- Bitcoin’s whale exercise recorded a serious decline

- BTC broke above a descending triangle sample, signaling a hike in shopping for strain

Bitcoin’s [BTC] whale exercise has cratered to its lowest degree because the starting of the yr. This, because the crypto developed resistance and assist ranges across the $65,000-price degree on the charts.

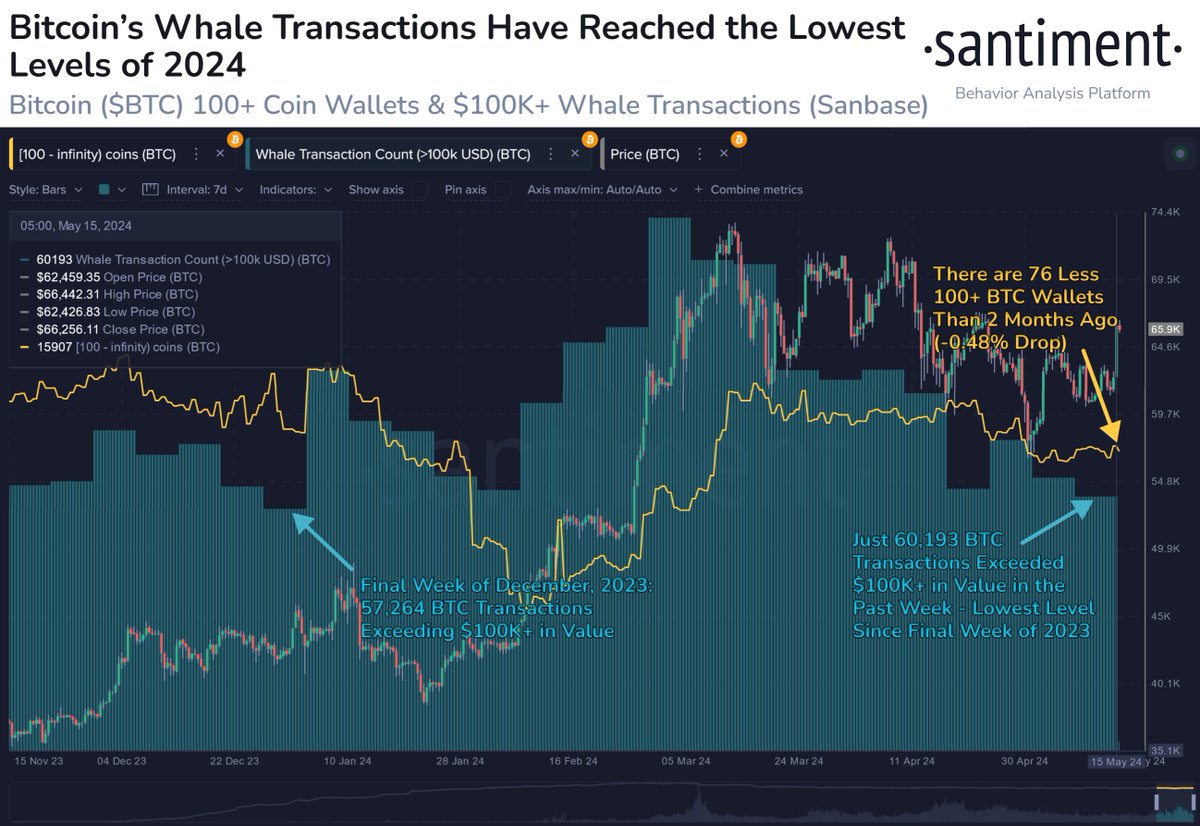

In actual fact, information obtained from Santiment revealed that over the previous week, solely 60,193 BTC transactions exceeded $100,000, marking its lowest rely because the ultimate week of 2023.

Additionally, the variety of BTC whales that maintain over 100 cash has dropped by 0.48% within the final two months – An replace presumably signifying a gradual uptick in profit-taking exercise amongst this investor class.

