- Bitcoin confirmed indicators of restoration with a 2.7% improve, buying and selling above $60,842 at press time.

- Analysts predicted both all-time highs or a drop to $48K, based mostly on upcoming financial information.

Bitcoin [BTC] is as soon as once more at a important juncture. After reaching an all-time excessive of over $73,000 in March, Bitcoin has gone via a rollercoaster trip, marked by vital fluctuations.

At the moment, Bitcoin confirmed indicators of recuperation, having elevated by 2.7% within the final 24 hours to a buying and selling worth of roughly $60,842.

The latest weeks have seen Bitcoin oscillate inside a slim vary, hinting at an underlying uncertainty in market sentiment.

This era of consolidation got here after a collection of declines and recoveries. Given this, the query now could be whether or not Bitcoin can maintain this nascent restoration and embark on a path again to its peak ranges.

Technical outlook from analysts

Michael Van De Poppe, a notable determine within the crypto evaluation house, has just lately provided his insights into Bitcoin’s potential instructions.

He outlines a bifurcated path relying on key resistance ranges and upcoming financial indicators, explaining,

“If Bitcoin maintains support above $56,000 and breaks through the $60-61K resistance, the path to retesting its all-time highs is clear.”

Conversely, antagonistic developments, similar to a disappointing Client Value Index (CPI) information, may push Bitcoin down in direction of the $48,000 mark.

Including to the dialogue, one other esteemed analyst, RektCapital, emphasised the significance of buying and selling quantity in confirming the restoration’s energy. He remarked,

“Elevated buy-side quantity is promising, however sustaining this momentum is essential for overcoming latest highs.“

A every day shut above roughly $61,700 would sign a powerful bullish affirmation.

Is Bitcoin heading for one more dip?

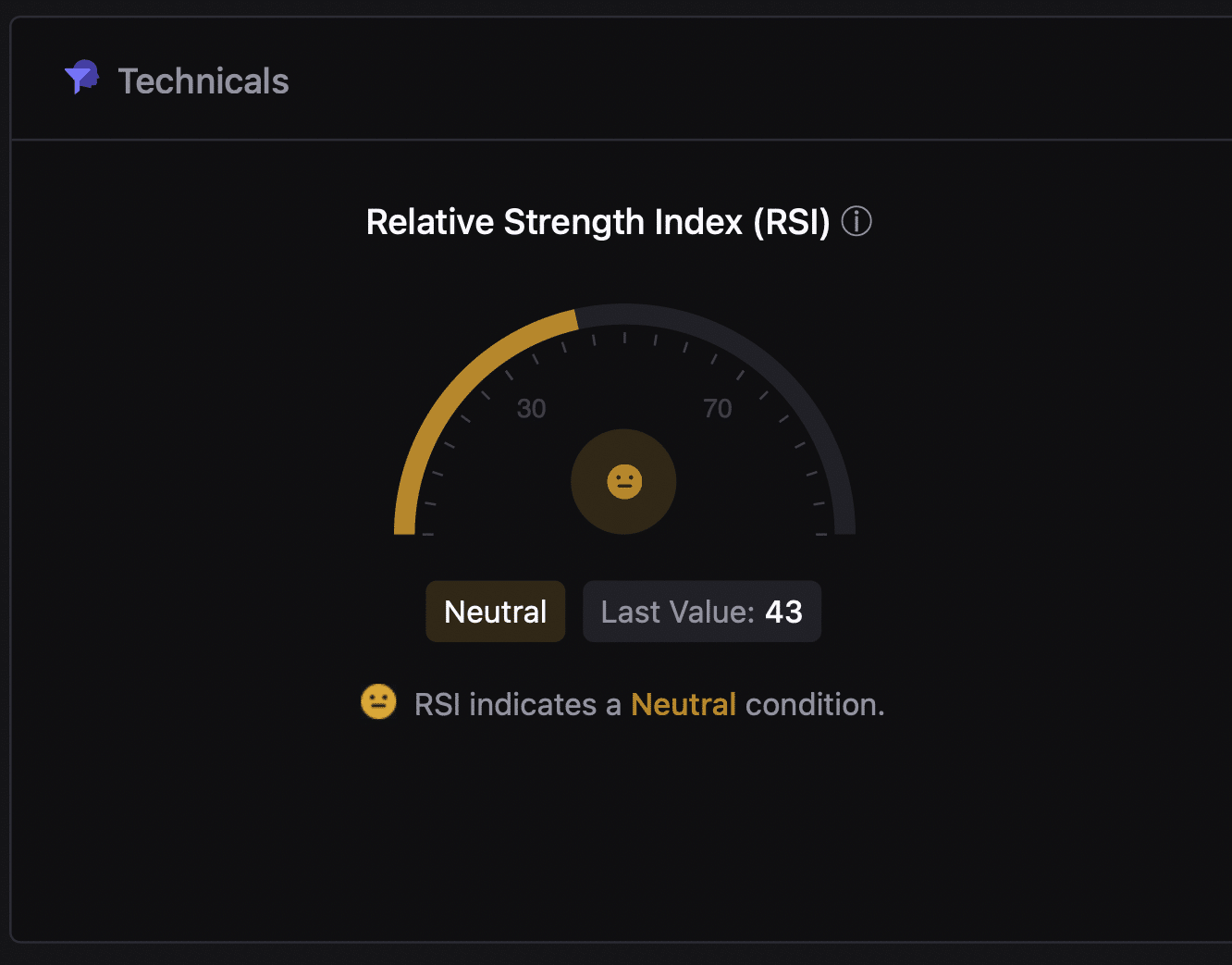

By way of Bitcoin’s technical well being, the Relative Energy Index (RSI), a instrument used to gauge market momentum and potential value reversals, stood at 43 at press time.

