- Shopping for momentum on Coinbase decreased, suggesting an additional decline for Bitcoin.

- The unfavorable Sharpe Ratio indicated that BTC won’t produce good positive factors within the brief time period.

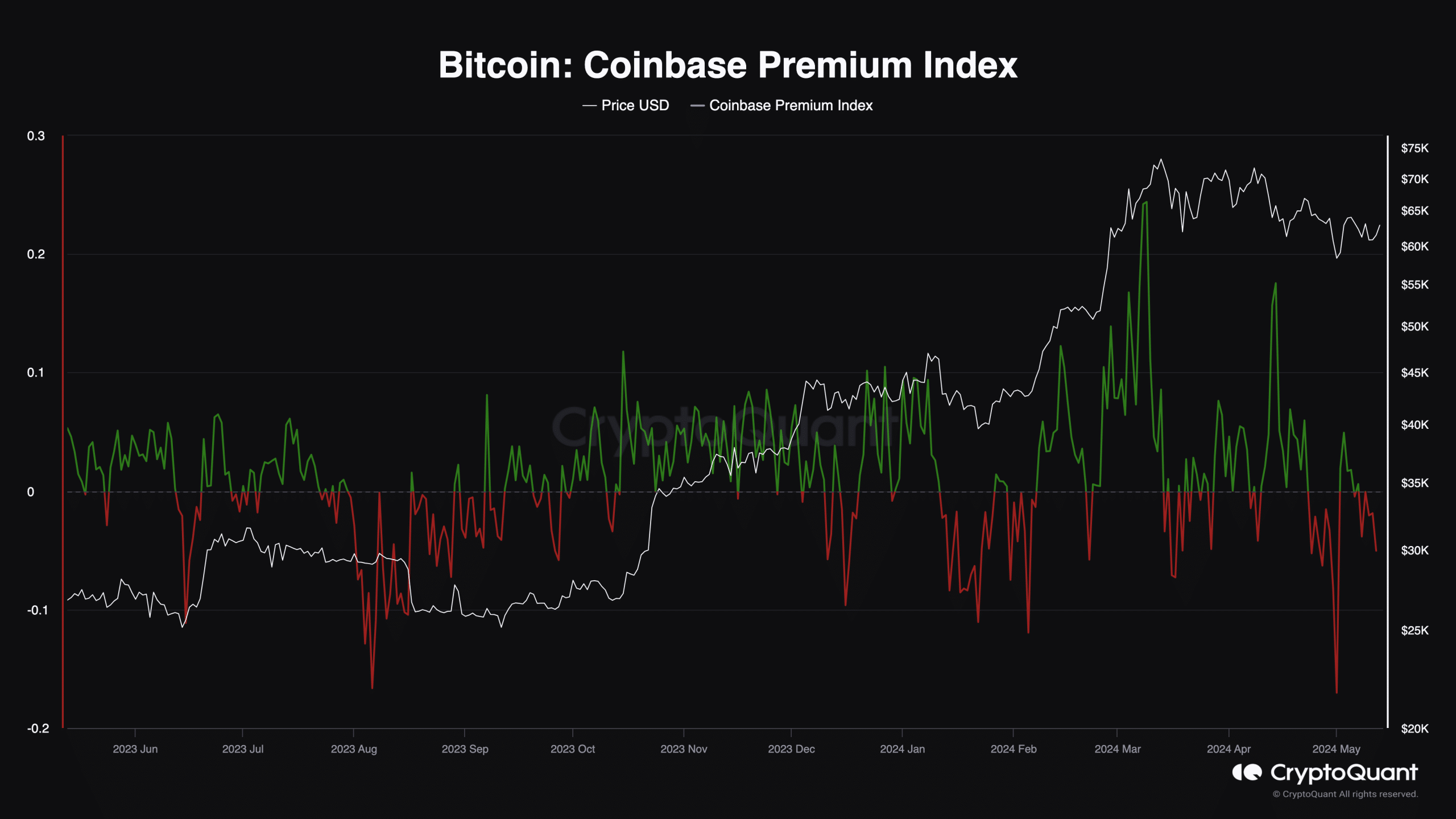

Bitcoin [BTC] would possibly expertise one other downturn, in line with alerts from the Coinbase Premium Index.

This index reveals the extent of shopping for strain amongst buyers within the U.S.— particularly because the nation has a excessive variety of Bitcoin holders.

Excessive premium values point out a rise in shopping for strain. Alternatively, a low studying of the Coinbase Premium Index suggests a surge in sell-offs.

The massive gamers are letting go

In response to AMBCrypto’s evaluation utilizing CryptoQuant, the index was -0.050 at press time. This was an indication that many U.S. Bitcoin holders have been promoting as a substitute of accumulating.

Sign Quant, a pockets profiler and writer on CryptoQuant commented on the pattern.

In response to the deal with, the state of this main indicator signifies that Bitcoin’s value would possibly expertise one other correction earlier than a big bounce.

“The current Coinbase Premium trend is currently positive, close to zero. So if the historical pattern repeats itself, we may have a better chance of success if we wait a bit longer and invest in the rebound after the trend turns negative.”

At press time, the worth of BTC was $62,785 — a 2.94% enhance within the final 24 hours. Coming from the evaluation above, this value enhance won’t final lengthy.

But when customers within the U.S. begin to purchase in giant numbers, this bearish outlook is perhaps invalidated. Nonetheless, AMBCrypto thought of different metrics to verify it an increase past Bitcoin’s present peak may take extra time.

Dangerous season is right here

To do that, we appeared on the Sharpe Ratio. In easy phrases, this metric tells you whether or not to take a danger with an funding or not.

If the Sharpe Ratio is optimistic, it signifies that the potential Return On Funding (ROI) is perhaps nice in comparison with the chance concerned.

Moreover, a unfavorable Sharpe Ratio signifies that the potential reward won’t be definitely worth the danger. This was the case with Bitcoin, as blockchain analytics instrument Messari confirmed that the studying was -2.22.

Nonetheless, returns for BTC would possibly begin to rise as soon as the metric rises to the zero midpoint. Within the meantime, Bitcoin’s whole provide in earnings was 87.03%.

For a big bounce to happen, the proportion would possibly have to lower. And a affordable level for it to drop to might be 78.20%. This was the identical revenue provide Bitcoin had earlier than it rallied again in March.

If the availability declines to an analogous stage, BTC would possibly start a run that might take it above $75,000.

Is your portfolio inexperienced? Examine the Bitcoin Revenue Calculator

As well as, the one-day circulation was all the way down to 17,600, indicating that the variety of cash engaged in transactions has decreased.

Ought to the circulation enhance, Bitcoin would possibly start one other journey down the charts.