- Kiyosaki sees the most recent bout of BTC weakening as a shopping for alternative

- Trump’s tariffs may dent the Fed price minimize outlook and Bitcoin’s projections amid renewed inflation fears

Robert Kiyosaki, creator of “Rich Dad, Poor Dad,” has termed the latest weakening of Bitcoin [BTC] following Trump’s tariffs a reduced “buying opportunity.”

President Donald Trump introduced tariffs towards imported items from Canada, China, and Mexico, with the identical set to be efficient from February. Market pundits have been cautious about tariff wars triggering inflation and denting the Fed price cuts’ outlook – One thing that’s bearish for threat belongings like Bitcoin.

Nevertheless, Kiyosaki additionally believes the U.S fiscal debt scenario is an even bigger drawback that may all the time make BTC, gold, and silver extra enticing. He stated,

“Trump tariffs begins: Gold, silver, Bitcoin may crash. Good. Will buy more after prices crash. Real problem is DEBT…which will only get worse. Crashes mean assets are on sale. Time to get richer.”

In January, the creator caught to his $175K-$350K worth goal for BTC by end-2025. Therefore, the query – Can the crypto nonetheless soar to those ranges?

Will we see February positive factors once more?

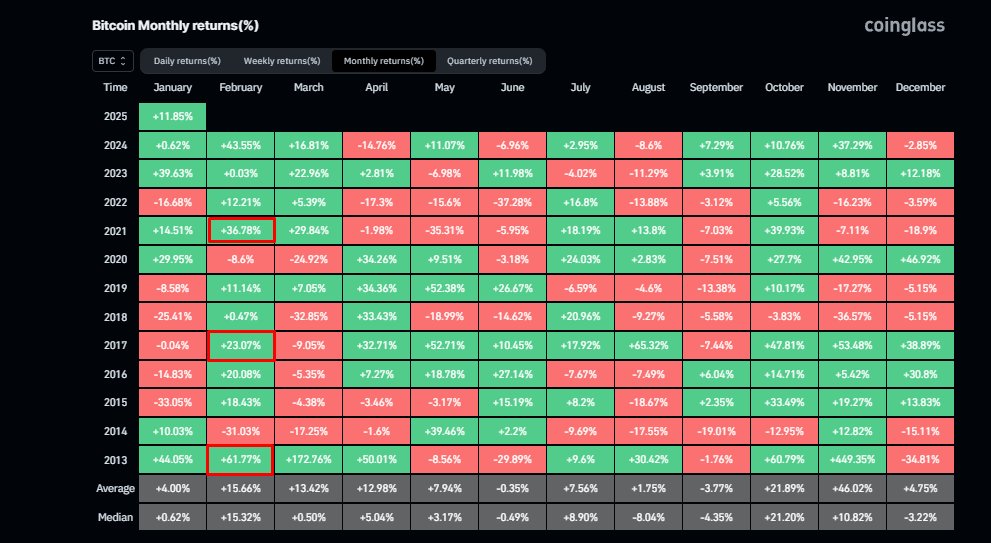

Bitcoin closed January within the inexperienced, with positive factors of 9.29% on the charts. Curiously, February has normally recorded large historic positive factors, particularly for the post-halving yr. As an example – Since 2013, BTC has by no means closed February within the pink, with a median of 15% positive factors. If the pattern repeats itself this time, BTC may edge greater in February.

Nevertheless, the tariff-induced inflation threat can’t be ignored simply but.

One other bullish indicator for the king coin is the U.S cash provide (M2) as USD liquidity is usually related to BTC rallies. Actually, according to market analyst Joe Burnett, the indicator may surpass 2021 highs and push the crypto even greater.

“M2 is set to break all-time highs for the first time since 2021. Infinite liquidity chasing 21,000,000 bitcoin. You know what happens next.”