Bitcoin’s descending triangle sample

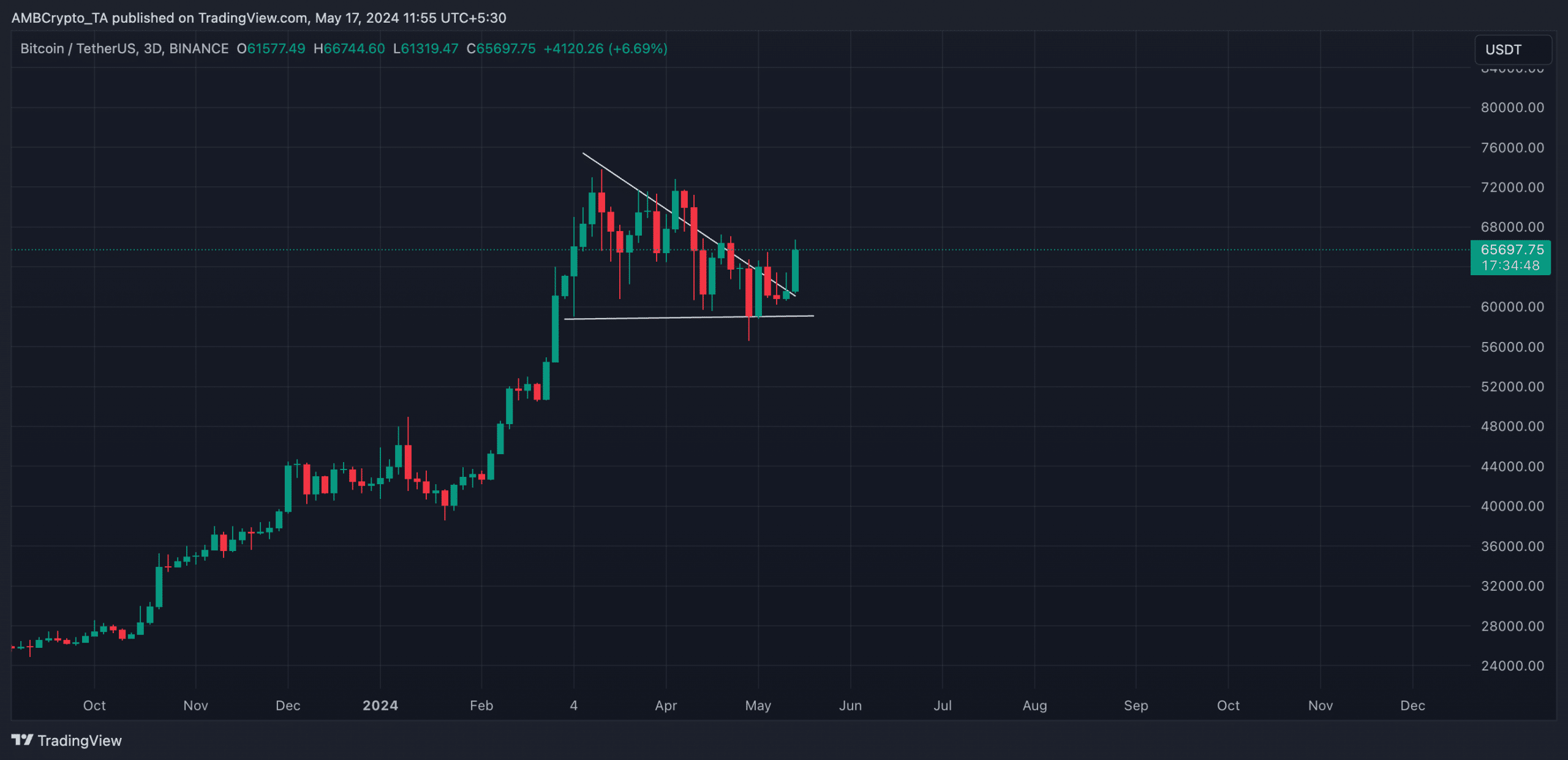

Because it rallied to an all-time excessive of $73,750, BTC’s value has fallen on the charts. In doing so, BTC hit a string of decrease highs to kind a descending triangle.

Now, though it breached the higher development line of this triangle in April when it reclaimed the $70,000-zone, the king coin’s value has traded inside this triangle over the previous three months.

This value decline may be why BTC whales have diminished the quantity of their transactions over the previous few weeks. At press time, Bitcoin was buying and selling at $65,696, sitting above the higher development line of the triangle.

When an asset’s value breaks above the highest of a descending triangle, it’s thought-about a bullish sign. This means a shift in shopping for energy because the bulls step in to beat the present promoting strain.

Confirming the shift in perspective in the direction of BTC, its weighted sentiment returned a constructive worth of 0.99 too.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

