- The market sentiment soured, and liquidity pockets attracted costs decrease.

- Bitcoin and Ethereum confronted rejections at their respective resistance zones.

On the twenty sixth of August, the full crypto market capitalization dropped from $2.216 trillion to $2.041 trillion the subsequent day. This was a $215.87 billion or 9.7% drop throughout the market.

Sure tokens had been affected greater than others.

Previously 24 hours, the market costs have already begun rebounding. Bitcoin [BTC] and Ethereum [ETH] had been up 3.84% and 6.82% respectively. However what might clarify why crypto is down for the reason that twenty sixth?

Market participant habits

The Tether dominance chart measures Tether’s market capitalization as a share of the full crypto market cap. The chart above confirmed USDT.D rose by 10.91% from Monday, operating right into a resistance zone at 5.9%.

Since then, it has declined. The Tether dominance and crypto value actions are inversely associated.

When USDT.D goes up it signifies extra traders and market individuals exchanging their crypto for Tether, implying a insecurity and a surge in promote stress.

This has abated in current hours and a value bounce was witnessed throughout the key altcoins and for Bitcoin.

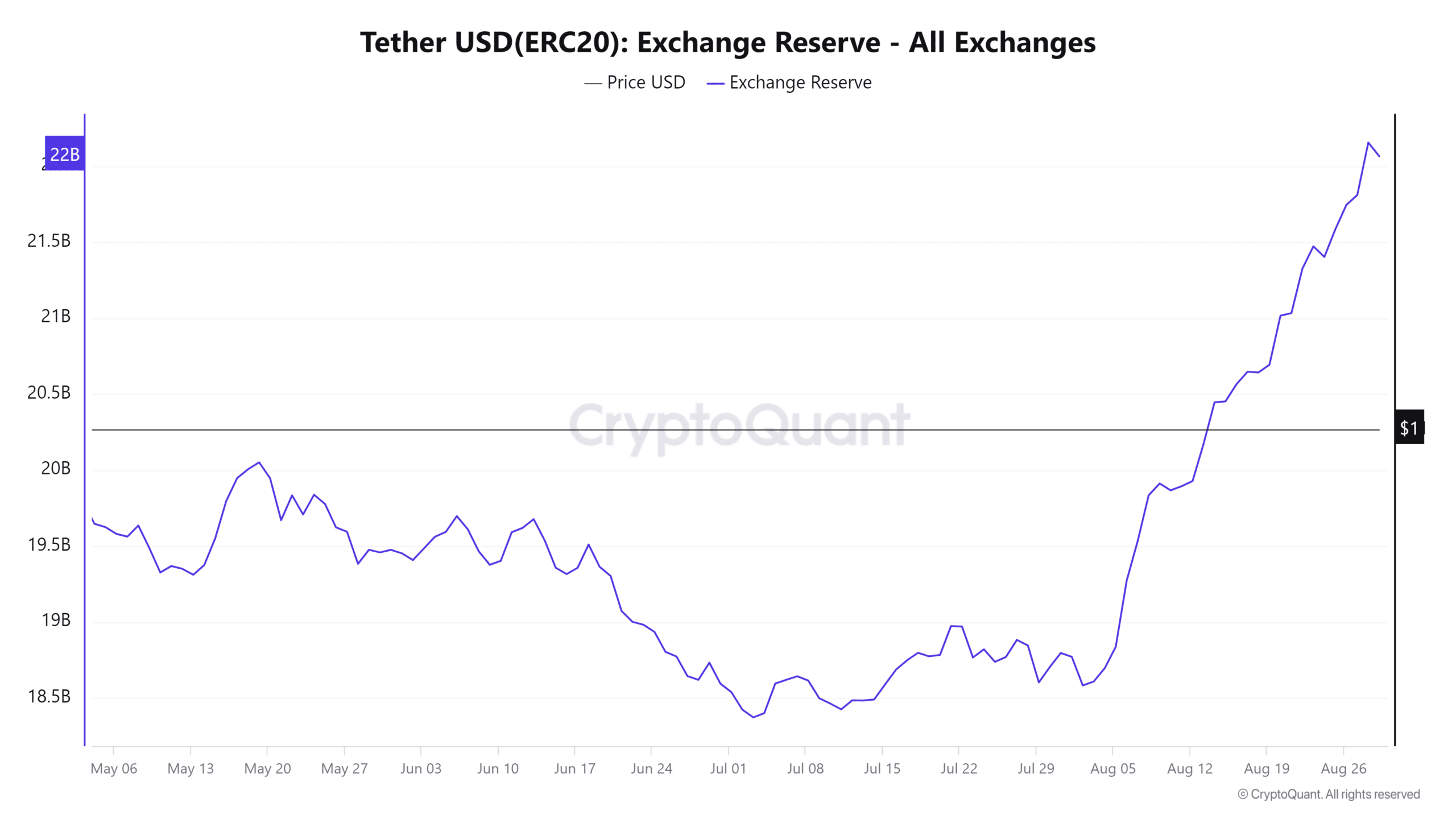

Supply: CryptoQuant

The Tether alternate reserve has been trending increased since early August. It was a sign of rising shopping for energy out there.

