- Analyst believes the crypto market will “bounce” as quickly as Bitcoin sees a serious breakout

- Altcoins anticipated to revenue considerably each time this breakout occurs

The worldwide crypto market cap has been in a state of flux over the previous few weeks, experiencing each positive factors and declines. After climbing to as excessive as $2.7 billion in March, the market has since struggled to take care of its momentum, with intermittent hikes failing to get better from the broader downtrend.

On the time of writing, the worldwide crypto market cap had dipped by 1.4% to face with a determine of $2.122 trillion. This, following a short rise to $2.140 trillion earlier within the day. This volatility has largely been pushed by Bitcoin, the dominant participant within the cryptocurrency market.

Bitcoin itself has proven a mixture of bullish and bearish developments. After briefly surpassing $58,000 yesterday, Bitcoin once more slipped under this threshold. The truth is, at a degree, it even traded at as little as $57,292 following a 0.5% decline.

Regardless of this uncertainty, nevertheless, analysts proceed to share insights into the way forward for the crypto market, with many predicting key actions forward.

In style crypto analyst CrediBull has provided a very compelling outlook. In line with him, Bitcoin’s breakout from its present consolidation part will set off a broader market rally.

Analyst’s outlook on the upcoming crypto bull run

CrediBull’s insights on X emphasised the important position Bitcoin performs in influencing your complete crypto market. He believes that Bitcoin’s upcoming breakout from its five-month consolidation part will seemingly elevate your complete crypto market.

Nonetheless, CrediBull warned that not all altcoins will profit equally. Some, particularly these forming multi-month distribution tops, might even see momentary “dead cat bounces,” earlier than going through an extra downward part often known as a crypto market “markdown.”

The analyst suggested buyers to be cautious, suggesting that these momentary rebounds might be the final likelihood to exit sure altcoins earlier than deeper declines.

Dogecoin (DOGE) for example of altcoin efficiency, the memecoin has mirrored the Bitcoin market’s volatility. DOGE briefly traded above $0.104 on Monday, however the positive factors have been short-lived, with the asset correcting to $0.098 by midweek.

Nonetheless, DOGE has since registered some restoration, buying and selling at $0.1031 at press time after a 0.4% hike in 24 hours. Regardless of these fluctuations, the memecoin’s resilience is an indication that some altcoins should still have room for progress amidst uncertainty.