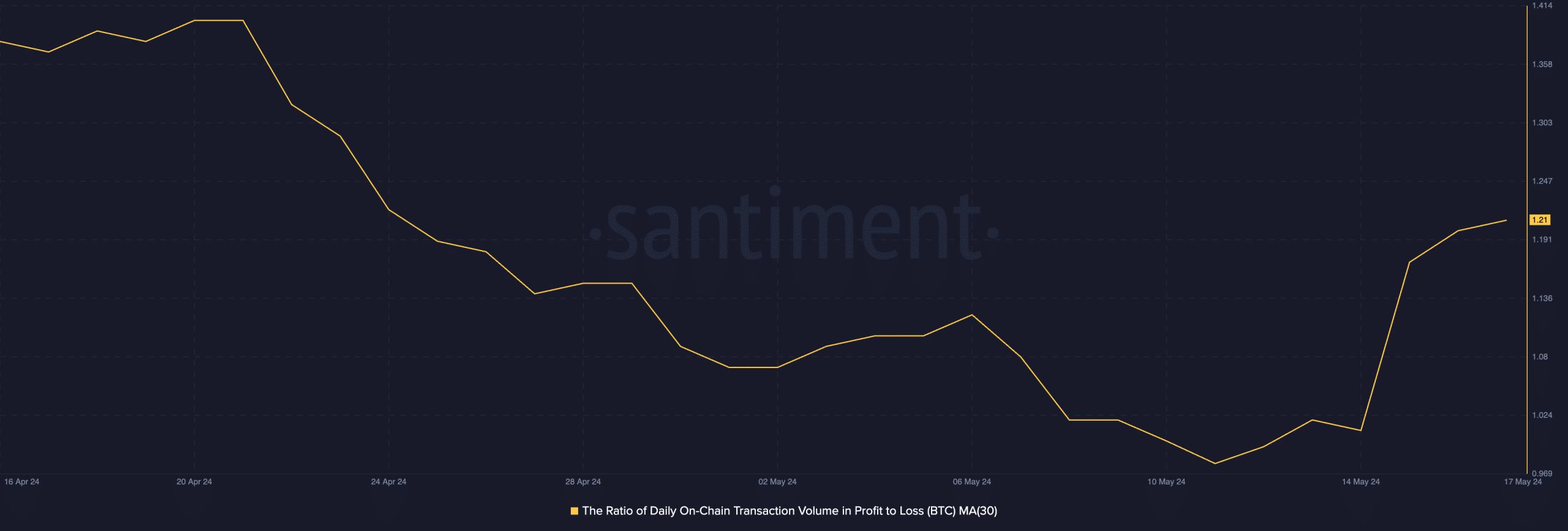

The shift in development might need been precipitated by the truth that regardless of BTC’s latest value troubles, each day merchants proceed to file revenue on their investments.

AMBCrypto assessed the each day ratio of BTC’s transaction quantity in revenue to loss utilizing a 30-day transferring common and located that it returned a worth of 1.21. Which means that for each BTC transaction that led to a loss over the previous month, 1.21 transactions returned earnings.

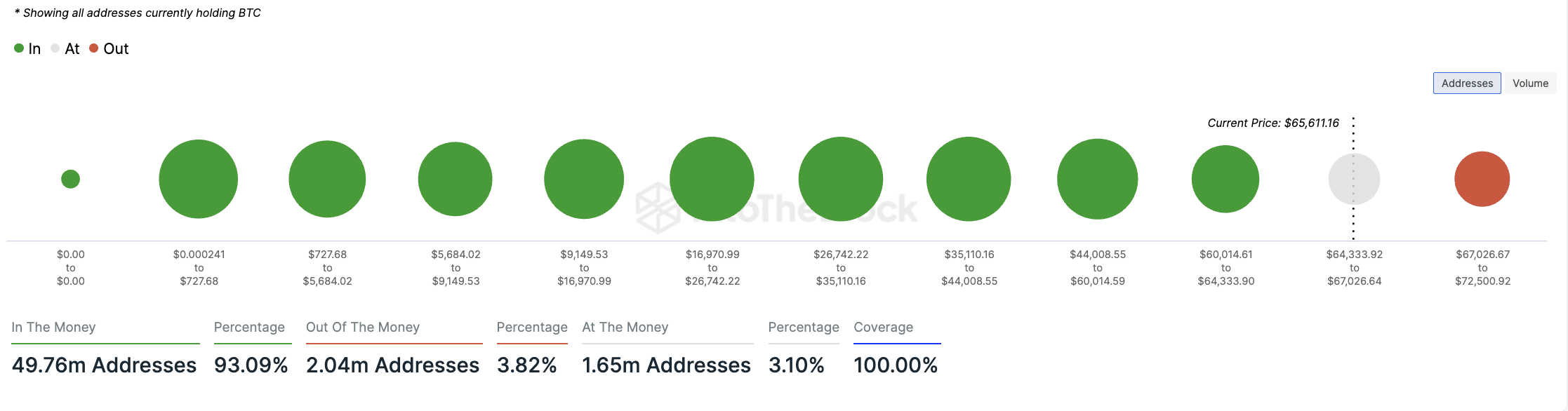

On the time of writing, 50 million pockets addresses, which comprise 93.09% of all BTC holders, had been “in the money.” Solely 4% of all coin holders appeared to carry at a loss.

Based on information from IntoTheBlock, this group consists of coin holders who purchased BTC between $67,000 and 72,000.