Picture supply: Unilever plc

Client items big Unilever (LSE: ULVR) has moved up by 20% over the previous yr on the London inventory market. However that merely takes the Unilever share worth again to… the place it was 5 years in the past!

The share at the moment stands inside 1% of its worth again then.

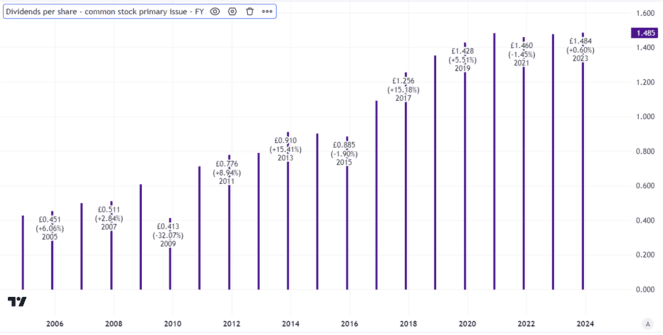

In the meantime, the enterprise pays quarterly dividends, with a good observe report of progress. However with its yield of three%, I’d describe Unilever as respectable slightly than particularly thrilling in the case of passive revenue.

Created utilizing TradingView

So, after a 20% rise, has the tide turned? May the maker of Magnums and Marmite maintain marching up in worth?

A misplaced 5 years

From an investing perspective, the previous 5 years will be seen as a misplaced interval for the enterprise. The Unilever share worth has gone exactly nowhere and the dividend yield is beneath the FTSE 100 common.

However as long-term buyers, typically now we have to take the tough with the graceful.

Unilever has confronted a number of challenges over that interval, from rampant inflation at occasions to stuttering client demand as a consequence of a weakening economic system.

Why the following 5 years might be totally different

The funding case for Unilever is far the identical because it has been for a very long time. Promoting merchandise which are recurrently utilized in households all over the world, from shampoo to laundry detergent, it will probably faucet into resilient long-term demand.

A portfolio of premium manufacturers provides the enterprise pricing energy and helps construct buyer loyalty. Nonetheless, a draw back is that when the economic system is weak because it at the moment is, some customers will commerce all the way down to cheaper grocery store personal label merchandise.

The corporate has launched a cost-cutting plan that’s anticipated to see hundreds of job roles eradicated. It additionally plans to hive off its ice cream enterprise. As that may be a decrease margin enterprise than private care merchandise, for instance, that would make the enterprise extra financially enticing over the long term.

The worth doesn’t appear to be a discount

I worry that unloading the ice cream enterprise might distract administration consideration, although.

I additionally assume the cost-cutting programme might be disruptive. Possibly it can assist enhance income over time. However such programmes are normally expensive to implement at first and might harm employees morale.

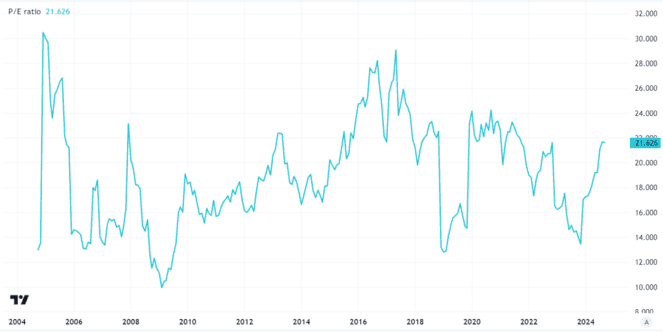

After the 20% rise previously yr, the Unilever share worth now trades on a price-to-earnings ratio of twenty-two.

That’s decrease than it has been traditionally, however markedly larger than it was just some months in the past.

Created utilizing TradingView

It’s larger than I’d take into account nearly as good worth for the corporate, particularly provided that it stays to be seen how properly it is ready to transfer ahead with its strategic plans and what that finally ends up that means in apply for the corporate’s monetary efficiency.

So, for now, my solely plans to attempt to clear up with Unilever contain utilizing Domestos or Cif, not shopping for the share.