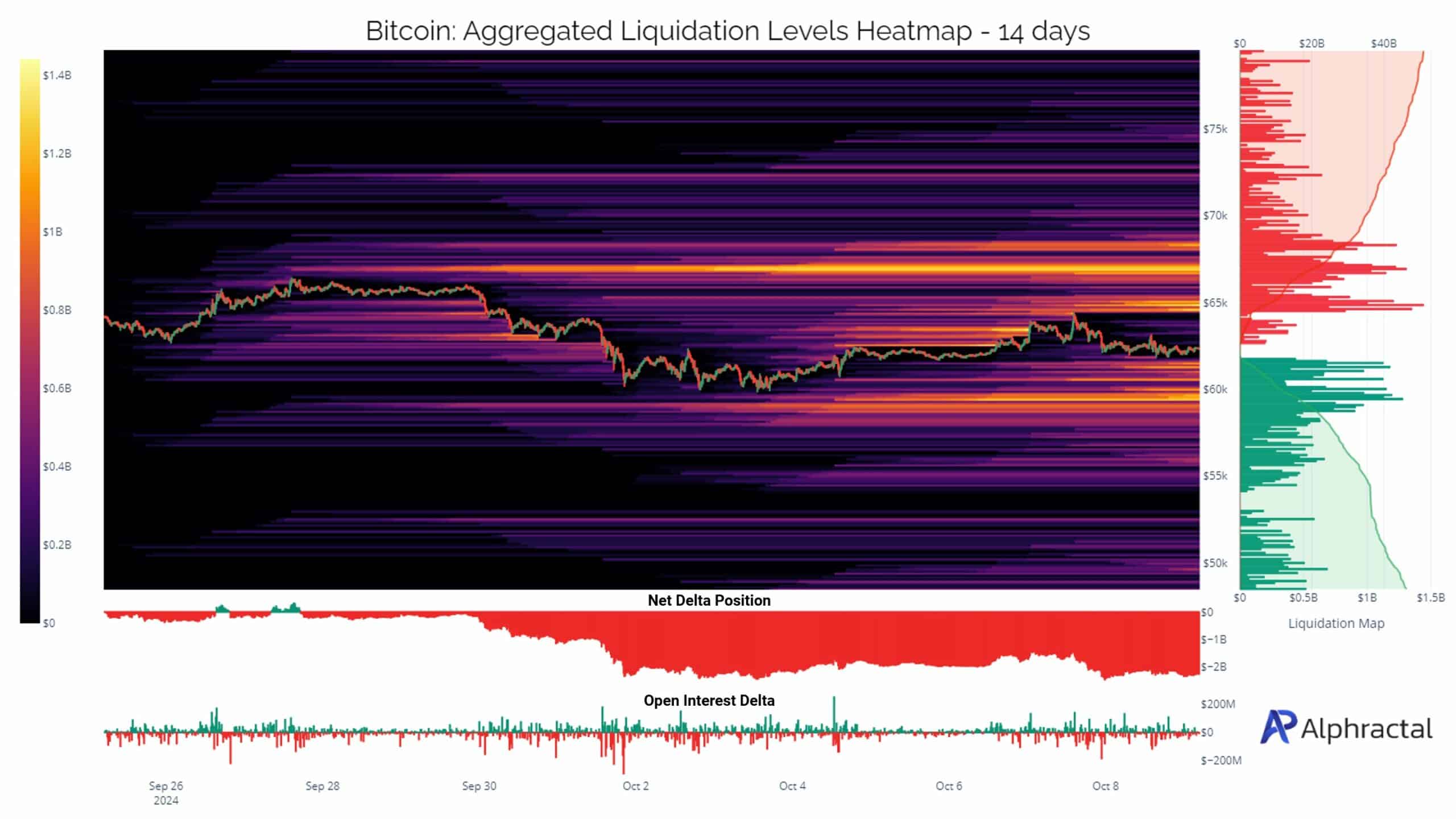

- The very best liquidation stage for Bitcoin was at $67K.

