Picture supply: Getty Photographs

Tesla (NASDAQ:TSLA) inventory surged on Donald Trump’s victory, owing to Elon Musk’s obvious alliance with the previous president. Unsurprisingly, it was essentially the most purchased inventory by traders utilizing the Hargreaves Lansdown platform final week.

Nonetheless, apparently, Tesla was additionally essentially the most bought inventory throughout the week, maybe indicating that some traders had been trying to money in on the surging shares — the inventory jumped 31% final week.

MicroStrategy (NASDAQ:MSTR) was the second-most purchased inventory by Hargreaves Lansdown traders who seemingly wished to US shares and the ‘Trump Trade’ fairly than these nearer to residence.

So, let’s take a better look as to why traders might need been concerned with these two firms.

Tesla: an ally in The White Home

Buyers flocked to Tesla shares following Trump’s presidential victory for a number of key causes.

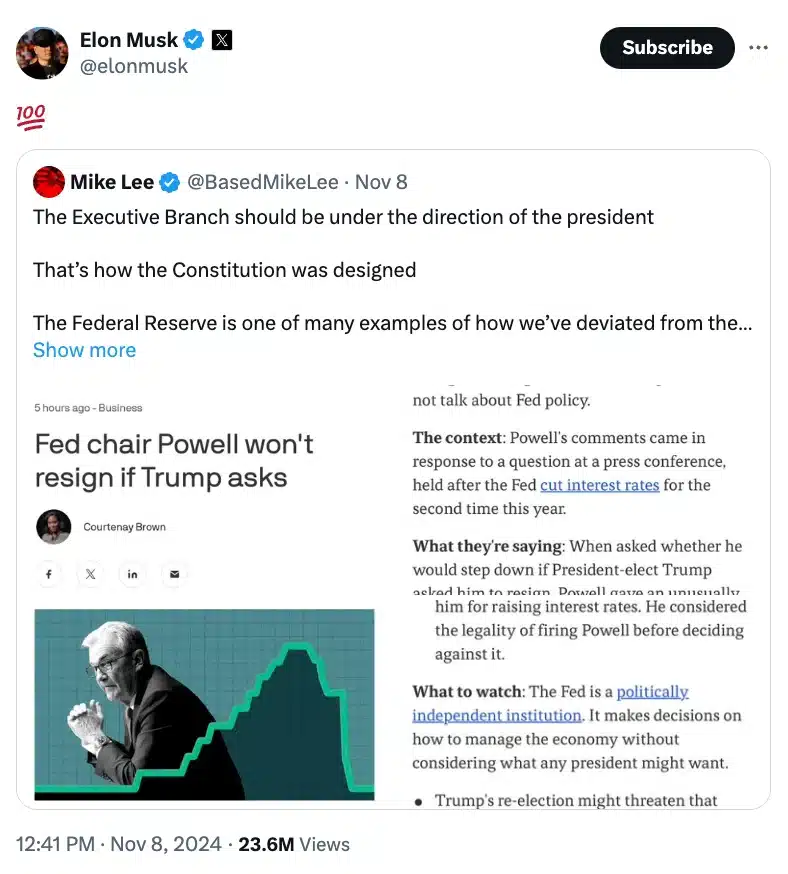

Firstly, Musk’s vocal assist for Trump might outcome within the South African billionaire having affect within the incoming presidency. Trump has even urged Musk may have an effectivity position throughout the administration.

Secondly, Trump’s proposed insurance policies, together with decrease company taxes and deregulation, are considered as probably helpful for Tesla’s development and profitability. Moreover, Trump’s stance on tariffs, significantly towards Chinese language imports, may give Tesla a aggressive edge over international EV producers within the US market.

Furthermore, the potential discount in EV subsidies underneath Trump’s administration can also be seen as probably benefiting cash-rich Tesla greater than its smaller opponents, given the corporate’s dominant market place and scale.

Lastly, however probably most significantly, traders speculated that Musk’s relationship with Trump may result in advantageous insurance policies for Tesla, significantly in areas like autonomous driving laws.

That is necessary as a result of Tesla inventory is valued on its potential within the autonomous driving realm and robotics, with a price-to-earnings (P/E) ratio of 100 occasions — that’s 5 occasions increased than EV friends.

Personally, I’d argue that the corporate is falling behind the likes of Waymo and Chinese language friends as its Robotaxi reveal fell considerably flat.

It’s a really costly inventory, which most likely explains why it was additionally essentially the most bought inventory final week by Hargreaves Lansdown traders. It’s additionally not on my watchlist given the inventory’s insane multiples.

MicroStrategy: a Bitcoin play

Buyers flocked to MicroStrategy — an American Bitcoin growth firm — inventory final week, pushed by a surge in Bitcoin’s worth following Trump’s election victory.

Trump’s sudden pro-crypto stance, together with guarantees to make the US a “crypto capital” and set up a nationwide Bitcoin reserve, ignited enthusiasm within the cryptocurrency market.

This was coupled with a pledge to finish the “anti-crypto crusade” and exchange SEC Chair Gary Gensler, signalling a probably extra beneficial regulatory setting for digital property.

This shift in Trump’s strategy to cryptocurrencies led to Bitcoin hovering above $80,000, instantly benefiting MicroStrategy as a result of its substantial Bitcoin holdings.

The corporate’s ’21/21 Plan’ will see it make investments $42bn in Bitcoin over the following three years and this seems to align nicely with the market’s renewed optimism for crypto.

It’s an attention-grabbing firm however I’m nonetheless unconvinced by crypto. There’s no P/E ratio because it’s not forecasted to show a revenue this 12 months regardless of surging crypto holdings. As soon as once more, it’s a inventory I’m staying away from as I desire extra predictable industries.