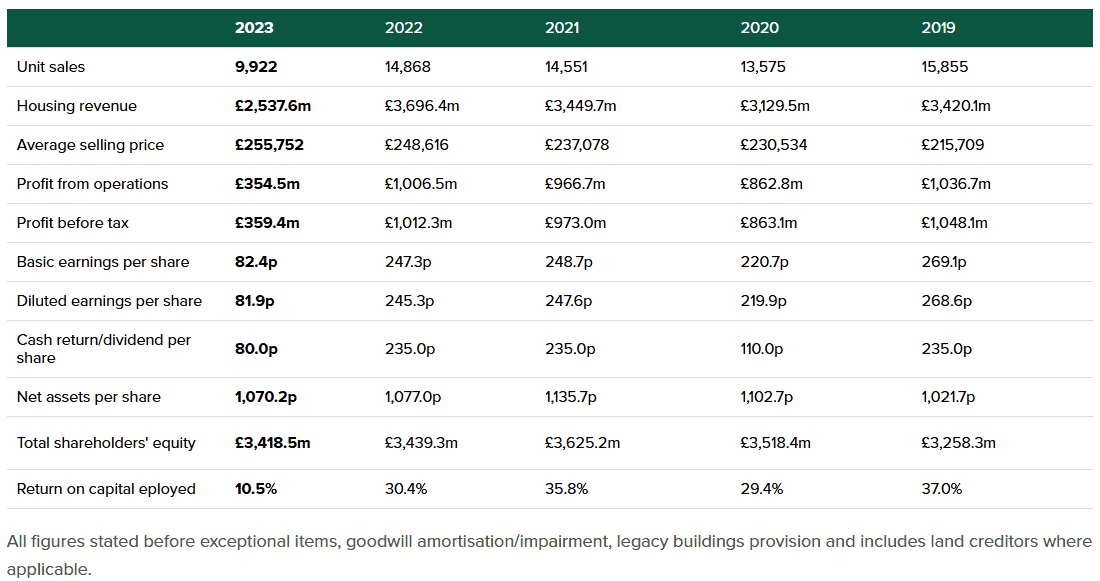

Not so way back, of all of the FTSE 100 shares, Persimmon (LSE:PSN) would’ve been thought of top-of-the-line for dividend revenue. For instance, in 2021 and 2022, the housebuilder paid 235p a share. On the finish of February 2023, its share value was 1,452p, implying an astonishing yield of 16.9%.

However skilled buyers know that yields like this are hardly ever sustainable. Certainly, on 1 March 2023, because of a lack of confidence within the housing market following a collection of post-pandemic rate of interest rises, the corporate introduced an enormous minimize in its payout.

Nevertheless, regardless of its latest woes, the corporate seems to be more likely to pay 60p a share in respect of its 2024 monetary yr.

Primarily based on a present (27 December) share value of 1,184p, this implies the inventory’s nonetheless yielding 5.1%. That is comfortably above the typical for the FTSE 100 as an entire (3.8%).

And it places it within the prime fifth of Footsie dividend payers.

Constructing blocks

In 2024, Persimmon expects to construct 10,500 properties. That is 5.8% greater than in 2023.

Nevertheless it stays 4,212 (28.6%) decrease than its 2019-2022 annual common of 14,712.

Nevertheless, if the corporate might return to its latest common, it’ll have demonstrated spectacular progress.

I’m positive the administrators of any enterprise that sells almost 30% extra of its principal product could be glad with its efficiency. And if the corporate can promote almost 15,000 properties, I’m assured its annual turnover might be its highest ever.

For the primary six months of 2024, its common promoting value was £263,288. Multiply this by 14,712 completions and annual income could be £3.87bn. This may beat its earlier better of £3.7bn, achieved in 2023.

A special panorama

Nevertheless, it’s earnings that actually matter.

And post-Covid inflation has essentially modified the fee base of Britain’s housebuilders. In 2023, Persimmon’s underlying working revenue margin was 14%, in comparison with 30.3%, in 2019. This can be a huge distinction and regardless of having the ability to move on a few of these extra prices to consumers, the typical working revenue per home, in 2023, fell to £35,729 (2019: £66,105).

Though historical past suggests the housing market will get better, there’s no assure. Nevertheless, if it does, the corporate’s nicely positioned to capitalise.

At 30 June 2024, it owned 81,545 plots. Of those, 38,067 had detailed planning consent.

My view

Though I’m assured Persimmon will promote extra homes in 2025, I believe there are many different shares that’ll develop their earnings quicker.

I believe confidence will return however I believe it’ll be a couple of years earlier than the corporate’s approaching 15,000 completions once more.

Nevertheless, I nonetheless consider the housebuilder would make a superb dividend inventory, which is why I plan to carry on to my shares.

The corporate’s managed to come back although the downturn with a powerful steadiness sheet. This makes me consider that its dividend in all fairness safe. And it ought to improve additional if the property market recovers as I anticipate.

In fact, there aren’t any ensures.

However its web belongings per share is now larger than on the finish of 2019. And the corporate has no debt. I consider it is a strong basis on which Persimmon can search to revive its standing as one of many Footsie’s finest dividend payers round.