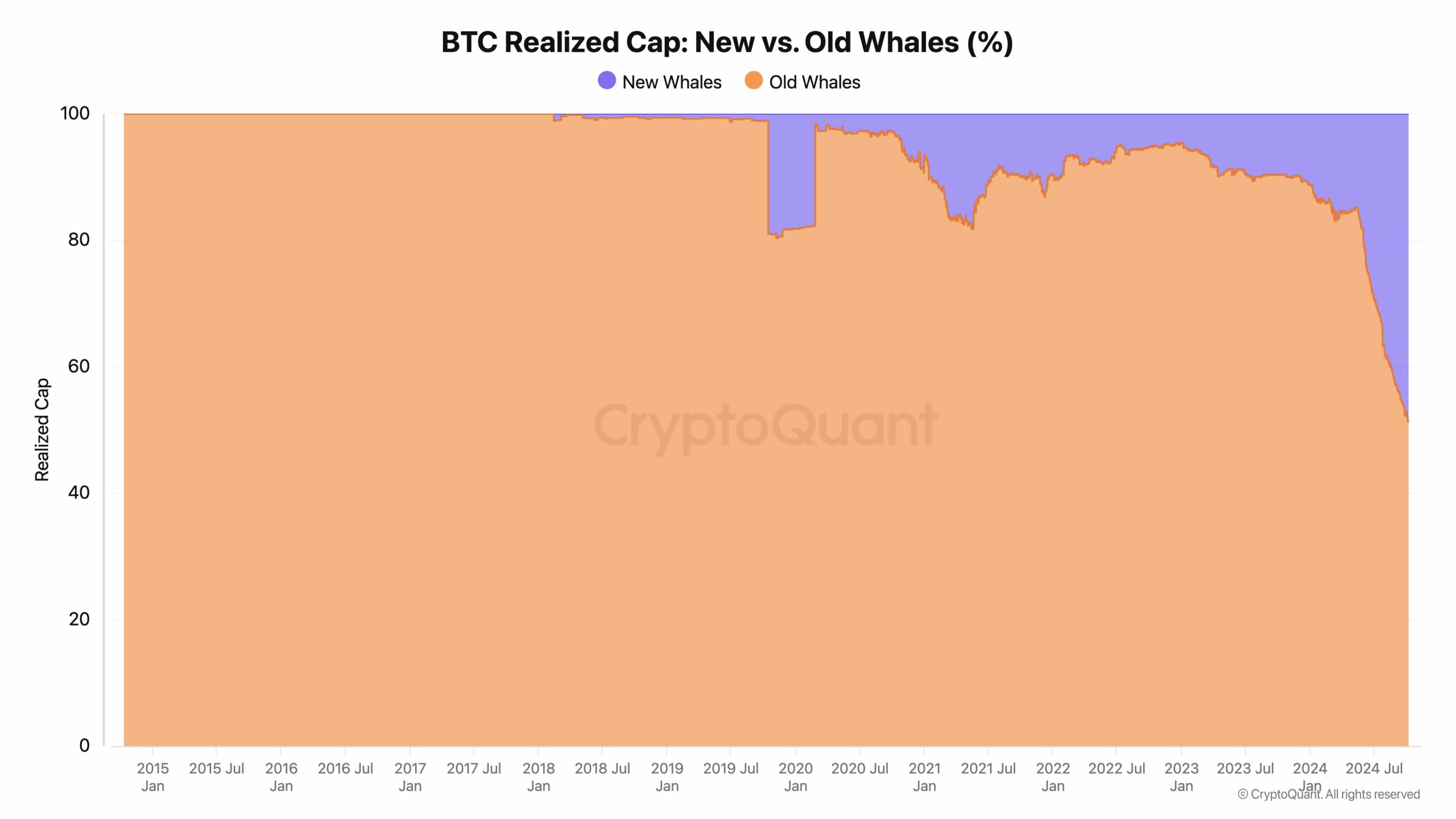

- There was a generational shift amongst these massive traders of Bitcoin.

The cryptocurrency market is all the time interested by key ranges for Bitcoin [BTC], particularly in periods of excessive volatility.

Presently, there’s anticipation that Bitcoin may see important motion attributable to massive liquidation ranges, which can stress merchants into decisive actions.

Over the past week, BTC has seen a notable focus of lengthy positions on main exchanges, forming massive liquidation swimming pools.

Essentially the most important Bitcoin ranges sits at $60K, however when extending evaluation to 2 weeks, $67K zone emerged the best liquidation stage.

This means that Bitcoin may probably transfer towards this zone, as value tends to gravitate towards excessive liquidity areas over time.

Bitcoin has additionally proven resilience when analyzing technical indicators. The cryptocurrency has managed to keep up its place above the bull market assist band for one more week.

It hasn’t achieved three consecutive weekly closes above this stage since Might, however there’s hope that bulls may push the worth increased from right here. That is particularly vital given the current consolidation available in the market.

Bitcoin can be relative energy when in comparison with shares, making the $67K goal seem more and more attainable.

BTC whales and energetic addresses

One other issue to contemplate is the shifting panorama of Bitcoin whales. There may be at present a generational shift amongst these massive traders.

New whales have invested $108 billion into Bitcoin, whereas older whales maintain $113 billion since its inception.

The ratio between these teams is narrowing, with new whales slowly gaining affect.

This shift means that new cash is coming into the market, which may push the worth of BTC increased over time, although the market stays unpredictable.

