Picture supply: Getty Pictures

One other day, one other achievement for Nvidia (NASDAQ: NVDA) inventory yesterday (5 November). That’s as a result of the chipmaker reclaimed its crown from Apple to turn into the world’s largest firm.

Each have market-caps above $3.3trn! But Nvidia ended 2014 with a market-cap of simply $11bn, that means its meteoric rise is really mind-boggling. Unprecedented even.

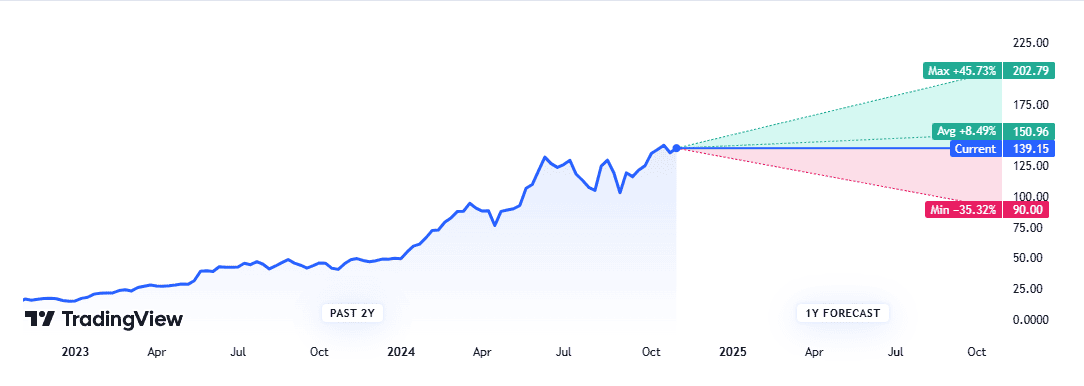

However the place do the specialists see the Nvidia share worth heading over the following 12 months? Let’s have a look.

Consensus forecast

Now, I’d take the next predictions with a pinch of salt. In my expertise an analyst’s worth goal can resemble a climate vane in shifting winds, always adjusting to comply with the inventory’s newest course.

As we are able to see, Wall Avenue analysts’ 12-month Nvidia worth targets cowl a variety. We’ve acquired a excessive of $202, representing potential share worth progress of 46% from $139. Then there’s a low of $90, suggesting a potential 35% decline.

From the 55 analysts providing 12-month share worth targets, the typical determine’s $150. That’s round 8% increased than $139.

The principle takeaway right here is that just about each single dealer is bullish on the inventory. An unimaginable 60 out of 65 analysts fee it as both a Sturdy Purchase or Purchase! None at the moment have the inventory down as a Promote.

| Analyst suggestions | November 2024 |

|---|---|

| Sturdy purchase | 51 |

| Purchase | 9 |

| Maintain | 5 |

| Promote | 0 |

| Sturdy promote | 0 |

In fact, this might shortly change after the corporate reviews its Q3 2025 earnings on 20 November.

What are the specialists anticipating in Q3?

In recent times, Nvidia’s tended to smash Wall Avenue expectations. However this trick might get more durable to repeat and spending on synthetic intelligence (AI) chips turns into extra predictable.

In a worst-case situation, AI spending might begin falling sharply subsequent yr as massive tech corporations reign of their huge investments. It’s potential we glance again in a couple of years’ time and see Nvidia’s income progress was unsustainable.

It’s additionally value remembering that transformative new applied sciences virtually at all times include preliminary investor hype, together with overestimations of their fast world-changing functions. The web, 3D printing, and cryptocurrencies spring to thoughts. All created bubbles.

As US scientist and futurologist Roy Amara famously stated: “We tend to overestimate the effect of a technology in the short run and underestimate the effect in the long run”.

Is it really completely different this time with generative AI? Solely time will inform. However for now at the very least, demand for Nvidia’s AI chips stays extremely excessive and analysts count on extra eye-popping progress in Q3.

| Q3 Forecast | 12 months-on-year progress | |

| Income | $32.9bn | 81.8% |

| Working revenue | $21.7bn | 87.9% |

| Earnings per share (EPS) | $0.74 | 84.5% |

Not an AI bear

To be clear, I’m not a bear that’s come out of its cave on AI. CEOs far smarter than me are predicting transformative issues from the disruptive know-how.

And regardless of promoting my holding in Nvidia earlier this yr, most of my portfolio’s nonetheless invested in corporations harnessing AI. Axon Enterprise, for instance, has developed an AI software that creates a tough draft of a police report utilizing body-worn digital camera audio. It might save every officer an hour of paperwork each shift!

Nonetheless, Nvidia inventory’s at the moment priced for absolute perfection. So I’d watch out about investing a big quantity. As an alternative, I’d look ahead to pullbacks and think about pound-cost averaging my method right into a place over time.