This impartial studying prompt that Bitcoin was neither overbought nor oversold, offering little directional bias and highlighting the market’s present indecision.

Is your portfolio inexperienced? Try the BTC Revenue Calculator

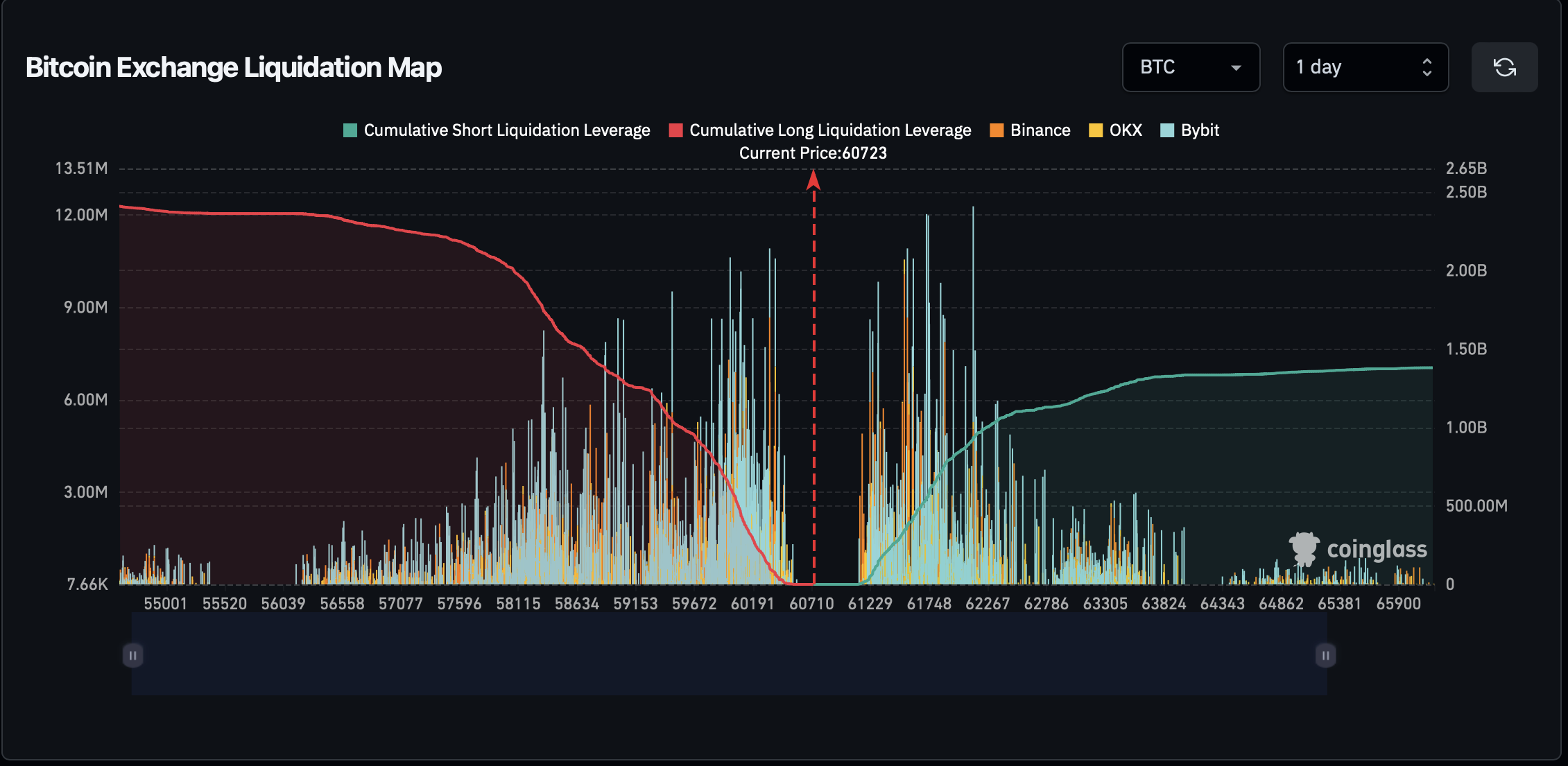

Furthermore, liquidation information from Coinglass revealed a major tilt in direction of quick positions. If Bitcoin’s value ascends, it may set off liquidations price $2.41 billion, including gasoline to the upward motion.

Nevertheless, a value drop may liquidate round $1.38 billion in lengthy positions, intensifying a downward pattern.