- Bitcoin bulls confirmed up in response to price hikes because the market receives a confidence enhance.

- Evaluating the danger of lengthy liquidations as volatility makes a comeback.

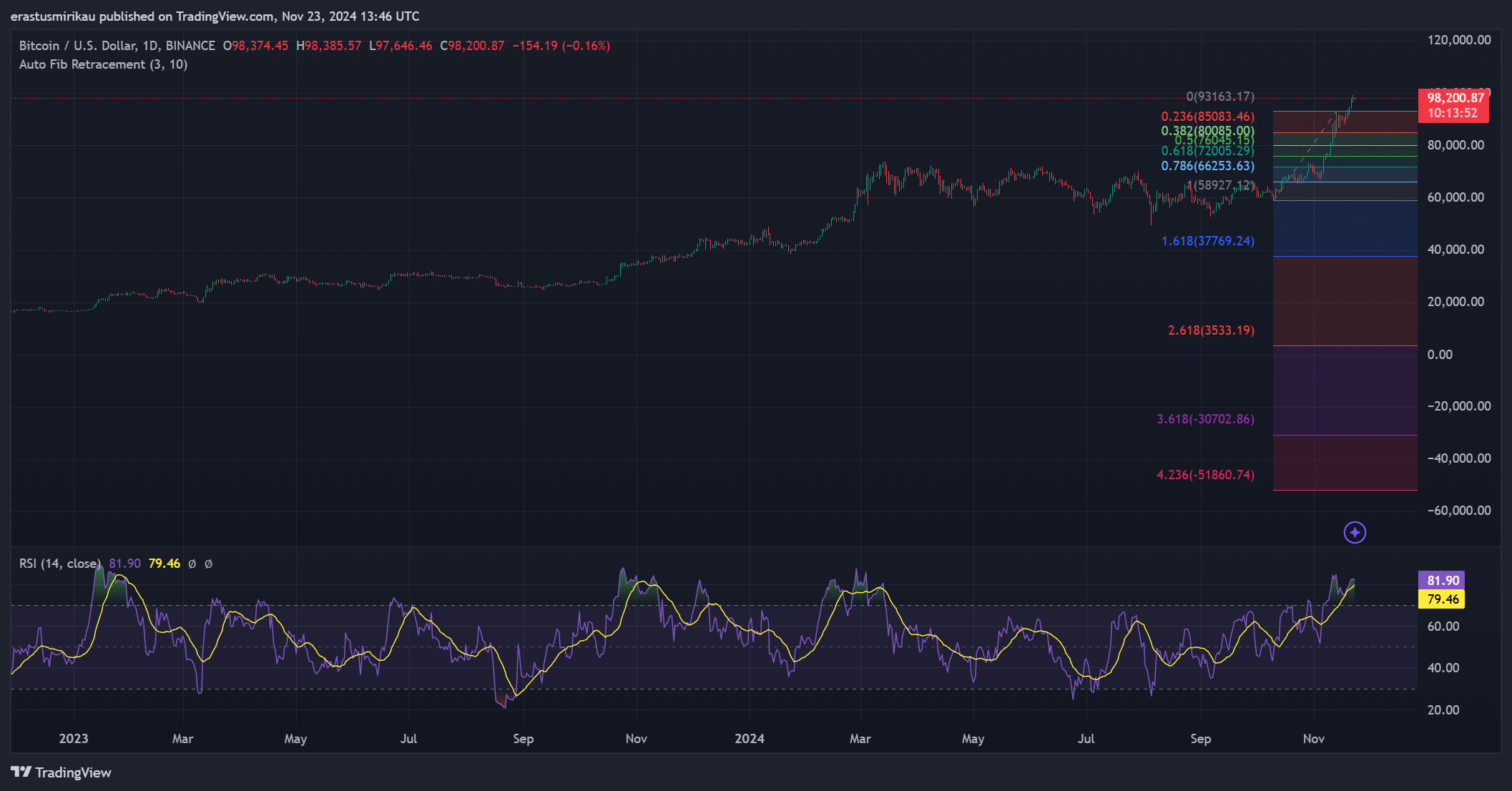

Bitcoin [BTC] responded positively to the Federal Reserve’s newest announcement concerning rate of interest cuts. The extremely anticipated determination revealed that charges will come down by 50 foundation factors.

Traders responded to the rate of interest cuts by partaking in a Bitcoin shopping for spree that pushed the value above $62,000 for the primary time this month.

This was consistent with earlier hypothesis, since decrease charges are anticipated to have a constructive impression on liquidity flows in risk-on belongings. However the actual query is, the place does the market go from right here?

A bumpy journey forward for Bitcoin?

There are excessive expectations round Bitcoin, particularly now that rates of interest are coming down. Whereas this may increasingly assist extra upside within the subsequent few months, it additionally paves the best way for extra volatility.

Translation, extra surprising pullbacks and extremely risky value actions.

A traditional instance of why Bitcoin will face extra volatility is that prime expectations result in extra optimism and the next urge for food for leverage. Extra lengthy positions are more likely to be executed now.

In the meantime, whales and institutional gamers see this as open season for liquidations.

