- US authorities moved $1.92 billion in Bitcoin, fueling issues about potential market impression.

- Bitcoin sale fears rise, however transfers could also be for safekeeping, not imminent liquidation.

As Donald Trump’s administration prepares for its official transition on twentieth January, 2025, the US authorities has taken vital steps involving its Bitcoin [BTC] holdings.

Just lately, $1.92 billion price of BTC, primarily seized from the Silk Street operation, was transferred into new wallets.

Of this, $963 million was instantly despatched to Coinbase, a transfer that alerts potential future gross sales.

This switch is a part of a broader pattern the place the U.S. authorities has shifted substantial Bitcoin belongings—roughly $2.6 billion between July and August—additional hinting at preparations for liquidation.

Is the Biden admin planning one thing huge?

Amid rising issues, neighborhood members speculate that President Joe Biden could also be making an attempt to dump the U.S. authorities’s BTC reserves earlier than Trump’s inauguration, probably undermining plans to ascertain a Bitcoin Reserve.

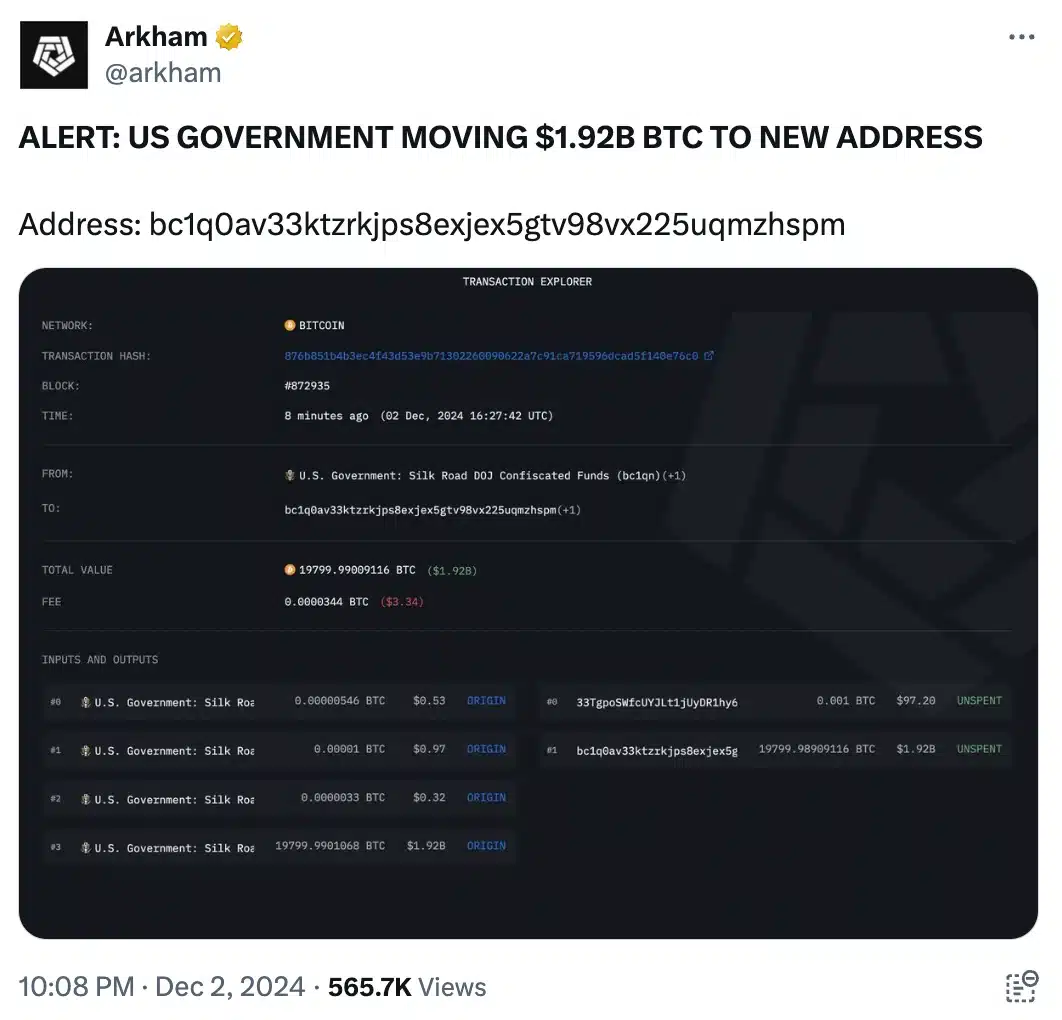

On 2nd December 2024, knowledge from Arkham, an on-chain intelligence platform, revealed that the U.S. authorities moved $1.92 billion price of BTC into new wallets.

This switch concerned splitting the belongings between two wallets, with one subsequently shifting $963 million in Bitcoin to Coinbase, fueling additional hypothesis about future gross sales and their potential impression available on the market.

The Bitcoin belongings in query had been seized from the notorious Silk Street, and since they’re legally owned by the U.S. authorities, there are rising issues that they could possibly be offered off in massive volumes, resulting in a possible market downturn.

Bitcoin’s current and upcoming traits

Such a sale may exert vital downward stress on BTC’s value, inflicting unease amongst traders.

This worry materialized swiftly, as Bitcoin’s value, which had been nearing the $100k threshold, dropped to $95,229.66, reflecting a 0.20% decline within the final 24 hours, in response to CoinMarketCap.

Remarking on the scenario, Carl B. Menger, an business commentator mentioned,

“Is the government planning to sell Bitcoin before Trump takes office? Outgoing administrations should not undermine the incoming President, as the people have already voted them out.”

Nonetheless, regardless of issues over the potential slowdown of the cryptocurrency market following Donald Trump’s inauguration the crypto neighborhood stays cautiously optimistic.

Challenges forward

Historic knowledge means that market rallies usually lose steam after presidential transitions, however the crypto house has proven resilience previously.

As an example, when the U.S. authorities ready to promote $600 million in Bitcoin 4 months in the past, the market initially faltered however shortly rebounded as institutional funding surged.

Furthermore, whereas the current transfers of Bitcoin by the Biden administration have sparked hypothesis, they could not point out imminent gross sales.

The U.S. Marshals Service, which has a safe custody settlement with Coinbase Prime, means that the belongings had been moved for safekeeping reasonably than speedy liquidation, with regulatory procedures nonetheless to be adopted earlier than any sale can happen.