Nonetheless, it’s arduous to inform when the crypto market costs would start to rally, however the metric confirmed that there’s room for growth.

Liquidity explains why crypto is down

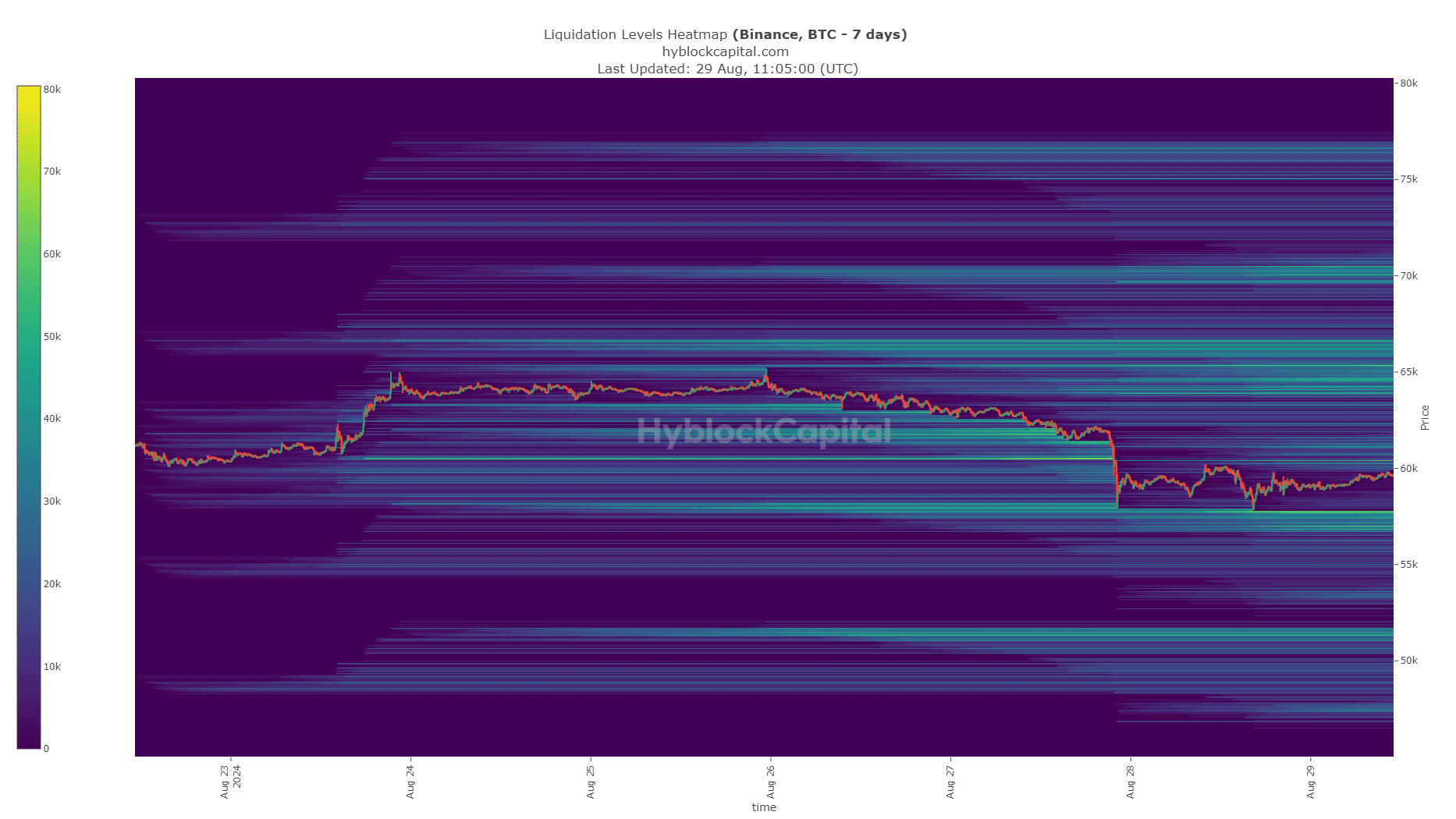

Supply: Hyblock

Traders fleeing to stablecoins is an efficient measure of market sentiment. One other strategy to gauge the place costs are prone to go is from the liquidation charts.