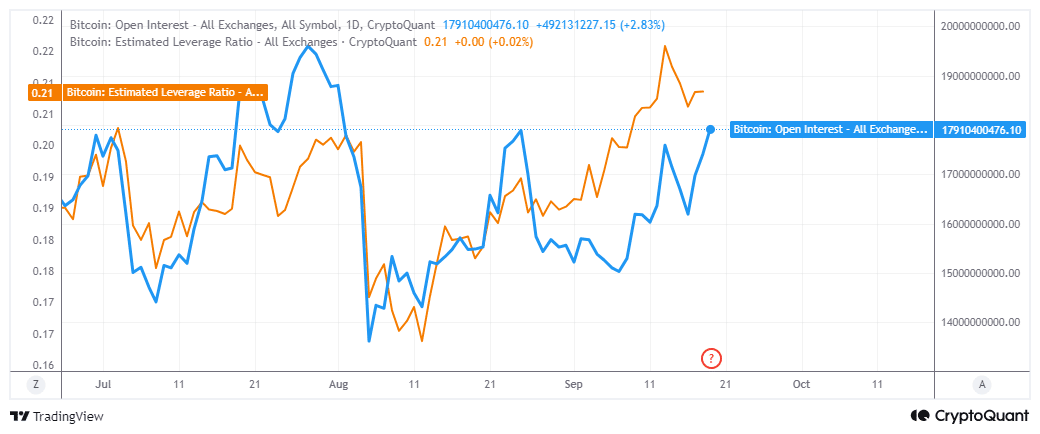

Market information coincides with the above expectations. For instance, Open curiosity simply soared to its highest degree within the final seven weeks.

The estimated leverage ratio which exhibits the extent of leverage at any given time has been rallying since August lows.

It pulled again barely for the reason that thirteenth of September however is poised to tick larger with latest enchancment in market sentiment.

Talking of sentiment, the speed cuts announcement seems to have had a constructive impression on Bitcoin ETFs. There was roughly $52.83 million price of Bitcoin ETF inflows on the 18th of September.

Optimistic ETF flows and anticipated liquidity injections ought to set the stage for a wholesome Bitcoin run-up. Nevertheless, it might additionally pave the best way for heavy liquidations and pullbacks alongside the best way.

Assessing latest demand

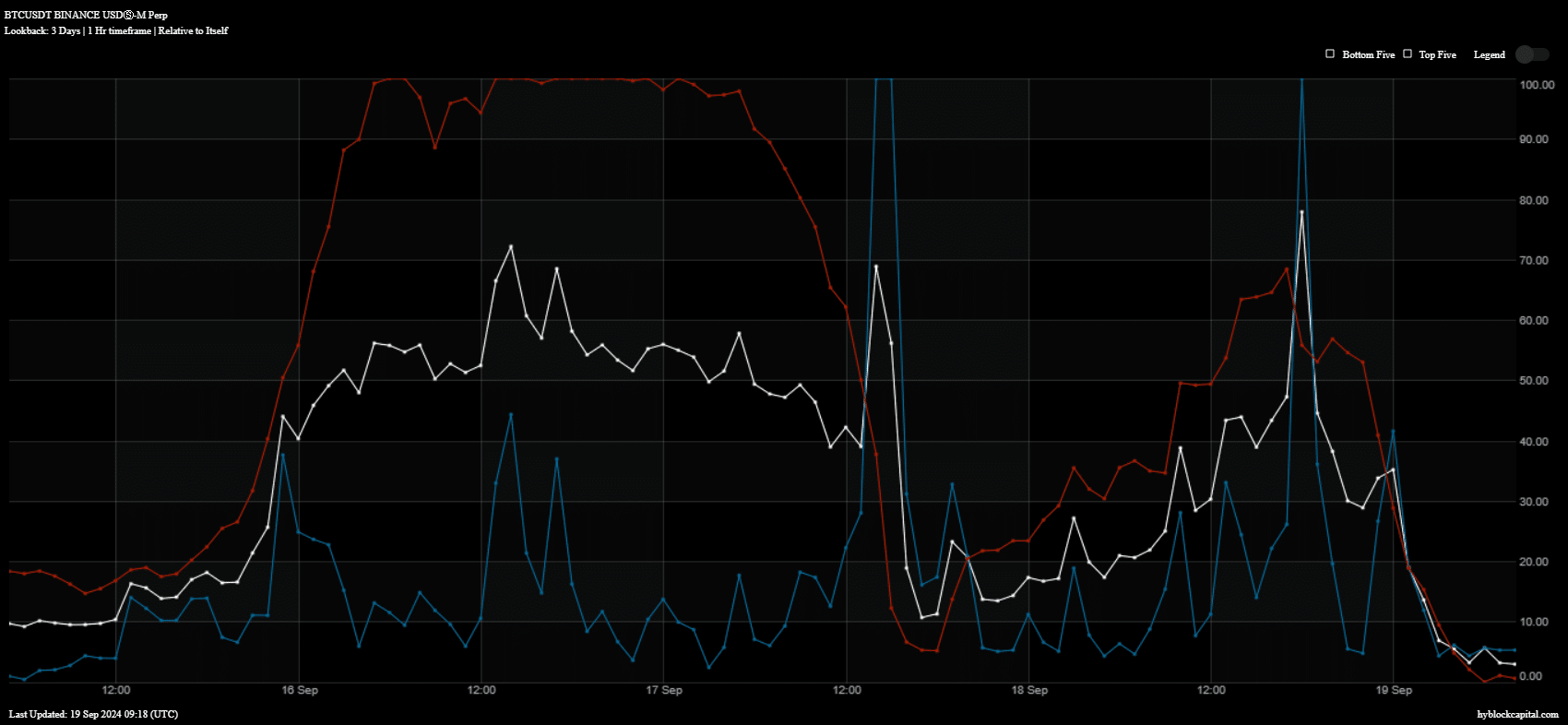

Bitcoin remains to be liable to liquidations which will happen quickly. On-chain information revealed that the latest wave of liquidity injection into Bitcoin has already dissipated, evidenced by the purchase quantity (blue).

We additionally noticed a spike in longs (crimson) which can be liable to liquidation if the market pulls again unexpectedly.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

The presence of extremely leveraged lengthy positions might pave the best way for whales and establishments to govern costs.

Regardless of the probabilities of a retracement, larger liquidity flows are anticipated to push Bitcoin larger within the subsequent few months.