- Curiosity in Bitcoin ETFs had grown as ETF volumes reached new highs.

- Whale curiosity additionally surged, nonetheless, BTC’s worth remained stagnant.

Bitcoin [BTC] has hit a droop over the previous few days as the worth has remained across the $64,000 degree for fairly a while.

Institutional curiosity

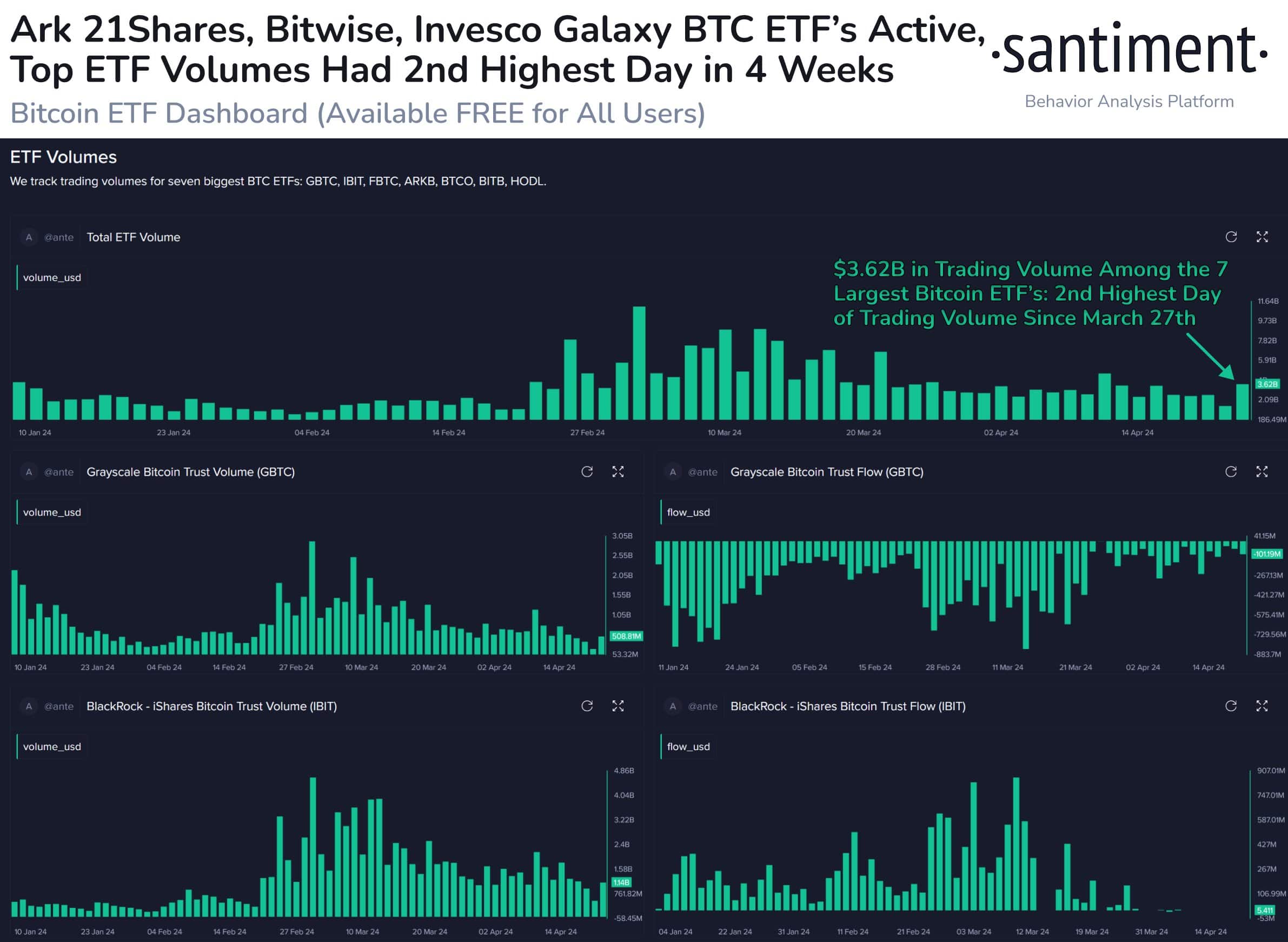

In line with Santiment’s knowledge, there’s some for optimistic motion for BTC sooner or later. The mixed each day buying and selling quantity of Bitcoin ETFs lately reached its highest level in 4 weeks, reaching $3.62 billion.

This surge in exercise consists of main Bitcoin ETFs like GBTC, IBIT, FBTC, ARKB, BTCO, and HODL.

This comes amidst a five-week interval of unpredictable sideways motion within the broader cryptocurrency market.

In gentle of this stagnation, the wholesome buying and selling exercise in Bitcoin ETFs could possibly be thought-about as a bullish signal.

It advised that buyers stay assured within the long-term potential of Bitcoin, and are utilizing ETFs as a technique to acquire publicity to the cryptocurrency.

The excessive buying and selling quantity in Bitcoin ETFs highlights their rising recognition as a neater entry level for buyers unfamiliar with cryptocurrencies.

This might sign broader adoption of Bitcoin as ETFs take away the hurdles of immediately shopping for and holding the digital asset.

Moreover, this bullish sentiment is echoed by on-chain knowledge, which reveals a large spike within the variety of whales accumulating Bitcoin over the past two months.

This advised that not solely have been new buyers coming into the area, however established gamers have been additionally rising their publicity, probably anticipating future worth appreciation.

How are buyers holding up?

