- BTC was approaching its resistance close to its 200-day easy transferring common.

- Promoting strain on the coin elevated within the final 24 hours.

Bitcoin [BTC] has been on a rising pattern, and the king coin was approaching a vital resistance. The most recent evaluation revealed that it’s crucial for the coin to go above that stage with a purpose to enter an precise bull market.

Bitcoin approaches a vital resistance

After per week of enhance, BTC confronted a slight correction. To be exact, BTC’s worth elevated by over 5% within the final seven days. However within the final 24 hours, the king coin’s worth dropped marginally.

On the time of writing, BTC was buying and selling at $63,037.03 with a market capitalization of over $1.25 trillion.

Within the meantime, Axel, a preferred crypto analyst, posted a tweet revealing an attention-grabbing growth. As per the tweet, it was essential for Bitcoin to show its 200-day easy transferring common (SMA) resistance into its new assist.

If that occurs, then solely we might enter an precise bull market, as per the tweet. At press time, Bitcoin was testing the resistance.

Due to this fact, AMBCrypto deliberate to have a better take a look at the coin’s state to see how seemingly it’s for BTC to show this resistance into its new assist.

What’s subsequent for BTC?

As per our evaluation of CryptoQuant’s knowledge, promoting strain on BTC was rising. For example, BTC’s trade reserve was rising. The coin’s web deposit on exchanges was additionally excessive in comparison with the final seven day common.

These two metrics indicated that promoting strain on Bitcoin was excessive. Moreover, the coin’s aSORP was additionally crimson. This recommended that extra traders had been promoting at a revenue. In the course of a bull market, it might point out a market high.

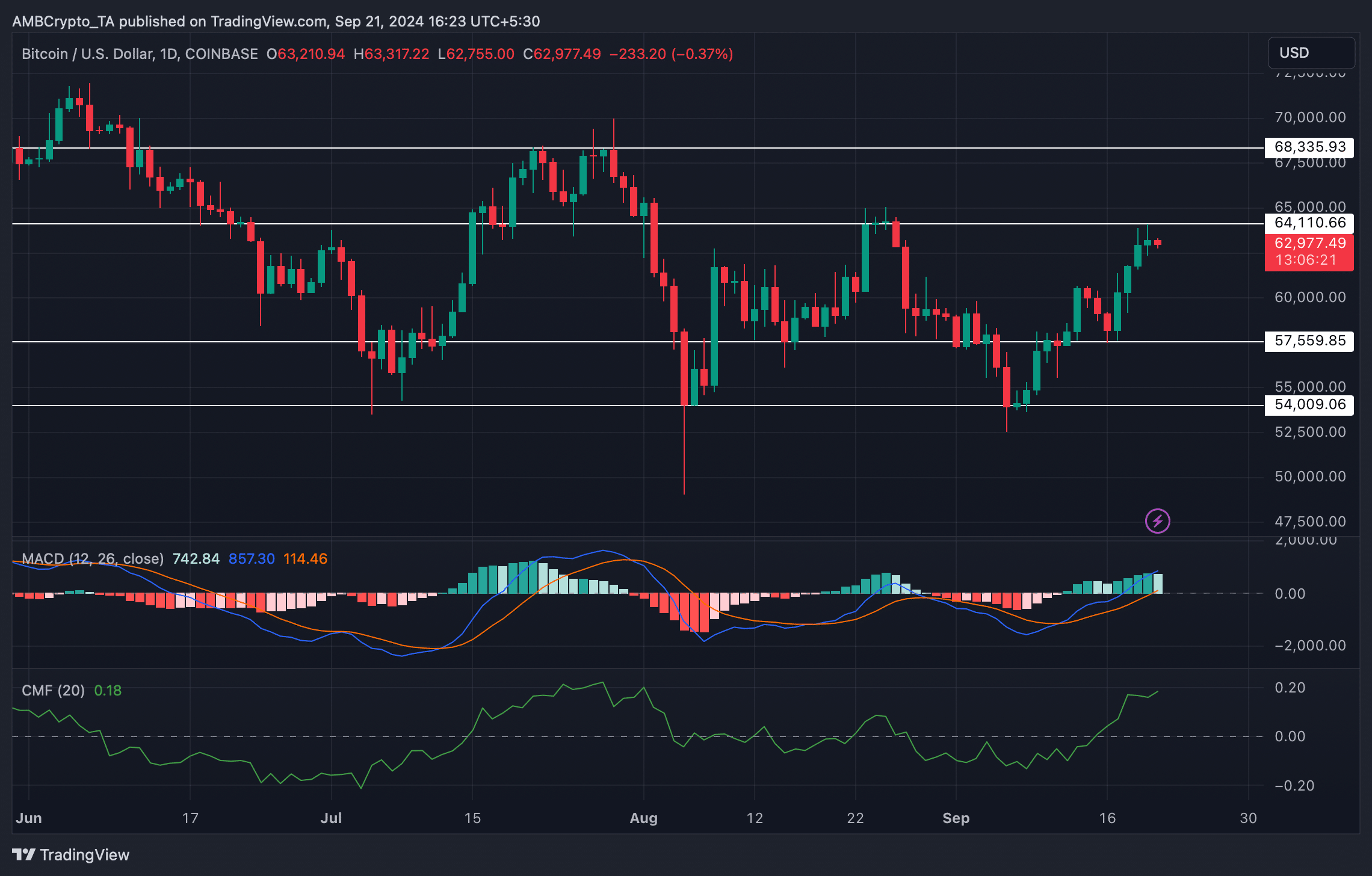

We then took a take a look at BTC’s every day chart to see whether or not it’s poised for a worth correction. We additionally discovered that BTC was approaching a resistance close to $64k. The excellent news was that the MACD displayed a bullish benefit out there.

Furthermore, the Chaikin Cash Movement (CMF) additionally supported the bulls because it moved up, hinting at a breakout above the resistance.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

Other than this, Hyblock Capital’s knowledge additionally revealed that BTC’s method in direction of $64k was clear as liquidation would solely rise at that stage. Usually, a hike in liquidation leads to short-term worth corrections.

However, within the occasion of a bearish takeover, it gained’t be shocking to see BTC fall to $57k once more.