- ETH long-term holders have been extra bullish than their BTC colleagues.

- ETH/BTC was at a pivotal level, however a robust rebound was but to be triggered.

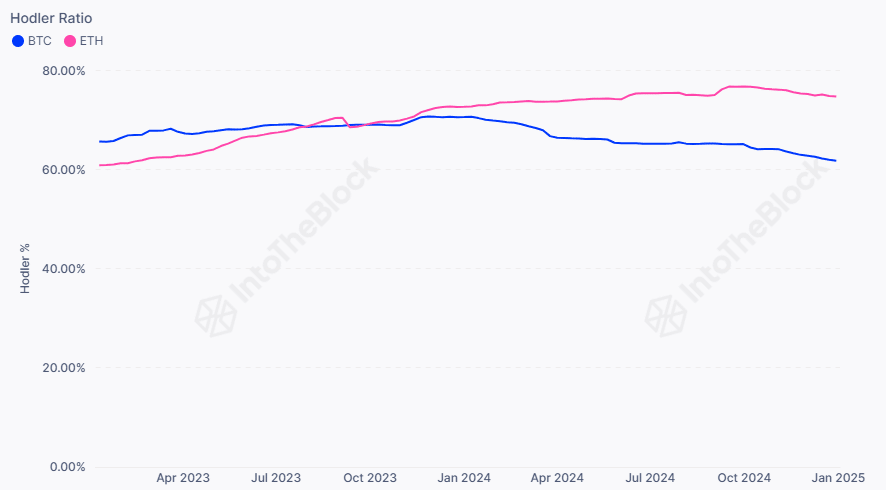

Ethereum’s [ETH] long-term holders (LTH) have proven extra bullish conviction than their Bitcoin [BTC] counterparts.

Analytics agency IntoTheBock confirmed that the market shift started in early 2024 and intensified into 2025 because the ETH LTH cohort elevated holdings and dominance to just about 75%.

Quite the opposite, the BTC LTH cohort has been relentlessly liquidating their holdings, dragging their dominance beneath 60%. The agency said,

“Currently, 74.7% of Ethereum addresses are long-term holders, significantly outpacing Bitcoin. This trend is likely to hold until Ethereum approaches its all-time high and holders start taking profits.”

Will ETH acquire floor in Q1?

The replace isn’t stunning as a result of ETH value efficiency has lagged behind BTC since early 2024. BTC crossed its earlier cycle excessive and topped $108K, making almost each holder worthwhile.

ETH hasn’t achieved such a feat. So, most ETH bulls is likely to be holding in anticipation of a future rally to make a revenue or break even on their investments.

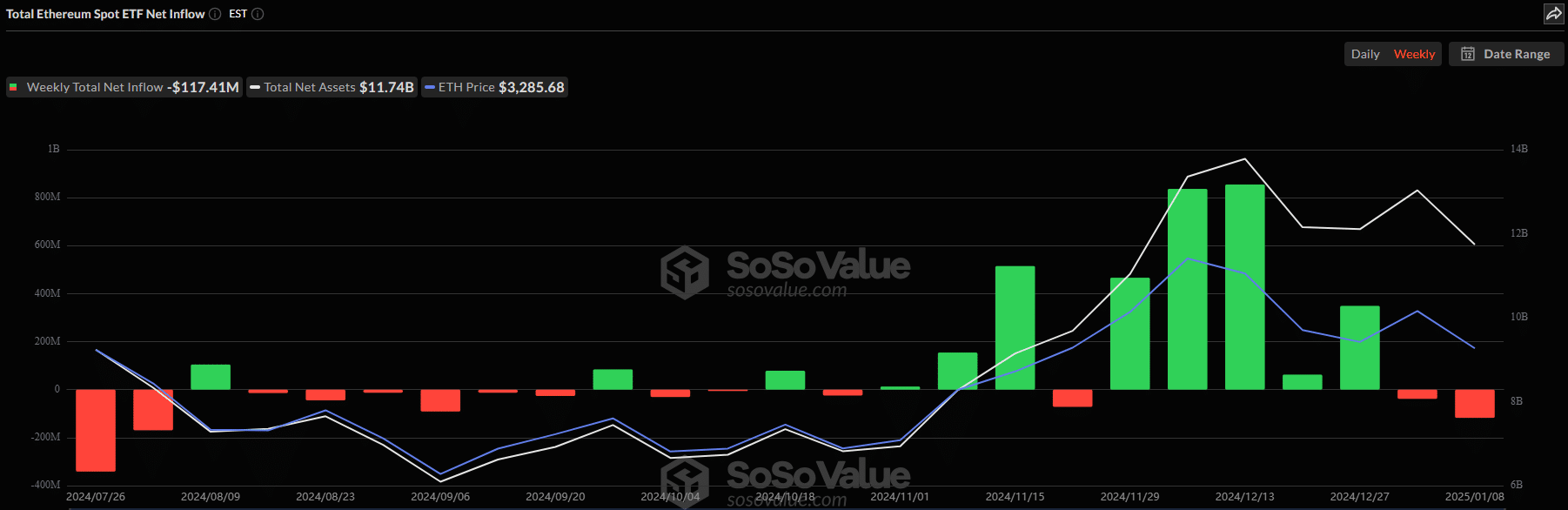

Institutional demand for ETH and BTC was barely distorted into the brand new 12 months. In accordance with Soso Worth information, ETH ETFs are on monitor to shut the second week of outflows. This contrasts with the demand seen in November when the merchandise logged 5 consecutive weeks of inflows.