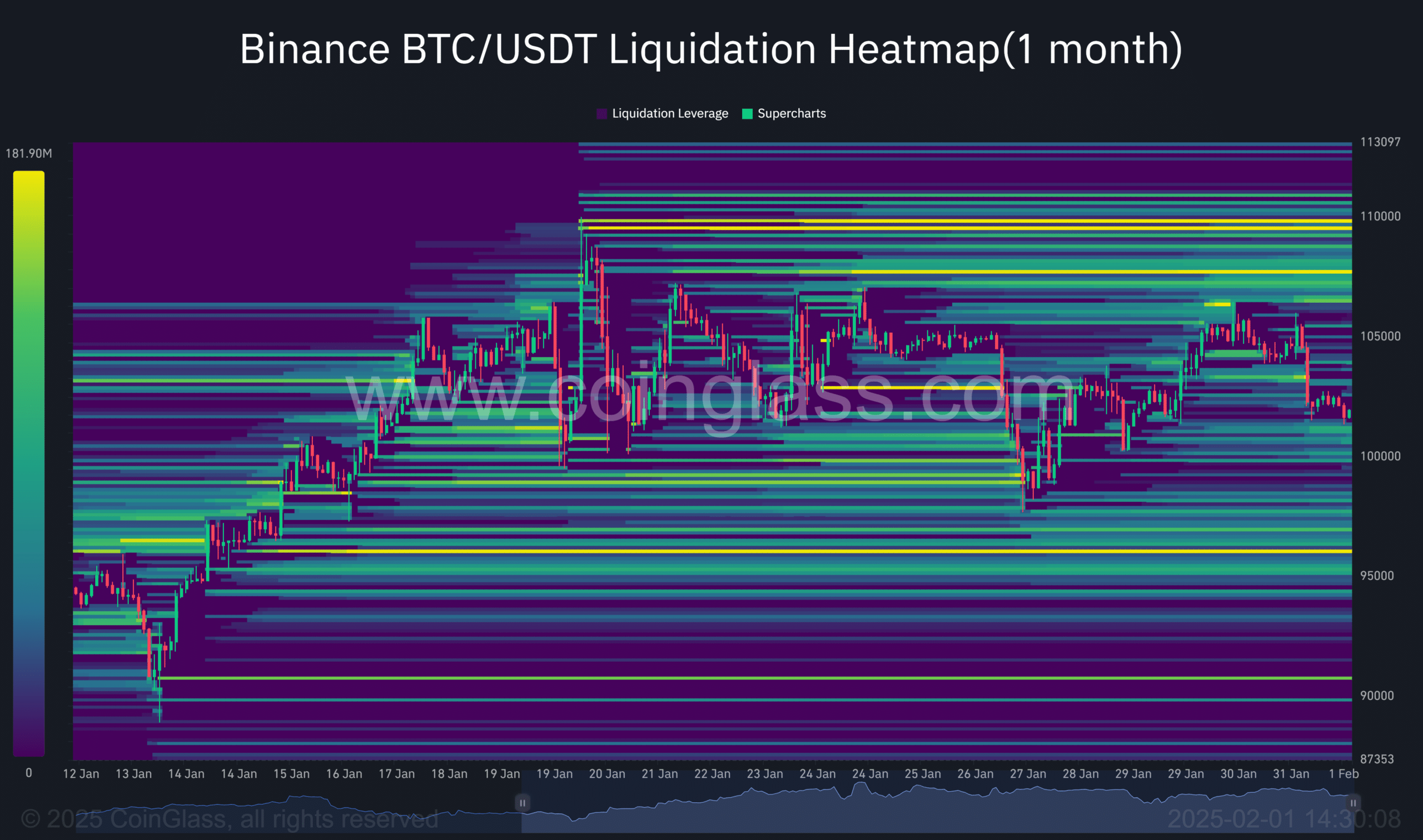

Within the meantime, the month-to-month liquidation heatmap indicated marked key ranges (shiny yellow) at $96k, $107k, and under $110k.

At press time, nonetheless, the value motion was almost midway from its key liquidity ranges. And, it could be tough to pinpoint which course it may take. Maybe, the U.S jobs report (Scheduled for 7 February) may supply extra readability when guessing BTC’s subsequent course.