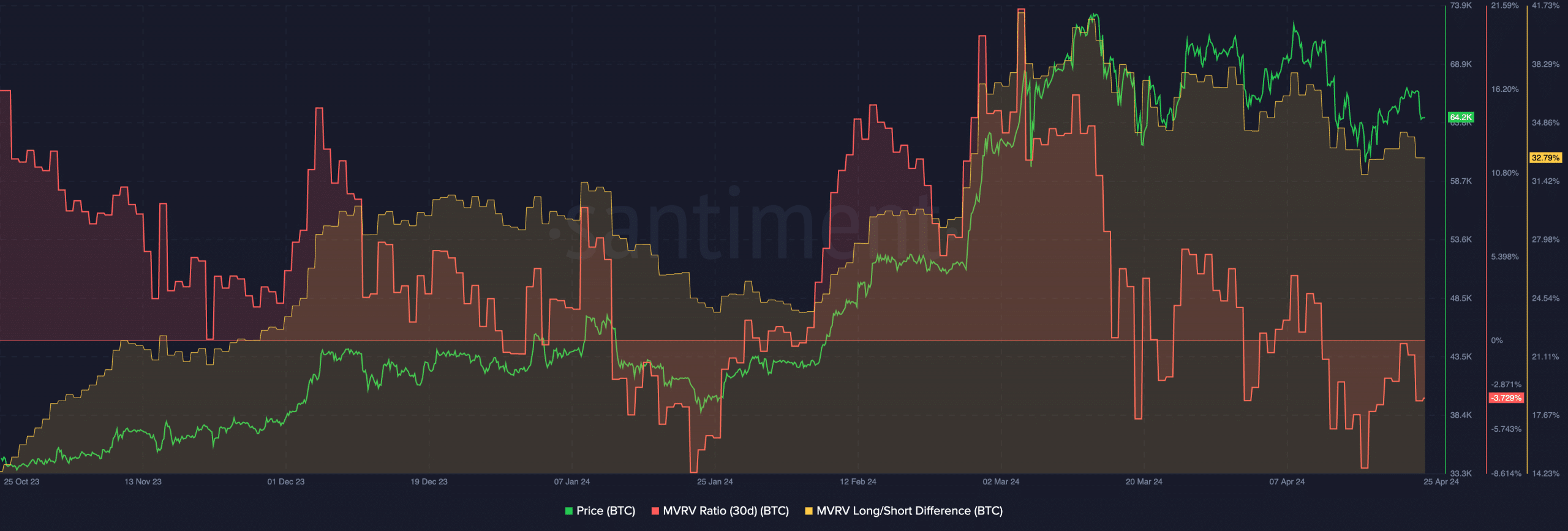

At press time, BTC was buying and selling at $64,334.93 and its worth had declined by 3.44% within the final 24 hours. The MVRV ratio had additionally declined throughout this era, indicating that almost all addresses weren’t worthwhile.

Moreover, the Lengthy/Brief distinction had grown regardless of the declining costs.

A falling Lengthy/Brief distinction indicated that the variety of long-term holders had outnumbered the short-term holders in the previous few days.

