Coinspeaker

Trump’s New Administration Guarantees Robust Greenback, 20% Tariffs, Says Financial Advisor

Forward of the November 5, 2024, Election Day, the potential Donald Trump administration has pledged to maintain the US greenback sturdy, adhering to the nation’s established financial insurance policies. Scott Bessent, Trump’s chief financial advisor, shared this dedication with the Monetary Occasions on Sunday, easing considerations a few weaker greenback underneath Trump’s management.

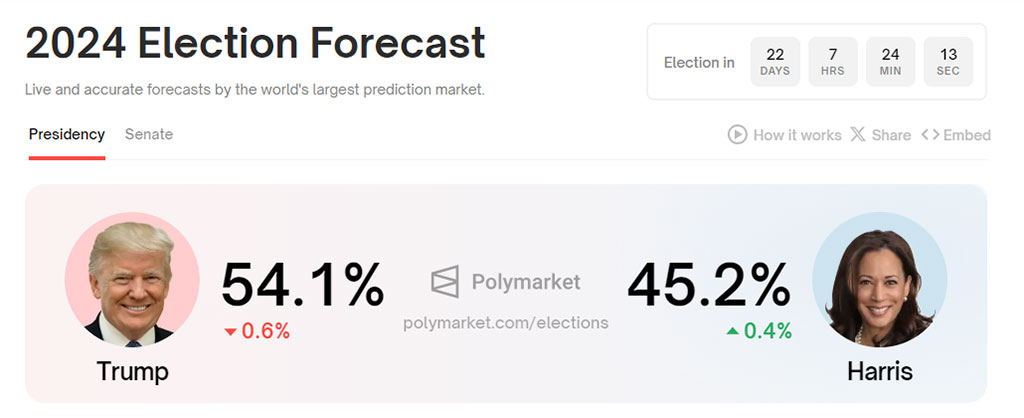

Because the election attracts close to, prediction markets like Polymarket present Democrat Kamala Harris lagging behind Republican Donald Trump, who favors cryptocurrency. Earlier this yr, Trump and his working mate, JD Vance, advocated for a weaker greenback to spice up manufacturing development. This place sparked worries amongst buyers and economists in regards to the doable decline of the US forex.

Nevertheless, Bessent clarified that he doesn’t anticipate Trump to scale back the USD worth deliberately. He highlighted the greenback’s standing as a “reserve currency” and indicated that Trump would preserve its power. Whereas devaluation normally means reducing the forex’s change price to make exports extra aggressive, Bessent dismissed this technique for the upcoming administration.

Bessent Defends 20% Import Tariffs

Bessent is rumored to be a high contender for the Treasury Secretary position underneath Trump, highlighting his important affect in crafting the administration’s financial methods. He additionally supported Trump’s proposal to introduce inflationary tariffs of as much as 20% on all imports, indicating that these “extreme positions” could possibly be softened in discussions with commerce companions.

“The reserve currency can go up and down based on the market. I believe that if you have good economic policies, you’re naturally going to have a strong dollar,” Bessent remarked. Moreover, he clarified that his statements don’t replicate Trump’s official stance, but they counsel a continuation of insurance policies that help a robust greenback.

Trump’s latest reward of Bessent as “one of the most brilliant men on Wall Street” exhibits the financial advisor’s important affect on the administration’s monetary methods.

In the course of the interview, Bessent praised Trump as a businessman who comprehends financial intricacies, contrasting him with Kamala Harris, whom he labeled “an economic illiterate,” and her working mate, Tim Walz, as “twice as illiterate”. These remarks underscore the sharp political and financial contrasts between the candidates.

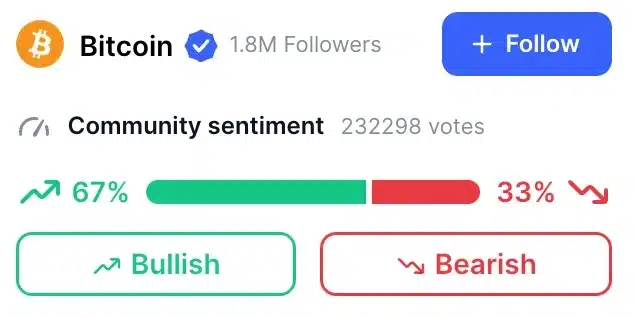

Election Affect on Digital Property Surge

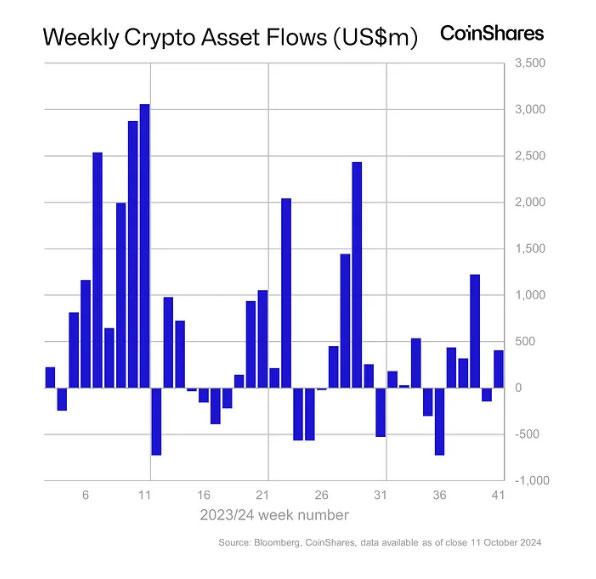

Political developments have triggered substantial investments within the digital asset market. Digital asset funding merchandise rose by $407 million, primarily pushed by the upcoming elections relatively than conventional financial insurance policies, based on CoinShares weekly report on October 14.

Bitcoin benefited probably the most from these political modifications, attracting $419 million in investments. In distinction, short-Bitcoin merchandise noticed outflows of $6.3 million. In the meantime, multi-asset funding merchandise continued their 17-week streak of inflows, although modestly at $1.5 million. On the similar time, Ethereum skilled outflows totaling US$9.8 million.

Trump’s New Administration Guarantees Robust Greenback, 20% Tariffs, Says Financial Advisor