DOGE fundamentals level to potential market stability

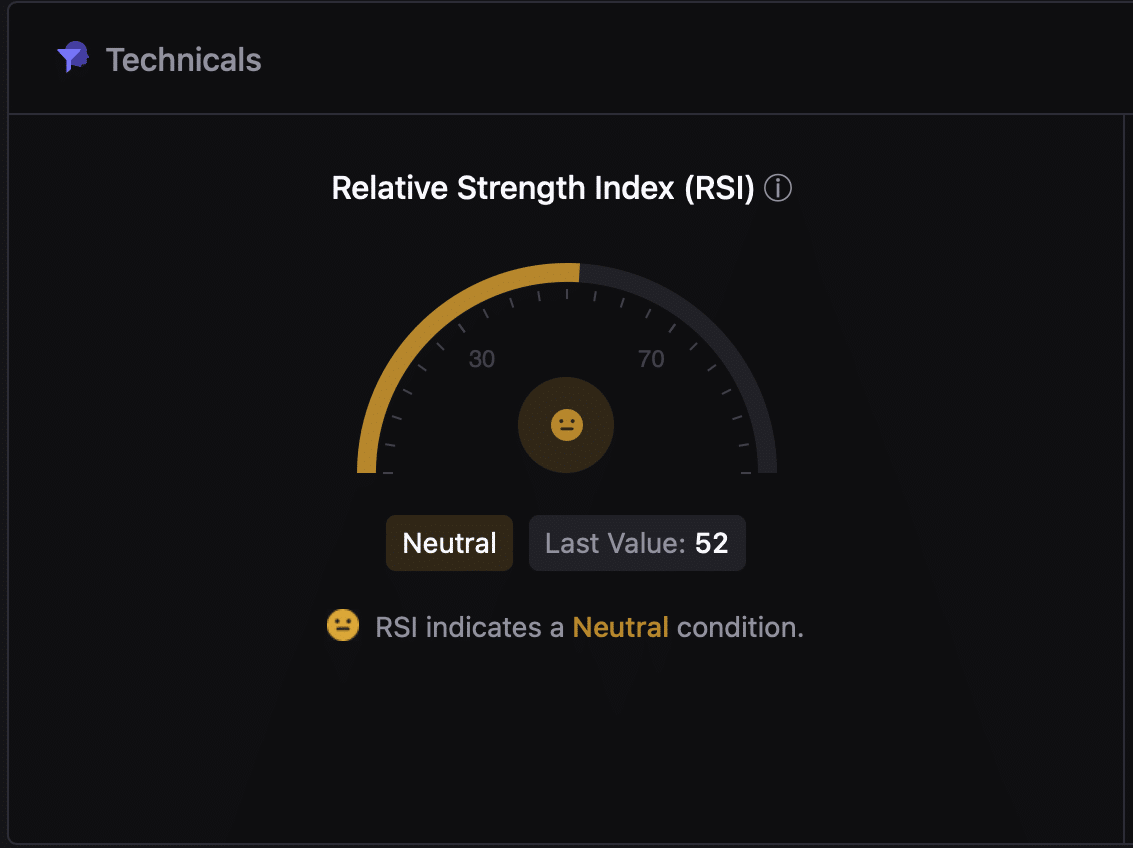

Past its value motion, assessing DOGE’s fundamentals provides us further insights into its market potential. For instance – In line with knowledge from CryptoQuant, DOGE’s Relative Power Index (RSI) had a studying of 52, indicating impartial market circumstances.

An RSI studying between 30 and 70 implies that the asset is neither overbought nor oversold – An indication of potential value stability within the close to time period.

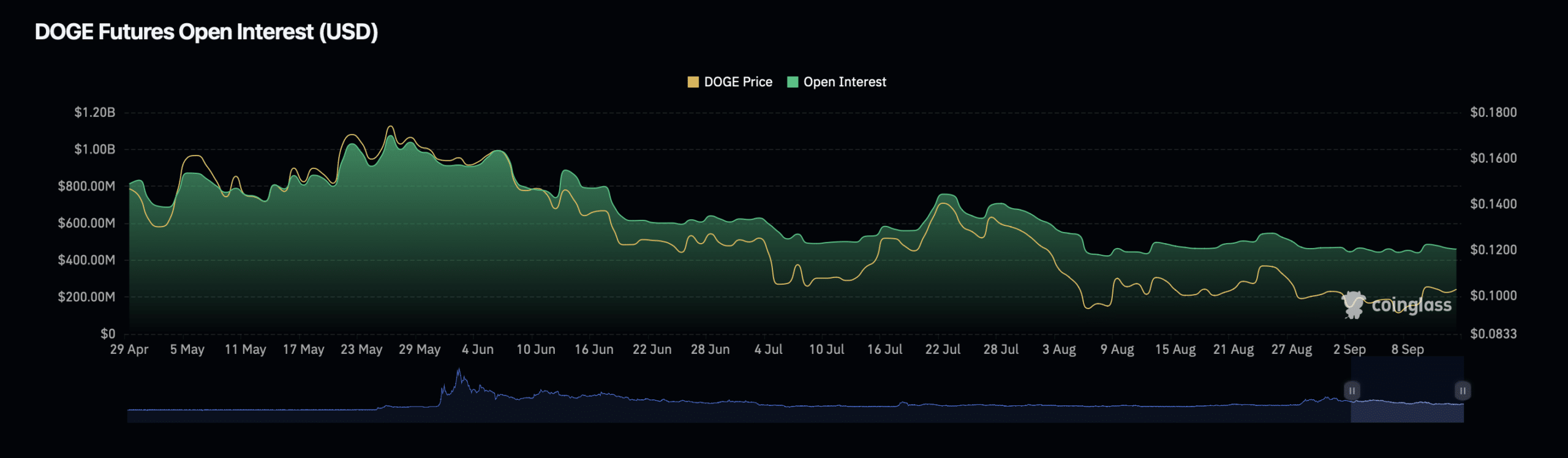

Moreover, knowledge from Coinglass recommended that DOGE’s Open Curiosity has seen a 1.46% hike, reaching a valuation of $476.12 million. Quite the opposite, the asset’s Open Curiosity quantity additionally declined by 13.46%, dropping to $670.33 million.

The uptick in Open Curiosity, regardless of the drop in quantity, could indicate that buyers are cautiously positioning themselves out there. They may be doing so whereas anticipating future value actions on DOGE’s charts.