Coinspeaker

US Bitcoin ETFs See 5-Day Influx Streak as BlackRock Leads with $184M

The current state of affairs with the US spot Bitcoin exchange-traded funds (ETFs) is one which displays the favored ‘tough times don’t last’ saying. This follows after the spot Bitcoin

BTC

$63 810

24h volatility:

-0.1%

Market cap:

$1.26 T

Vol. 24h:

$24.24 B

ETFs registered one other day of cumulative influx on Wednesday, making it 5 days in a row.

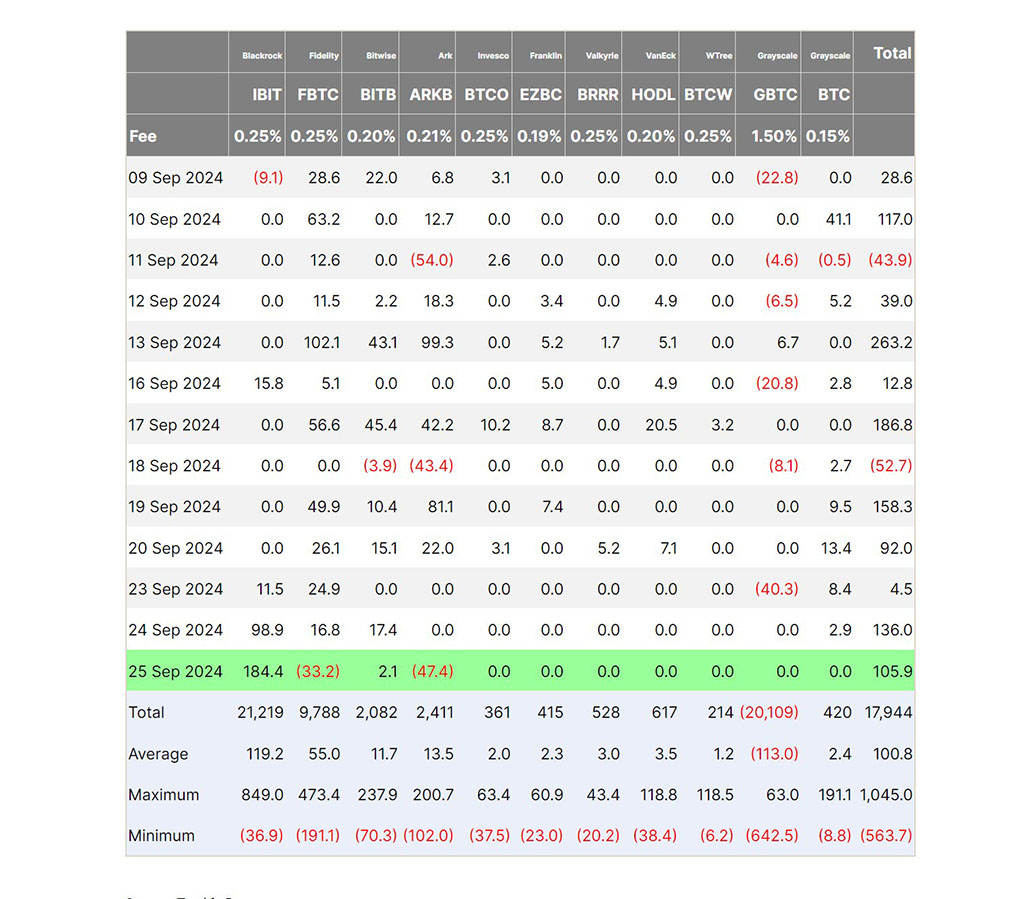

In response to information from Farside Traders, the funds pulled in a formidable $106 million on the day, with BlackRock’s iShares Bitcoin Belief (IBIT) clearly answerable for the motion.

Supply: Farside Traders

As seen within the picture above, the IBIT fund noticed web inflows of over $184 million on the day, reflecting what seems to be an investor choice for BlackRock’s product.

Typically, although, and contemplating the strong momentum being displayed, it may be secure to say that investor confidence in Bitcoin ETFs has grown remarkably in latest occasions. That’s, regardless of the unstable market situations and regulatory points throughout.

BlackRock Dominates, Different Bitcoin ETFs Present Combined Outcomes

There isn’t any gainsaying that BlackRock has a chokehold on this sector, at the very least, in the intervening time. Nevertheless, whereas its IBIT fund continues to see most exercise and enjoys surging investor curiosity, the identical can’t be stated of different Bitcoin ETFs.

As an illustration, on Wednesday, Bitwise’s Bitcoin ETF (BITB) attracted simply over $2 million in new capital, a far cry from IBIT’s bigger positive factors. Nevertheless, although BITB recorded a comparatively smaller stage of success than BlackRock’s IBIT, it nonetheless carried out higher than each different fund.

Constancy’s Bitcoin Fund (FBTC) and ARK Make investments/21Shares’s Bitcoin ETF (ARKB) are examples of such different funds that skilled large outflows on the day. Whereas $33 million in capital left Constancy, ARK Make investments/21Shares noticed a fair greater outflow of about $47 million.

Each different Bitcoin ETF that’s listed within the US skilled zero web flows on Wednesday. Nevertheless, essentially the most notable fund in that class was the Grayscale Bitcoin Belief (GBTC).

GBTC was once a main pressure within the ETF market earlier than dropping its steam. Since changing from a belief to an ETF, buyers have pulled out over $20 billion from the fund.

On a extra optimistic notice, although, the large outflows noticed from GBTC earlier have begun to decelerate in latest weeks.

General, it seems that buyers are starting to shift their preferences. This could clarify the contrasting experiences of the funds. Whereas BlackRock’s IBIT continues to seize the vast majority of new capital, different ETFs are struggling to maintain up with the tempo of a market that’s more and more shifting towards bigger and extra established funds.

In whole, US spot Bitcoin ETFs noticed $246 million in web inflows this week. So, it may be secure to say that digital asset investments are nonetheless a factor no matter latest market volatility.

US Bitcoin ETFs See 5-Day Influx Streak as BlackRock Leads with $184M