These holders are much less more likely to promote their holdings and might help BTC retain its present worth ranges.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

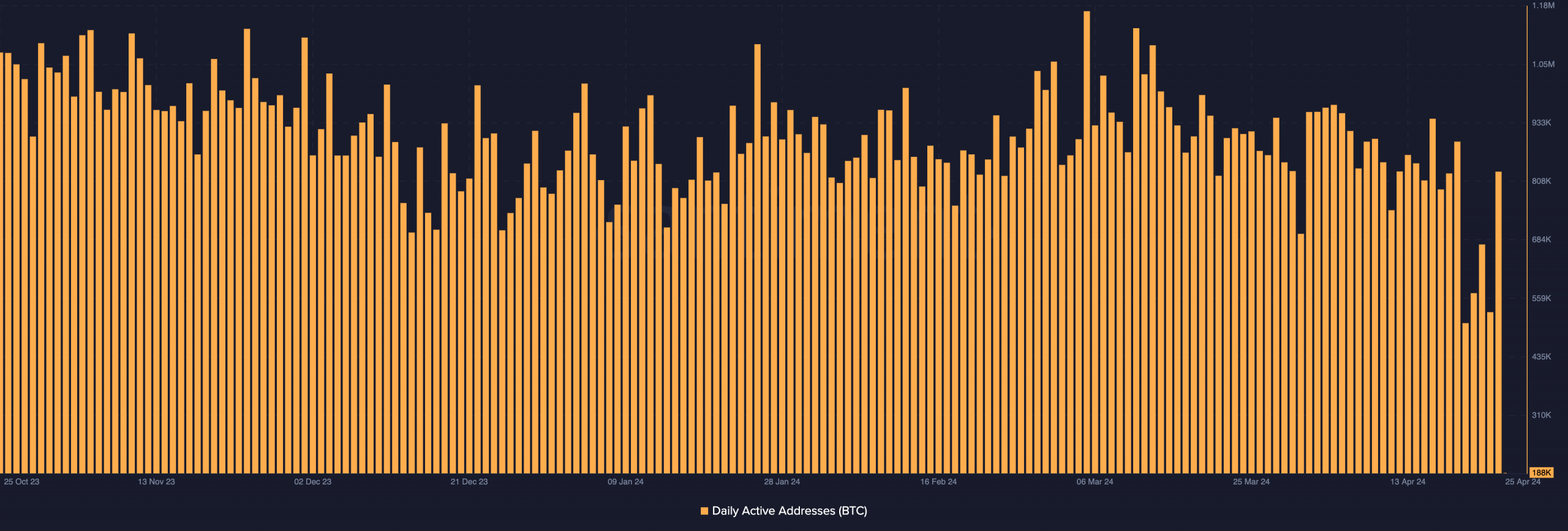

The general curiosity in Bitcoin’s ecosystem would additionally play a terrific function within the king coin’s progress.

Notably, in the previous few days, the variety of each day energetic addresses on the community declined considerably throughout this era.