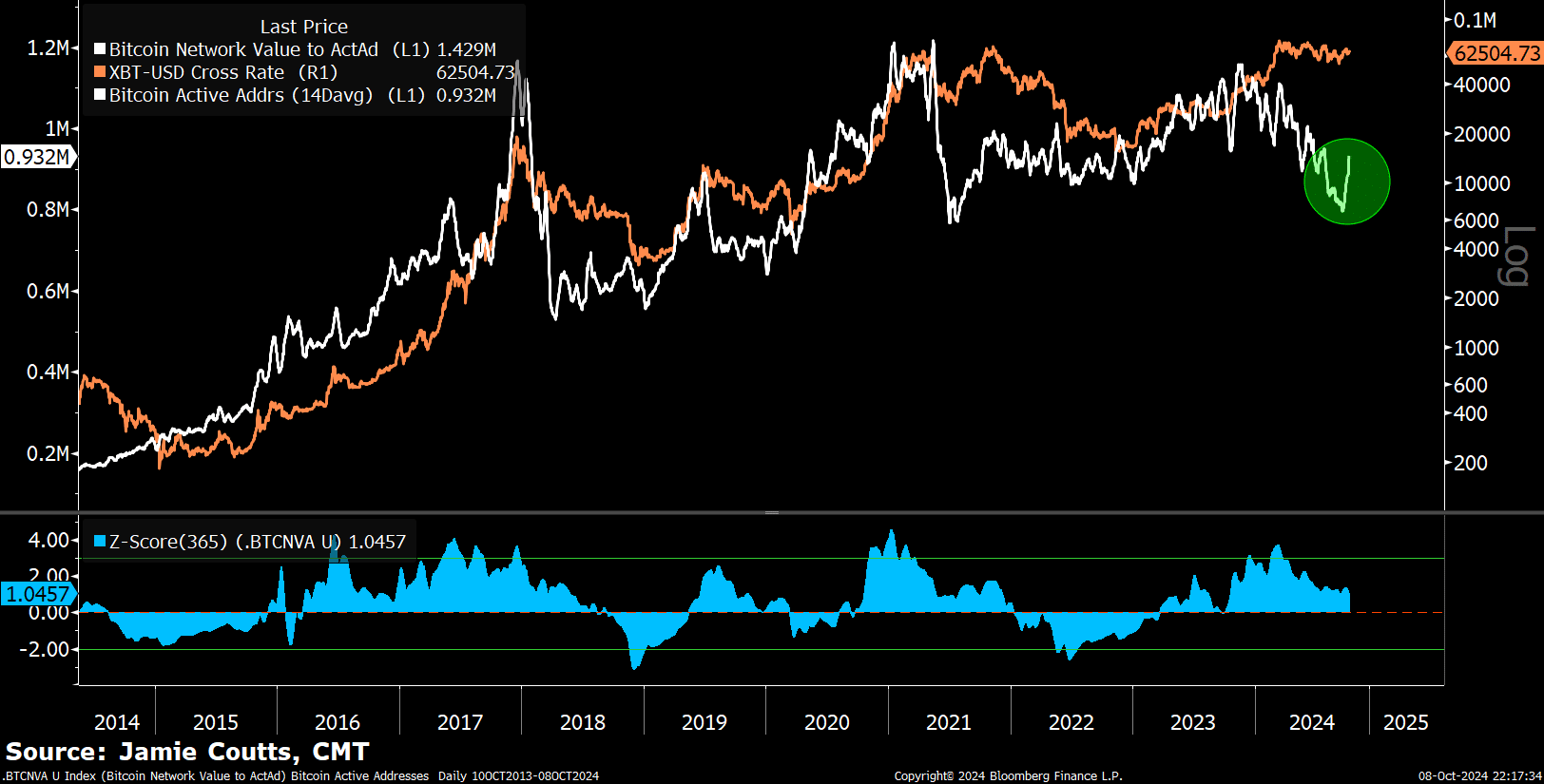

On the on-chain metrics facet, Bitcoin’s energetic deal with rely has just lately seen a resurgence after an 11-month downtrend.

Though this metric’s predictive energy has declined over the previous 4 years, it stays a major indicator of community exercise.

The decreased correlation between energetic addresses and value is probably going attributable to a number of elements.

This contains the rise of ETF flows as a key value driver, elevated cost exercise on L2s just like the Lightning Community, and adjustments in on-chain habits attributable to improvements like Ordinals and NFTs.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

Whereas there’s optimism that Bitcoin may surpass its all-time excessive throughout this cycle, a corresponding enhance in base chain energetic addresses would assist affirm the community’s rising worth.

As Bitcoin operates as a world financial community, it’s demonstrating natural community progress throughout all metrics. With the best situations, BTC may quickly be on its approach to testing the $67K stage.