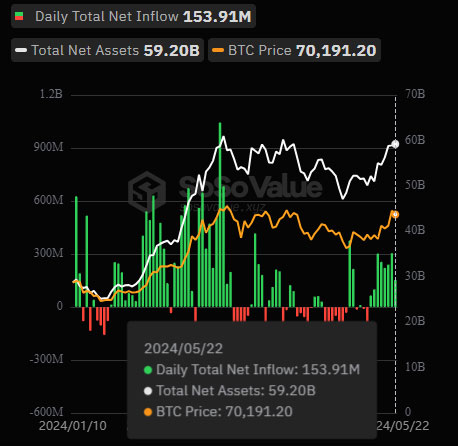

Photograph: SoSoValue

Information from SoSo Worth reveals that spot Bitcoin ETFs attracted $153.91 million on Wednesday. BlackRock’s iShares Bitcoin Belief (IBIT) led with $92 million inflows. Constancy Digital Property’ Smart Origin Bitcoin ETF followed with $75 million, whereas Ark Make investments and 21Shares Bitcoin ETF had $3 million in inflows.

However, Grayscale’s industry-leading Bitcoin Investment Belief (GBTC) experienced internet outflows of $16 million on Wednesday. Seven different spot Bitcoin ETFs from Bitwise, VanEck, and others maintained impartial positions with zero internet flows.

Regardless of this minor setback, the general pattern for spot Bitcoin ETFs remains constructive. Since their January 2024 launch, these funds have gained $13.33 billion in net inflows, displaying investor confidence on this new asset class. The cumulative buying and selling quantity exceeds $267 billion for the spot Bitcoin ETFs, indicating a extremely lively market.

FIT21 Act Spurs Spot Bitcoin ETFs

The constructive sentiment round spot Bitcoin ETFs coincides with the latest passing of the Monetary Innovation and Know-how for the twenty first Century Act (FIT21) by the US Home of Representatives. This Republican-led invoice goals to ascertain a authorized framework for the digital asset {industry}, granting the Commodity Futures Buying and selling Fee (CFTC) extra authority to supervise crypto property as “digital commodities.”

Whereas the invoice is a major step in direction of crypto regulation, it has drawn criticism from each events. Rep. Nancy Pelosi (D-CA) expressed issues that the present model of FIT21 lacks sufficient shopper safety measures and wishes additional refinement. Securities and Change Fee (SEC) Chair Gary Gensler agreed, arguing that the invoice places digital asset buyers in danger.

The US crypto market now eagerly awaits the potential approval of spot Ether ETFs. The SEC reportedly requested amendments and refiling of 19b-4 types from exchanges earlier this week, a transfer usually seen as a precursor to approval. Cboe BZX submitted revised types for 5 spot Ether ETFs, whereas Nasdaq filed the amended kind for BlackRock’s providing.

Solana’s ETF Prospects

BKCM CEO Brian Kelly recently speculated that Solana may very well be the subsequent cryptocurrency to receive a spot ETF. Whereas specific particulars and timelines repredominant unclear, the likelihood highlights Solana’s rising prominence available in the market.

Traditionally, the approval of a spot Bitcoin ETF led to a 12% surge within the ETH/BTC buying and selling pair inside a weeok. Daniel Yan, co-founder of Matrixport, means that Solana may experience comparable positive factors if a spot Ether ETF is greenlit.

Solana’s power lies in its high-speed, low-cost transactions, which are a magnet for vital investor interelaxation. A spot ETF may additional improve its visibility and mainstream adoption. The confluence of constructive developments (sustained inflows into spot Bitcoin ETFs, the passing of the FIT21 invoice, and the potential approval of spot Ether ETFs) paints a promising image for the way forward for cryptocurrency.

Spot Bitcoin ETFs Sees eighth Consecutive Day of Influx Streak