In distinction, BTC noticed internet inflows up to now two weeks. If this institutional demand pattern persists, BTC may outperform ETH on the value charts.

Nonetheless, one other indicator, the ETH/BTC ratio, confirmed a possible pivot for ETH. This indicator tracks ETH’s relative value efficiency towards BTC. It dropped to a 4-year low of 0.30, underscoring ETH’s underperformance over that interval.

But, it shaped a double backside sample, indicating a possible rebound and certain market shift in favor of ETH.

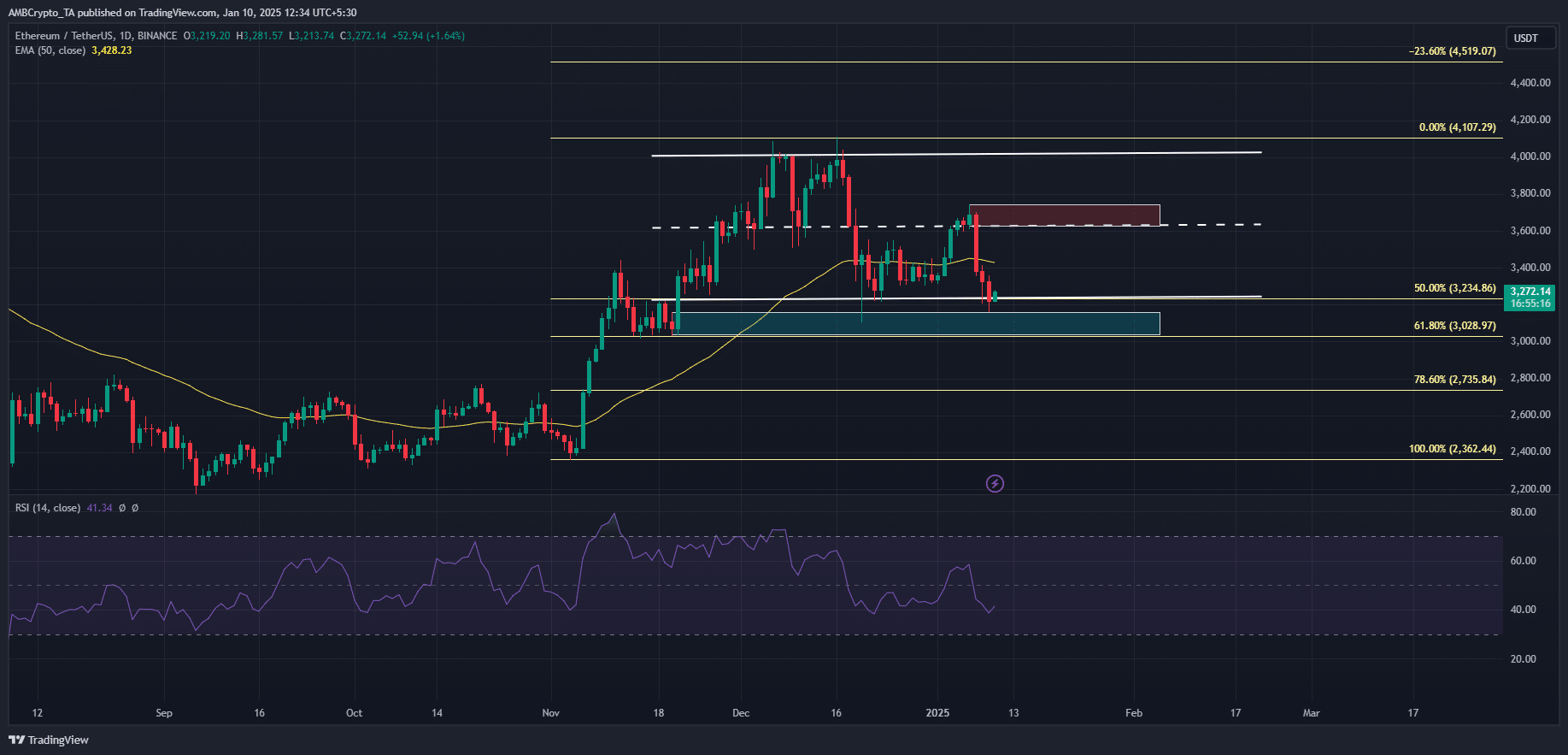

That mentioned, the latest market crash dragged ETH to its December lows above $3K. ETH may try a rebound from the $3K-$3.3K help zone, with the rapid goal at $3.6K. This was the identical outlook shared by some ETH merchants on X (previously Twitter).

Learn Ethereum’s [ETH] Value Prediction 2025–2026

Nonetheless, ETH’s possible restoration might be additional strengthened if it reclaimed the 50-day EMA.