Picture supply: Getty Photos

It’s not arduous to seek out low-cost dividend shares at this second in time. Nevertheless, this one actually seems to be the half on paper, providing an enormous 13.2% ahead dividend yield.

Which means if I had been to take a position £1,000 as we speak, I’d obtain £132 over the subsequent 12 months within the type of dividends. Curiously, the corporate pays its dividends quarterly, which can curiosity buyers in search of common money movement.

So, what is that this lesser-known dividend inventory? Properly, it’s Nordic American Tankers (NYSE:NAT), a US-listed firm that specialises in Suezmax crude oil tankers.

An missed sector

Nordic American Tankers operates a fleet of 19 such tankers. Suezmax vessels are designed to transit the Suez Canal at full capability, usually carrying round a million barrels of oil.

These ships are versatile, in a position to serve many main ports and navigate by means of key transport routes just like the Suez and Panama Canals.

Ship provide has been drastically impacted during the last 12 months resulting from droughts in Panama and assaults on ships within the Crimson Sea. This shortage of obtainable ships has led to an uptick in earnings for corporations like Nordic. The agency reported that about 57% of its spot voyage days for Q1 2024 had been booked at a mean Time Constitution Equal (TCE) of $40,690 per day per ship — that’s far above long-term averages.

Shortage isn’t simply a problem within the quick time period, nonetheless.

Tanker corporations delayed new orders in the course of the pandemic. The result’s a a lot older international fleet than we’ve seen for years. And these tankers take years to construct.

As such, provide shortages are anticipated to persist.

A dividend large, however there are points

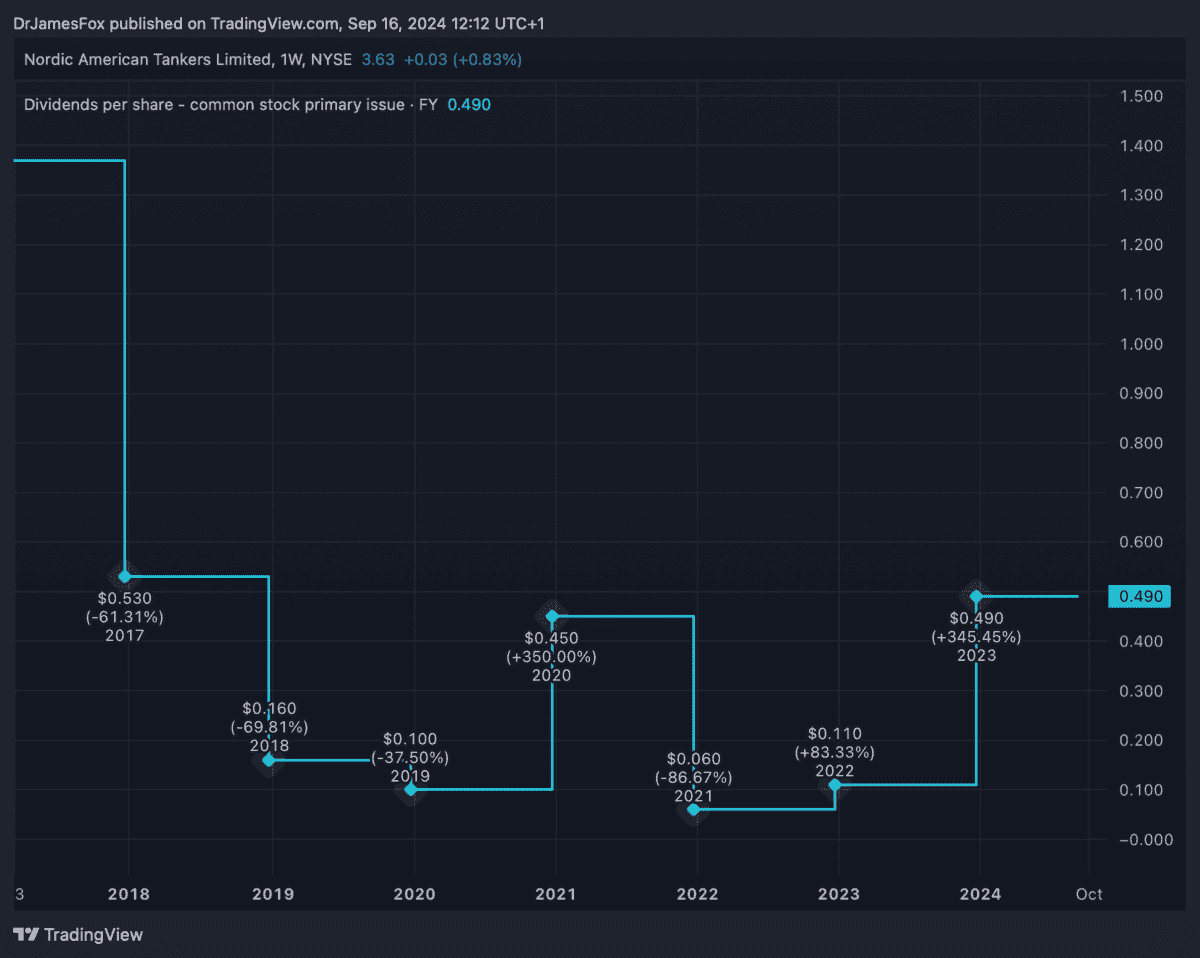

Nordic American is a dividend large, having paid a dividend for every of the final 108 quarters. It’s a very phenomenal file.

Nevertheless, dividends haven’t at all times elevated in the course of the interval, and typically the dividend funds have been pretty nominal.

This 12 months, Nordic American is because of pay $0.48 per share in dividends, primarily based on the present $0.12 per share per quarter.

Nevertheless, the corporate is simply forecast to earn $0.43 per share in 2024, suggesting that administration is paying out extra in dividends than the corporate earns. It additionally factors to a ahead price-to-earnings of 8.5 occasions — a 24% low cost to the sector.

This payout ratio is a giant purple flag and one that means the dividend must fall.

The caveat is that monetary efficiency is predicted to enhance considerably in 2025. In accordance with analysts, Nordic will earn $0.64 in 2025 after which $0.68 in 2026.

With this in thoughts, it might proceed with the present dividend funds. But it surely’s a danger.

A danger value taking?

Personally, I consider it’s a danger value taking. I used to be first made conscious of this inventory by one of many world’s high analysts protecting the transport and tanker sectors. His returns — round 43% every year over eight years — have been really groundbreaking.

He thinks this inventory will carry out in the long term, and so do I.