By Harry Robertson and Tom Westbrook

LONDON/SINGAPORE (Reuters) – The Japanese yen rallied for a second day on Thursday after information on Wednesday confirmed a slowdown in U.S. inflation, whereas the greenback discovered a footing in opposition to different currencies following a pointy drop the day gone by.

U.S. inflation slowed to 0.3% in April from a month earlier, down from 0.4% in March and under expectations for an additional 0.4% studying, Wednesday’s information confirmed.

Yr-on-year core inflation – which strips out risky meals and power costs – fell to its lowest in three years at 3.6%. In the meantime, retail gross sales had been flat, suggesting situations for Federal Reserve rate of interest cuts are falling into place.

The greenback dropped 1% in opposition to the yen on Wednesday after the information and was down an extra 0.38% on Thursday at 154.32, having fallen as little as 153.6 earlier than weak Japanese progress figures took a number of the shine off the yen.

The Japanese foreign money has fallen round 9.5% this 12 months because the Financial institution of Japan has saved financial coverage free whereas increased Fed rates of interest have drawn cash in direction of U.S. bonds and the greenback. The yen has been notably delicate to any widening or closing of the rate of interest differential.

The , which tracks the foreign money in opposition to six main friends, was final up 0.11% at 104.32 on Thursday after falling 0.75% on Wednesday as traders increase their bets on Fed charge cuts, now envisaging two reductions by the tip of the 12 months.

Some analysts stated Fed officers will wish to see proof of inflation’s downward path earlier than countenancing cuts, a degree made by Minneapolis Fed President Neel Kashkari on Wednesday.

take away advertisements

.

Francesco Pesole, FX strategist at ING, stated: “In practice there isn’t all that much to be all that optimistic about. Inflation is moving in the right direction but still not at levels that would allow the Fed to cut rates.”

Pesole stated traders had been now ready for U.S. private consumption expenditures inflation information in late Might. “My view at this stage is that we could just default to another couple of weeks of low volatility, lack of direction, and range-bound trading.”

The euro hit a two-month excessive at $1.0895 on Thursday earlier than dipping to commerce 0.1% decrease at $1.0874. Britain’s pound reached a one-month high of $1.2675 earlier than falling again barely.

The Australian greenback, which surged 1% on Wednesday, hit a four-month excessive at $0.6714 however then paused after an surprising rise in Australian unemployment.

It was final at $0.6684 as merchants priced out any danger of an extra charge hike in Australia.

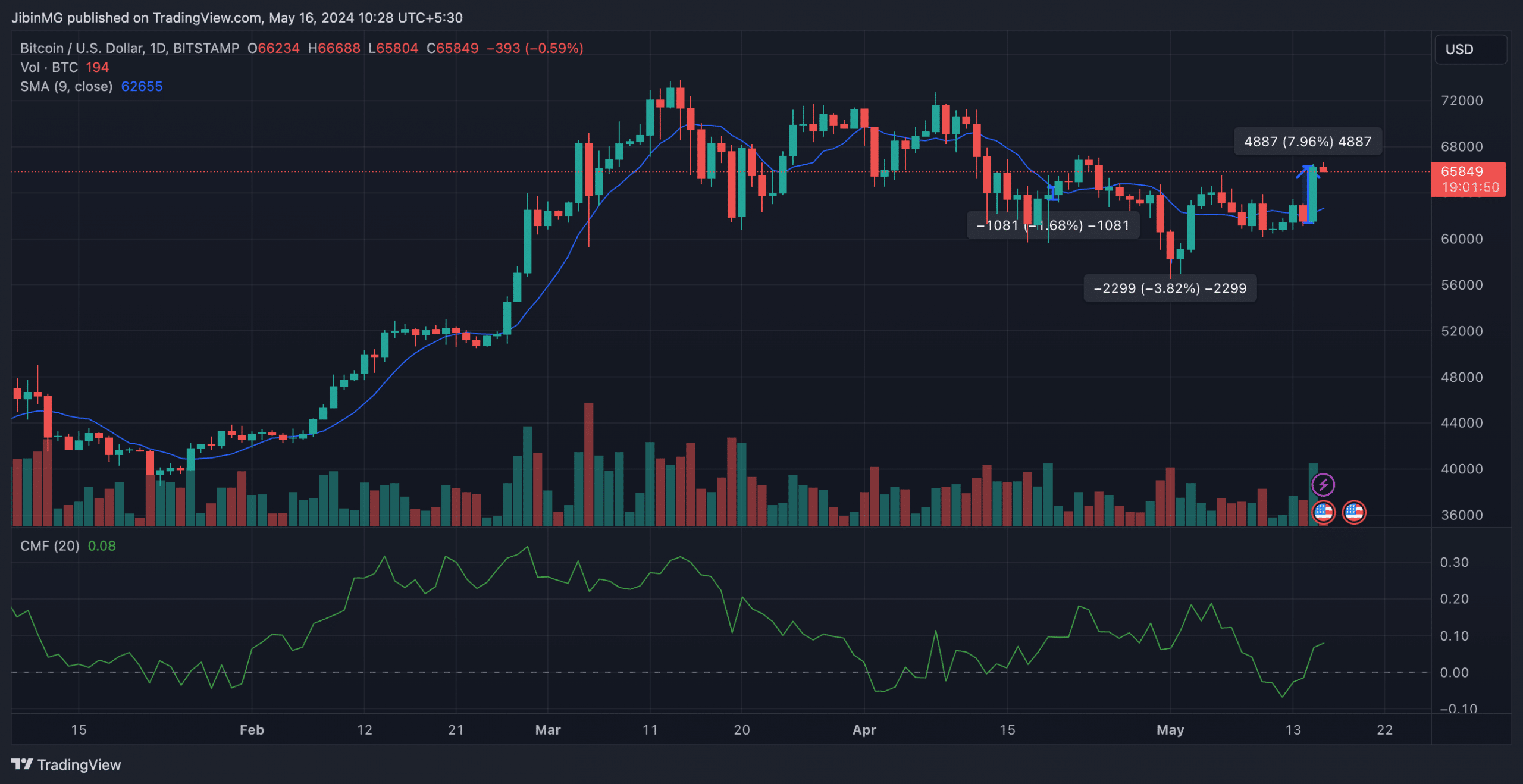

touched a three-week excessive of $66,695 earlier than dipping barely.