Since Bitcoin and Ethereum are the biggest property and most main altcoins’ value efficiency has a excessive constructive correlation with them, AMBCrypto determined to look at their liquidation heatmaps.

On the twenty seventh of August, Bitcoin plunged by a number of short-term liquidity clusters, shortly reaching the $58k liquidity pool. It has stabilized since then, however liquidity is a key driver of value actions.

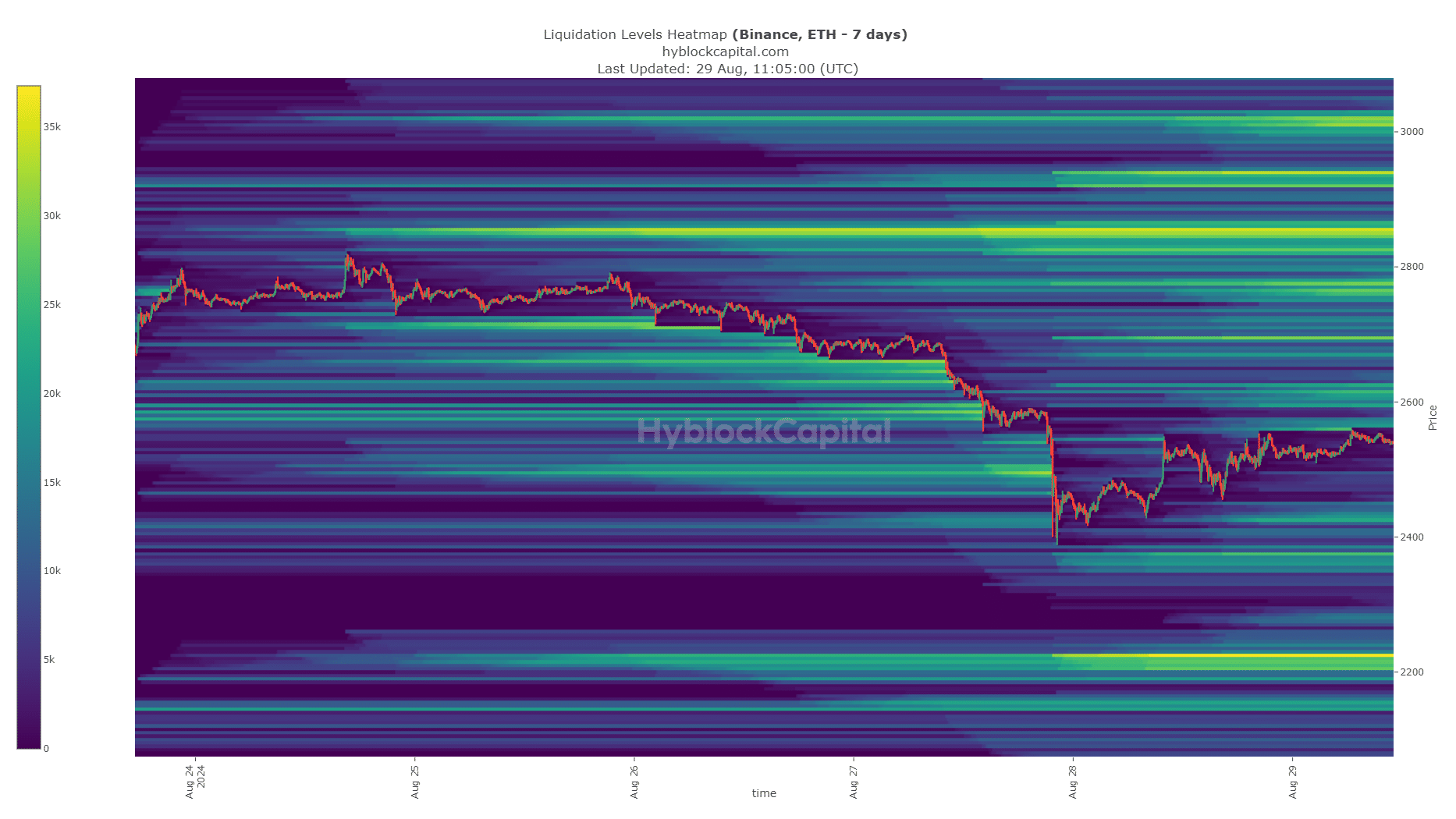

Supply: Hyblock

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Ethereum additionally noticed a dense cluster of liquidation ranges hit at $2490, however ETH continued to drop and reached the $2415 pocket. At press time, it appeared headed for the $2.6k liquidity band.

Liquidity and market sentiment had been the important thing elements behind why crypto is down. The transfer induced tens of millions of {dollars} in liquidations, and the crypto market might consolidate over the subsequent few days.